Introduction

The New Tax Regime, as per Budget 2025, has changed the way individuals calculate their income tax. It’s like switching from a complex multi-lane highway filled with toll booths (old regime) to a smoother, faster expressway (new regime) — but with fewer stops for deductions and exemptions.

If you’re wondering whether this new system benefits you, or how to calculate your tax under it, this guide walks you through everything — from eligibility and rates to deductions, exemptions, and practical examples.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the New Tax Regime as per Budget 2025 |

| 2 | Key Features of the New Tax Regime |

| 3 | Tax Slabs and Rates under the New Regime |

| 4 | Who Should Opt for the New Tax Regime? |

| 5 | Standard Deduction in the New Tax Regime |

| 6 | Exemptions and Allowances Allowed |

| 7 | Deductions Not Available in the New Regime |

| 8 | How the New Regime Became the Default Option |

| 9 | Comparing Old vs New Tax Regime |

| 10 | How to Switch Between Tax Regimes |

| 11 | Filing Requirements and Form 10-IEA |

| 12 | Using Excel Tax Calculators for Easy Computation |

| 13 | Step-by-Step Example of Tax Calculation |

| 14 | Common Mistakes to Avoid |

| 15 | Final Thoughts on Choosing the Right Regime |

1. Understanding the New Tax Regime as per Budget 2025

The Government of India introduced the new tax regime in the Union Budget 2020-21 and revised it in subsequent budgets, including the latest Budget 2025. It aims to simplify the tax system by offering lower tax rates but removing most deductions and exemptions.

Instead of claiming multiple allowances and investment-based deductions, you pay tax based mainly on your income slab. This straightforward approach saves time and paperwork.

2. Key Features of the New Tax Regime

Under the New Tax Regime, as per Budget 2025, the government has focused on simplicity and efficiency. Key features include:

- Lower tax rates compared to the old regime.

- Fewer exemptions and deductions to claim.

- Standard deduction increased to ₹75,000 for salaried employees and pensioners.

- Default regime from FY 2023-24 onwards, unless you opt for the old regime.

- No need to maintain a long list of proofs for deductions.

3. Tax Slabs and Rates under the New Regime

The latest Budget 2025 revised the tax slabs to make them more beneficial for middle-class taxpayers:

| Annual Income (₹) | Tax Rate |

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

These rates apply before cess and surcharge.

4. Who Should Opt for the New Tax Regime?

The New Tax Regime benefits taxpayers who:

- Do not claim high deductions under sections like 80C, 80D, or HRA.

- Prefer a hassle-free tax filing process.

- Have straightforward salary structures without multiple allowances.

If your total deductions under the old regime are less than ₹3,00,000, the new regime could be more tax-friendly.

5. Standard Deduction in the New Tax Regime

From FY 2025-26, the government increased the standard deduction to ₹75,000 for all salaried individuals and pensioners under the new regime.

This means you automatically reduce your taxable income by ₹75,000 — without submitting any proof or documentation.

6. Exemptions and Allowances Allowed

Although the new regime removed most exemptions, you can still enjoy certain benefits:

- Retirement Benefits: Gratuity and leave encashment at retirement remain tax-free.

- Employer Contributions: NPS and Provident Fund employer contributions are exempt.

- Agnipath Scheme (Section 80CCH) income exemption.

- Conveyance Allowance: Work-related travel allowances for those without employer-provided transport remain exempt.

- Allowance for Disabled Employees: Transport allowance for employees with disabilities is tax-free.

7. Deductions Not Available in the New Regime

You cannot claim the following in the new regime:

- Section 80C deductions (like LIC, PPF, ELSS).

- Section 80D deductions (health insurance premium).

- HRA exemption (except under certain special conditions).

- Education loan interest deduction (Section 80E).

- Savings bank interest exemption (Section 80TTA/TTB).

8. How the New Regime Became the Default Option

From FY 2023-24 onwards, the new tax regime automatically applies unless you opt for the old regime.

