All about Form16. Form 16 is a document or certificate, issued according to Section 203 of the Income-Tax Act 1961, to salaried experts in India by their individual employers. This Form 16 has detailed about the salary paid by the employer to the employee in a financial year and the income tax that has been deducted from the salary of the person by the payer| The TDS, so deducted, by the employer is stored with the Income Tax department and Form 16, thusly, is confirmation of the equivalent. Employers need to give Form 16 to their employees prior to fifteenth June of the financial year quickly following the financial year in which the income was paid and tax deducted. Qualification rules for Form 16? Each salaried person who falls under the taxable section is qualified for Form 16. On the off chance that an employee doesn't fall inside the tax sections set, he/she won't have to have Tax Deducted at Source (TDS)

You may also, like:- Automated Income Tax Revised Form 16 Part A&B and Part B for the F.Y.2020-21[This Excel Utility Prepare One by One Form 16 Part A&B and Part B]

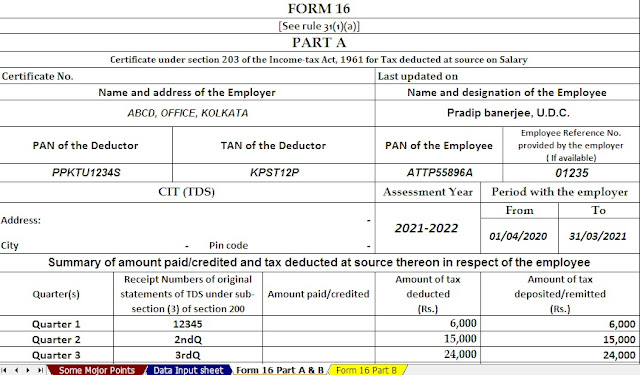

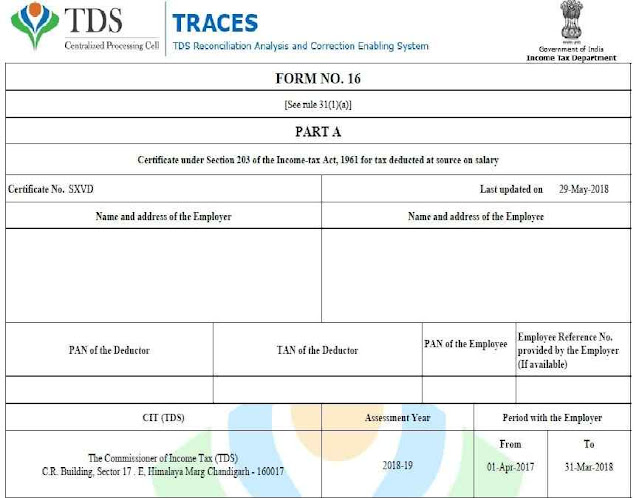

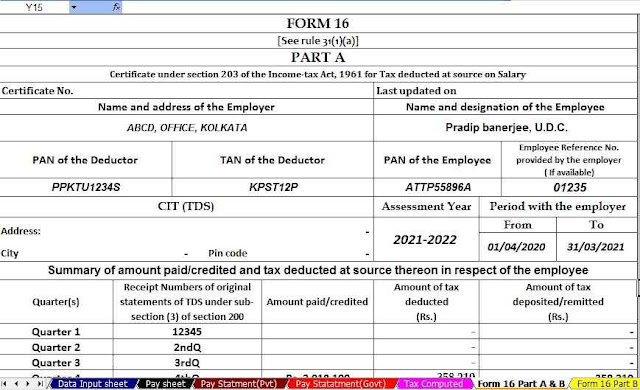

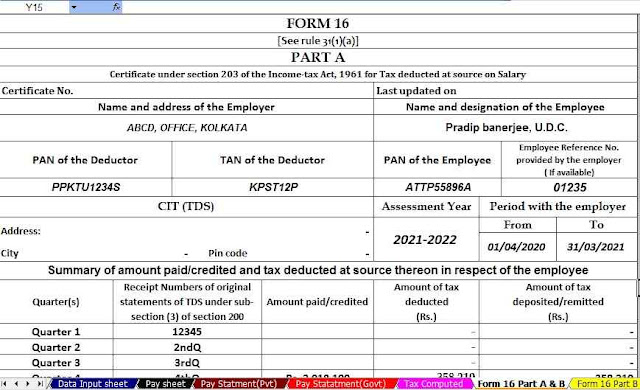

Income Tax of Form 16 is sub-separated into the accompanying two parts which include: Salary Certificate Form 16 Part A and Part B. Form 16 Part A gives the outline of tax gathered by the employer from the salary income, for the employee's benefit, and kept in the public authority's record. It is an accreditation appropriately endorsed by the employer that they have deducted the TDS from the employee's salary and stored it with the income tax department| This part is created and downloaded through the Follows entrance of the Income Tax department|

You may also, like - Automated Income Tax Revised Form 16 Part B for the F|Y.2020-21[This Excel Utility Prepare One by One Form 16 Part B]

It contains the accompanying details: Individual information of the employer just as the employee. Particulars, for example, the individual and employer's name, address details, Dish details of both, and employer's TAN details. The Appraisal Year (A|Y) The time-frame for which the individual was utilized with the employer in the concerned Financial Year Synopsis of the salary paid Date of tax allowance from the salary Date of tax store in the record of government Outline of tax deducted and saved quarterly with the Income Tax Department Affirmation Number of the TDS Installment|

You may also, like: - Automated Income Tax Revised Form 16 Part A&B for the F|Y 2020-21[This Excel Utility Prepare at a time 50 Employees Form 16 Part A&B]

