Introduction

If you are a salaried employee in West Bengal, especially for the Financial Year (FY) 2025-26, you might have already come across the term Form 10-IE. At first glance, it might sound technical or confusing, but don’t worry. By the end of this article, you will not only know what the Form 10-IE is but also how to use it effectively with Automatic Income Tax Preparation Software All-in-One in Excel.

Think of Form 10-IE as your “switchboard.” Just like you flip a switch at home to choose between light or fan, Form 10-IE helps you switch between the old tax regime and the new tax regime. Without it, your choice cannot be officially recorded by the Income Tax Department.

To make things easier, we’ll break down this concept into simple steps and also show how Excel-based automatic software can save your time and reduce mistakes.

Table of Contents

| Sr# | Headings |

| 1 | Understanding What is the Form 10-IE |

| 2 | Why Do Employees Need Form 10-IE? |

| 3 | Difference Between Old and New Tax Regimes |

| 4 | How Form 10-IE Works for West Bengal State Employees |

| 5 | Eligibility to File Form 10-IE |

| 6 | When Should You File Form 10-IE? |

| 7 | Step-by-Step Process to File Form 10-IE |

| 8 | Common Mistakes People Make While Filing Form 10-IE |

| 9 | Advantages of Filing Form 10-IE on Time |

| 10 | Introduction to Automatic Income Tax Preparation Software in Excel |

| 11 | Features of the All-in-One Excel Utility |

| 12 | How West Bengal State Employees Benefit from Excel Tax Software |

| 13 | Comparison: Manual Filing vs. Automatic Excel Utility |

| 14 | Practical Example: Tax Calculation with Form 10-IE in Excel |

| 15 | Final Tips for West Bengal Employees for F.Y.2025-26 |

| 16 | Conclusion |

| 17 | FAQs |

1. Understanding What is the Form 10-IE

Form 10-IE is a mandatory declaration form that taxpayers must submit if they want to opt for the new income tax regime under Section 115BAC of the Income Tax Act. Simply put, this form communicates your decision to the tax department about whether you will follow the old regime (with deductions and exemptions) or the new regime (with lower tax rates but fewer deductions).

2. Why Do Employees Need Form 10-IE?

Employees in West Bengal, just like in other states, need Form 10-IE because:

- The Income Tax Department requires official documentation of your regime choice.

- Without filing it, your tax computation may automatically follow the old regime.

- It helps avoid confusion between your employer’s payroll system and your actual tax return.

3. Difference Between Old and New Tax Regimes

To truly understand the importance of Form 10-IE, you must know the difference:

- Old Regime: Allows exemptions (like HRA, LTA) and deductions (like 80C, 80D, etc.).

- New Regime: Offers reduced tax rates but removes most exemptions and deductions.

This choice can significantly affect your take-home salary. Filing Form 10-IE ensures that your preference is officially recorded.

4. How Form 10-IE Works for West Bengal State Employees

For state employees in West Bengal, Form 10-IE is especially important because:

- Salary structures often include allowances like House Rent Allowance (HRA), which matter only under the old regime.

- The West Bengal government salary rules align with central tax rules, so employees need to declare their preference correctly.

- The choice affects not just the yearly tax but also the monthly TDS deductions by the employer.

5. Eligibility to File Form 10-IE

You are eligible to file Form 10-IE if:

- You are an individual taxpayer or a Hindu Undivided Family (HUF).

- You want to shift from the old regime to the new regime (or vice versa).

- You are a salaried employee, pensioner, or professional.

6. When Should You File Form 10-IE?

- Ideally, before filing your Income Tax Return (ITR) for the financial year.

- If you want your employer to deduct TDS under the new regime, inform them early.

- You must file it online through the Income Tax e-filing portal.

7. Step-by-Step Process to File Form 10-IE

- Log in to the Income Tax e-filing portal.

- Go to Income Tax Forms under the e-file menu.

- Select Form 10-IE.

- Fill in basic details such as name, PAN, and assessment year.

- Choose your preferred tax regime.

- Verify and submit the form.

8. Common Mistakes People Make While Filing Form 10-IE

- Forgetting to file before the due date.

- Providing incorrect PAN details.

- Not keeping a copy of the acknowledgement.

- Switching regimes multiple times without clarity.

9. Advantages of Filing Form 10-IE on Time

- Smooth TDS deductions by your employer.

- Peace of mind at the time of filing ITR.

- Flexibility to switch regimes based on financial planning.

10. Introduction to Automatic Income Tax Preparation Software in Excel

The Automatic Income Tax Preparation Software All-in-One in Excel is a simple, user-friendly tool that:

- Prepares your Tax Computed Sheet

- Is updated as per the Budget 2025 rules.