If you want to use the old regime, you must file Form 10-IEA before the income tax return due date.

9. Comparing Old vs New Tax Regime

| Feature | Old Regime | New Regime |

| Tax Rates | Higher | Lower |

| Deductions | Many | Limited |

| Compliance | High paperwork | Minimal paperwork |

| Best For | High deduction claimers | Simple salary earners |

10. How to Switch Between Tax Regimes

- Salaried employees can choose the regime every year while filing returns.

- Business owners can switch only once after choosing the new regime.

11. Filing Requirements and Form 10-IEA

To opt for the old regime, file Form 10-IEA online before your ITR due date. Without this, the department considers you under the new regime by default.

12. Using Excel Tax Calculators for Easy Computation

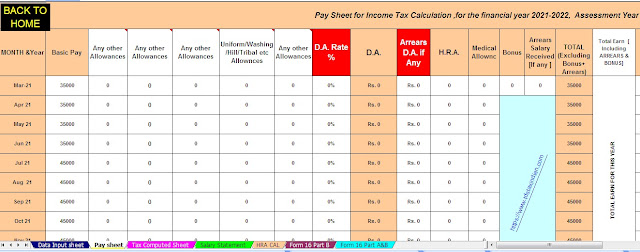

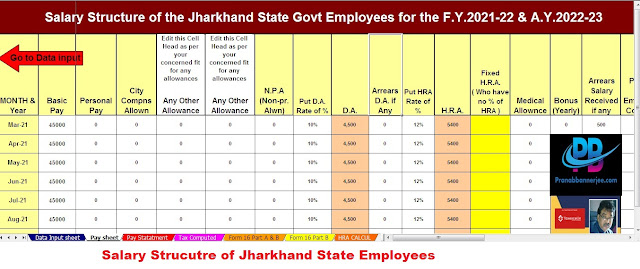

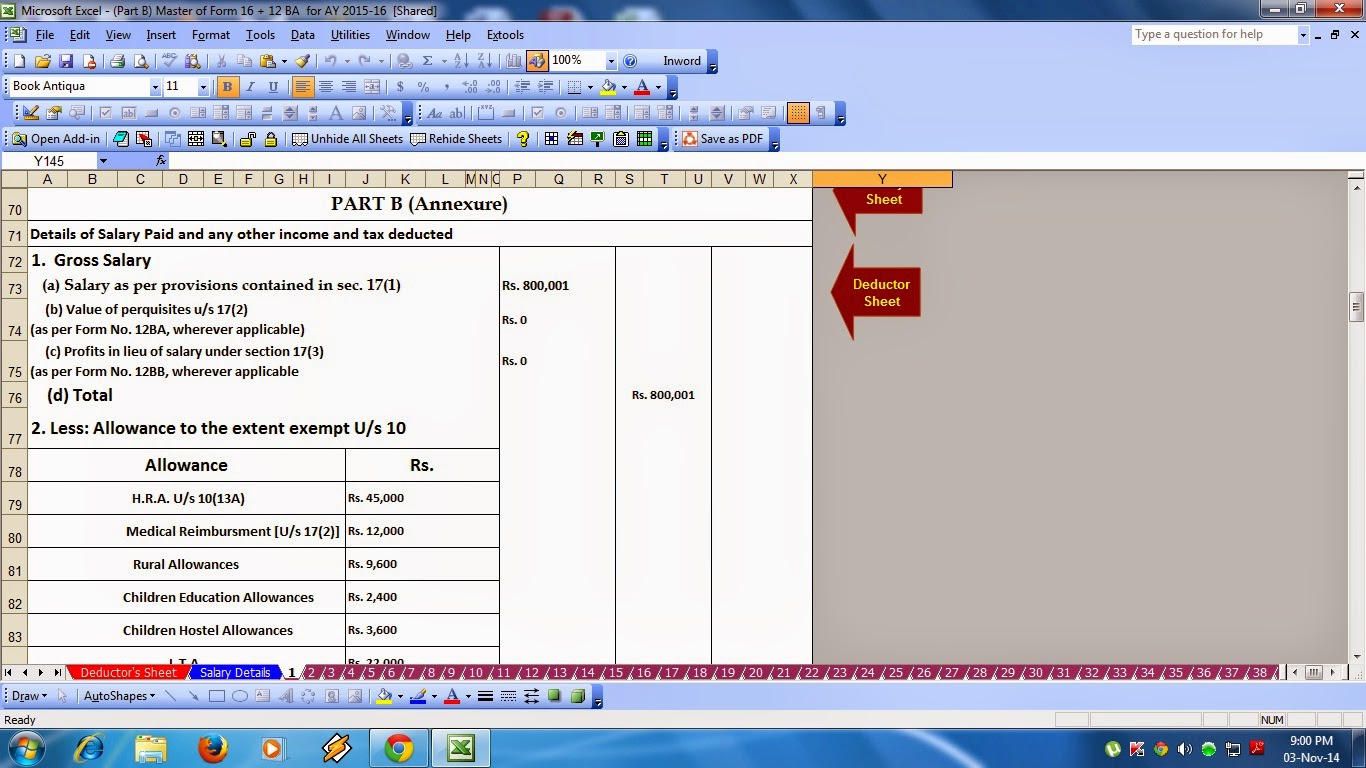

You can avoid manual calculations by using automated Excel tools like the Download Automatic Income Tax Calculator All in One for the Non-Government Employees in Excel for the F.Y.2025-26.

This Excel calculator includes:

- Tax computation sheet as per Budget 2025.

- Built-in salary structure for non-government employees.

- Automatic HRA exemption calculation.

- Auto-generated Form 12BA, Form 16 Part A & B.

13. Step-by-Step Example of Tax Calculation

Example: A salaried person earns ₹12,00,000 annually.

- Gross Income: ₹12,00,000

- Less Standard Deduction: ₹75,000

- Taxable Income: ₹11,25,000

Tax:

- 0 – 3,00,000 → Nil

- 3,00,001 – 6,00,000 → ₹15,000 (5%)

- 6,00,001 – 9,00,000 → ₹30,000 (10%)