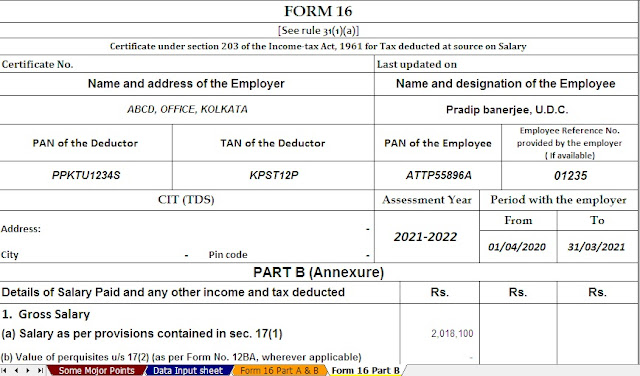

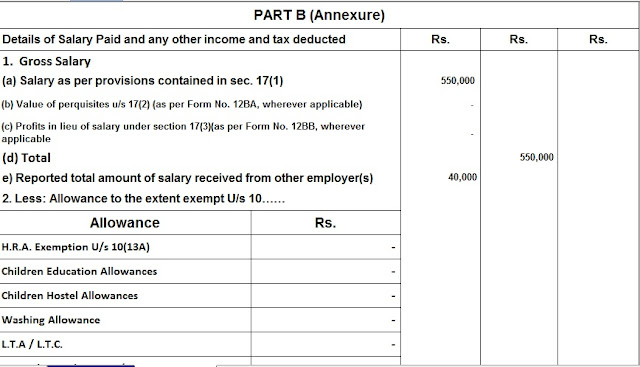

Form 16 Part B Part B is a united assertion covering details regarding salary paid, some other income as revealed by the employee to his/her association, a measure of tax paid, and tax due assuming any| Salary Certificate Form Part B of Form 16 is related to Form 16 Part A| It addresses the information alongside the exclusions and allowances appropriate consequently. Employee details, for example, name and Skillet are referenced even in Part B|

You may also, like:- Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21[This Excel Utility Prepare at a time 100 Employees Form 16 Part A&B ]

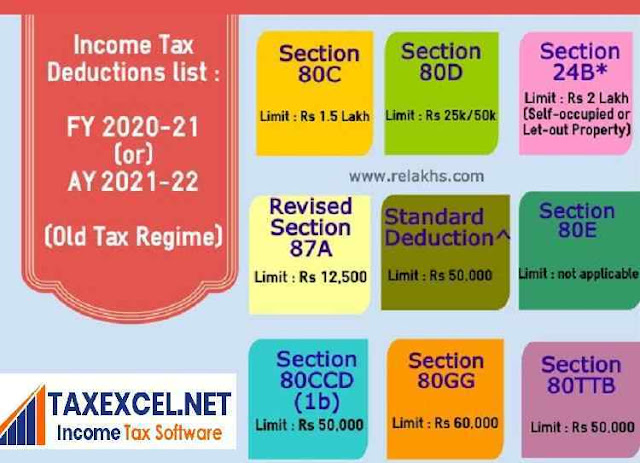

It contains the accompanying information: Complete Salary Got Exceptions Permitted U/s 10(5) 10(10) 10(10A) 10(10AA) 10(13A), a measure of some other exclusion U/s 10| The standard derivation permitted under section 16 of the Income Tax Act. Income (or acceptable misfortune) from house property revealed by employee offered for TDS, Income under the head Different Sources offered for TDS. A field for revealing the aggregate sum of salary got from different employers is available. Derivations from Salary: Section 80 C/80 CCC/80 CCD/80D/80E/80G/80TTA and other relevant sections are given|

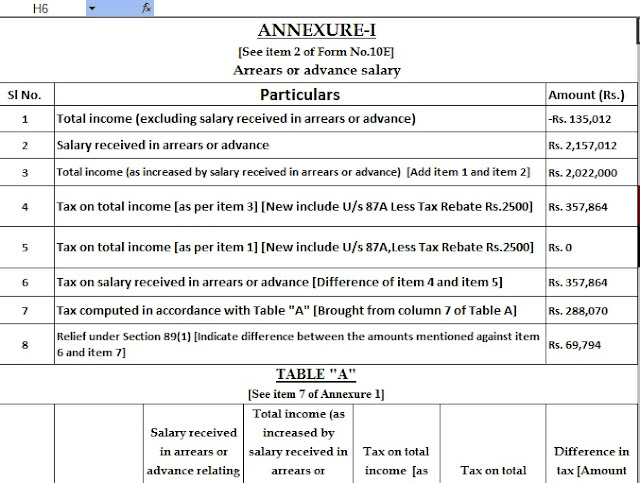

The details for all these derivations require to be put together by the employee alongside the vital supporting documents to the employer. Net Taxable Salary. Instruction Cess and overcharges assuming any. Discount under Section 87, if material. Help under Section 89, if any Aggregate sum of tax payable on income. Tax deducted and the equilibrium tax due or discount material|

Feature of this Excel Utility:-

1) This Excel Utility Prepare at a time 50 Employees Form 16 Part B as per the new and old tax regime U/s 115 BAC |

2) This Excel Utility has the all Income Tax Sections as per the Income Tax Act |

3) This Excel utility has an option for opting your option as a New and Old Tax Regime |

4) This Excel Utility has instruction for how to calculate Income Tax As per U/s 115 BAC |

5) This Excel The utility can prepare more than 1000 Income Tax Form 16 Part B|