- Works for both Government and Non-Government employees in West Bengal.

11. Features of the All-in-One Excel Utility

- Automatic calculation of HRA exemption under Section 10.

- Built-in salary structure for West Bengal

- Option to prepare tax sheets for old and new regimes

- Auto-generated Form 16 for employees.

12. How West Bengal State Employees Benefit from Excel Tax Software

- No need to manually calculate tax; the software does it.

- Saves time and reduces the chance of human error.

- Helps in the quick comparison of old vs new regimes.

- Provides ready-to-submit Form 10-IE details.

13. Comparison: Manual Filing vs. Automatic Excel Utility

| Aspect | Manual Filing | Excel Utility |

| Time Taken | High | Very Low |

| Accuracy | Error-prone | Highly Accurate |

| User-Friendliness | Complicated | Simple & Automated |

| Regime Comparison | Difficult | Instant |

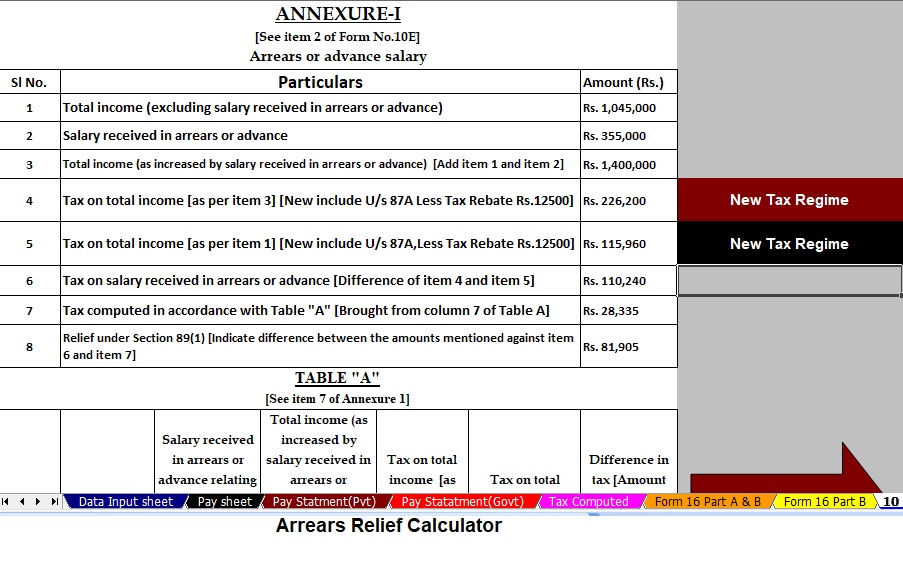

14. Practical Example: Tax Calculation with Form 10-IE in Excel

Imagine you are a West Bengal State Employee with a salary of ₹8,00,000.

- Under the old regime, you can claim deductions like 80C (₹1,50,000) and HRA exemption.

- Under the new regime, you get lower tax rates but no deductions.

With the Excel software, you can enter your details and instantly see which regime saves more tax. It even prepares a ready reference for filing Form 10-IE.

15. Final Tips for West Bengal Employees for F.Y.2025-26

- Always compare both regimes before making a choice.

- File Form 10-IE before the due date.

- Use Excel software to avoid manual errors.

- Keep a digital copy of the acknowledgement for future reference.

16. Conclusion

To wrap up, understanding what the Form 10-IE is is crucial for every West Bengal State Employee in F.Y.2025-26. This form ensures that your tax regime choice is recognised by the Income Tax Department. Moreover, with Automatic Income Tax Preparation Software All in One in Excel, you can prepare your tax files quickly, accurately, and stress-free.

Choosing the right regime is like choosing the best road for your journey—while both may lead to the same destination, one may save you time and money.

17. FAQs

- What is the Form 10-IE in income tax?

Form 10-IE is a declaration form used to opt for the new tax regime under Section 115BAC. - Do I need to file Form 10-IE every year?

Yes, you must file it whenever you want to switch regimes. - Can West Bengal State Employees file Form 10-IE online?

Yes, it is filed through the official Income Tax e-filing portal. - What happens if I forget to file Form 10-IE?

Your income will be taxed under the old regime by default. - Can I use Excel software to prepare details for Form 10-IE?

Yes, the Automatic Income Tax Preparation Software in Excel provides all necessary details for easy filing.

Automatic Income Tax Preparation Software All-in-One in Excel for the West Bengal State Employees for the F.Y.2025-26