- 9,00,001 – 11,25,000 → ₹33,750 (15%)

Total Tax = ₹78,750 + Cess

14. Common Mistakes to Avoid

- Forgetting to file Form 10-IEA when opting for the old regime.

- Not checking tax savings under both regimes before deciding.

- Misreporting taxable income due to missed allowances.

15. Final Thoughts on Choosing the Right Regime

The New Tax Regime, as per Budget 2025, is ideal for those who value simplicity and don’t rely heavily on deductions. But the best choice depends on your personal financial situation — compare both before filing.

FAQs

- What is the main benefit of the New Tax Regime as per the Budget 2025?

It offers lower tax rates with simplified filing, reducing paperwork. - Can I claim Section 80C deductions in the new regime?

No, Section 80C deductions are not available under the new regime. - Is the new regime mandatory for everyone?

No, but it is the default. You can opt for the old regime by filing Form 10-IEA. - What is the standard deduction under the new regime for FY 2025-26?

It is ₹75,000 for salaried individuals and pensioners. - Which tax regime saves more money?

It depends on your income and deductions. Calculate both before deciding.

Download Automatic Income Tax Calculator All in One for the Non-Government Employees in Excel for the F.Y.2025-26

[This Excel Calculator can prepare your Tax Computed Sheet as per Budget 2025 + Inbuilt Salary Structure for both Non-Govt Employees + Automatic Salary Sheet + Automatic calculation of H.R.A. Exemption U/s 10(13A + Automatic Form 12BA Automatic Form 16 Part A and B + Automatic Income Tax Form 16 Part B]