To begin with, this Tax Preparation Excel-based Software All-in-One simplifies income tax preparation for salaried individuals in a practical and user-friendly way. First of all, it brings all tax-related calculations into one structured Excel file. Instead of switching between multiple websites, tools, and calculators, you can complete everything in a single place. Moreover, it automatically calculates income, deductions, tax slabs, and final tax payable. Consequently, users save time, avoid confusion, and gain complete control over their tax data. As a result, tax preparation becomes faster, smoother, and more reliable.

2. Why Choose Excel for Tax Preparation

Notably, Excel remains one of the most familiar tools for working professionals. Therefore, users do not need special training or technical knowledge. Additionally, Excel offers flexibility, transparency, and full visibility of calculations. In other words, users can track every formula and figure step by step. Furthermore, Excel works like a clear glass window, allowing you to see how each value affects your final tax. As a consequence, confidence increases, errors reduce, and decision-making improves significantly.

3. Who Can Use This Software

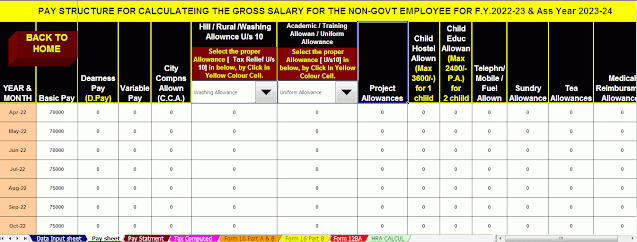

Importantly, both Government and Non-Government employees can use this Excel-based tax software effectively. Whether you work as a teacher, clerk, officer, IT professional, accountant, or private employee, this tool adapts easily to your salary structure. Moreover, it suits beginners as well as experienced users. Hence, it serves a wide audience. Ultimately, it fulfils the needs of the general public without limitations.

4. Key Features of the All-in-One Tax Tool

Above all, this software combines income details, deductions, tax calculations, and reports in one integrated system. Furthermore, it removes the need for repetitive manual entries. Consequently, users experience fewer mistakes and faster processing. Additionally, built-in automation improves accuracy and consistency. As a result, tax filing becomes smooth, dependable, and stress-free.

5. Automatic Income & Tax Calculation

Once users enter salary details, the software instantly calculates gross income, taxable income, and final tax payable. Thus, it eliminates long hours of manual work. Meanwhile, smart formulas handle complex calculations in the background. Therefore, accuracy remains consistent every time. Eventually, users gain quick and reliable tax results without effort.

6. Support for Old and New Tax Regime

Equally important, this Excel tool supports both the old and new tax regimes for FY 2025-26. Therefore, users can compare tax liability under both options side by side. Additionally, it helps identify the most beneficial regime. Consequently, decision-making becomes simple, logical, and transparent. As a result, users avoid confusion and choose wisely.

7. Deductions, Exemptions & Rebates

In addition, the software automatically considers deductions under Section 80C, 80D, 80CCD, and other applicable sections. Similarly, it calculates exemptions such as HRA and standard deduction accurately. Moreover, it applies rebates wherever eligible. Consequently, users never miss legitimate tax benefits. Ultimately, this leads to optimised tax savings.

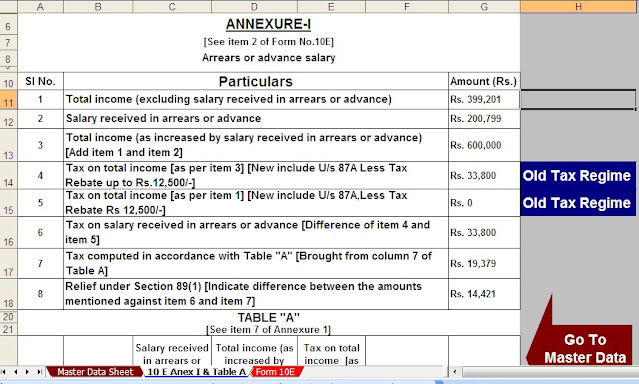

8. Form 16, Form 10E & Other Reports

Another major advantage is the automatic generation of Form 16 and Form 10E. As a result, arrears relief calculations become simple and error-free. Furthermore, the software creates printable and filing-ready reports. Therefore, documentation stays organised. In turn, filing income tax returns becomes effortless.

9. Ease of Use for Non-Technical Users

Surprisingly, even users with minimal Excel knowledge can operate this software comfortably. Because it uses simple input fields, drop-down options, and clear instructions, anyone can use it confidently. Hence, no technical background is required. Consequently, beginners feel empowered instead of confused.

10. Accuracy, Compliance & Regular Updates

Most importantly, the software follows the latest income tax rules applicable for FY 2025-26. Therefore, calculations remain compliant with current laws. Additionally, logical formulas significantly reduce human errors. As a result, users gain peace of mind knowing their tax data is accurate and lawful.

11. Time-Saving & Cost-Effective Solution

Compared to hiring tax consultants or purchasing expensive software, this Excel tool saves money. Likewise, it saves time by delivering instant results. Moreover, users avoid recurring professional fees. In short, it delivers maximum value with minimum investment.

12. Data Security & Customisation

Unlike online tax tools, this Excel-based software keeps all data on your personal computer. Consequently, privacy stays fully protected. Moreover, users can customise sheets according to their personal or organisational needs. As a result, flexibility and security go hand in hand.

13. Benefits for Government Employees

For government employees, the software aligns perfectly with salary structures, allowances, and arrears systems. Therefore, it ensures precise tax computation. Additionally, it simplifies departmental reporting. Ultimately, government staff manage taxes independently and confidently.

14. Benefits for Non-Government Employees

Similarly, private sector employees benefit from flexible income inputs and deduction options. Thus, the software adapts to both fixed and variable salary patterns. Moreover, it handles incentives, bonuses, and allowances smoothly. Consequently, it suits private employees perfectly.

15. Why This Software Is Future-Ready

Finally, as income tax rules continue to evolve, Excel-based solutions remain adaptable. In essence, this software works like a Swiss Army knife for tax planning. Therefore, it stays relevant for future financial years. Ultimately, users remain prepared for upcoming changes.

In Conclusion

In conclusion, the Tax Preparation Excel-based Software All-in-One for FY 2025-26 delivers simplicity, accuracy, and complete control. Whether you are a government or non-government employee, this Excel utility makes tax preparation easier, faster, and stress-free. Ultimately, it empowers users to manage taxes confidently without unnecessary complexity.

Frequently Asked Questions (FAQs)

Is this Excel-based tax software suitable for beginners?

Yes, it uses simple inputs and clear instructions, making it beginner-friendly.

Does the software support both old and new tax regimes?

Absolutely, it allows easy comparison between both regimes for FY 2025-26.

Can government employees use this software effectively?

Yes, it is fully suitable for government salary structures and allowances.

Is my personal tax data safe in this Excel tool?

Yes, all data remains offline on your computer, ensuring complete privacy.

Does this software help in preparing Form 16 and Form 10E?

Yes, it provides automatic calculation and preparation support for both forms.

Salary Structure[/caption]

Salary Structure[/caption]