Introduction

Are you planning a family vacation and wondering how to save tax through Leave Travel Allowance (LTA)? What if we told you there’s an Excel-based tax solution that simplifies everything for you, from calculating LTA exemptions to generating Form 16 automatically?

This article is your step-by-step guide to understanding LTA exemptions and using an Income Tax Preparation software All in One in Excel, designed specifically for Government and Non-Government employees for the Financial Year 2025-26. Let’s make tax-saving as smooth as your travel plans.

Table of Contents

| Sr# | Headings |

| 1 | What is Leave Travel Allowance (LTA)? |

| 2 | Who is Eligible to Claim LTA? |

| 3 | LTA Exemption Rules Under Section 10(5) |

| 4 | How Often Can You Claim LTA Exemption? |

| 5 | What Expenses are Covered Under LTA? |

| 6 | Documents Required to Claim LTA |

| 7 | LTA Exemption for Non-Government Employees |

| 8 | LTA for Government Employees: Key Differences |

| 9 | Common Mistakes to Avoid While Claiming LTA |

| 10 | Role of Income Tax Preparation software All in One in Excel |

| 11 | Features of the Excel-Based Tax Software |

| 12 | Automate LTA Exemption Calculations |

| 13 | Generate Form 16 Instantly with Software |

| 14 | User Interface: Simple Yet Powerful |

| 15 | Conclusion and Tax-Saving Tip |

1. What is Leave Travel Allowance (LTA)?

Leave Travel Allowance (LTA) is a component of your salary that employers provide for travel expenses within India. It’s not just a perk—it’s a smart way to save on taxes.

2. Who is Eligible to Claim LTA?

Any salaried employee, whether Government or Non-Government, can claim LTA, provided their employer includes it in their salary package. But remember, LTA can be claimed only for domestic travel.

3. LTA Exemption Rules Under Section 10(5)

Section 10(5) of the Income Tax Act allows you to claim LTA exemption only for travel expenses. It does not include hotel stays, food bills, or shopping. You must travel during leave and provide proof of travel to qualify.

4. How Often Can You Claim LTA Exemption?

You can claim LTA exemption twice in a block of four years. The current block is 2022–2025. If you miss claiming LTA in one block, you can carry it forward to the first year of the next block.

5. What Expenses are Covered Under LTA?

Only the travel fare of the employee and their immediate family (spouse, children, and dependent parents/siblings) is exempt. Travel can be by rail, air, or public transport — but private taxis are excluded.

6. Documents Required to Claim LTA

To support your claim, you need to submit:

- Proof of travel (tickets, boarding passes)

- Employer-declared LTA policy

- Declaration form

- Bills showing actual expenditure

The Income Tax Department doesn’t require submission, but your employer does, and may deny the exemption if you don’t submit proof.

7. LTA Exemption for Non-Government Employees

Many non-Govt employees ignore LTA benefits, thinking it's a complex process. But with the right tools like the Income Tax Preparation software All in One in Excel, it's simplified. The software walks you through every field to ensure you don’t miss out on exemptions.

8. LTA for Government Employees: Key Differences

Government employees often receive pre-approved travel leaves and fixed LTA slabs. The software includes customised salary structures that automatically recognise these components and calculate exemptions accordingly.

9. Common Mistakes to Avoid While Claiming LTA

- Claiming for international travel

- Submitting incomplete documentation

- Not understanding block periods

- Including non-family members

- Not maintaining proof of travel

Avoiding these is easy with an automated Excel calculator, which gives instant alerts for invalid entries.

10. Role of Income Tax Preparation software All in One in Excel

This tool is more than just a calculator. It:

- Automatically computes your LTA exemption

- Integrates salary structure with tax logic

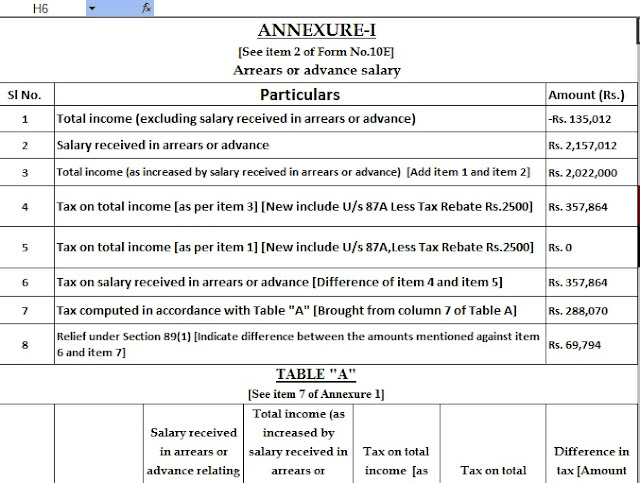

- Generates all necessary forms, including Form 10E and Form 16

- Works for both Govt and Non-Govt employees

Think of it like a GPS for your taxes—guiding you at every turn.

11. Features of the Excel-Based Tax Software

Here’s what makes it powerful:

- Auto-filled Salary Sheet

- HRA & LTA Exemption Calculations

- Tax Arrears Relief U/s 89(1)

- Form 16 Part A & B generation

- Support for multiple employees (Govt/Non-Govt)

This all-in-one solution keeps everything at your fingertips.

12. Automate LTA Exemption Calculations

Instead of using complicated formulas or external help, you can let the software handle everything. Just enter your journey details, and it auto-applies Section 10(5) rules to give you the exact exemption amount.

13. Generate Form 16 Instantly with Software

Why wait weeks for your HR? With a few clicks, this Excel tool generates Form 16, with both Part A and Part B, ready for filing or employee handover.

14. User Interface: Simple Yet Powerful

The Excel-based software is designed with user-friendly menus, drop-down lists, and pre-formatted fields. Even someone with basic Excel knowledge can operate it without error.

15. Conclusion and Tax-Saving Tip

LTA exemption isn’t just a tax benefit—it’s your reward for travelling with your family. And with the Income Tax Preparation software All in One in Excel, claiming this exemption becomes as easy as booking your ticket.

So, take that well-deserved trip, save on taxes, and let your software handle the rest!

FAQs

- Can I claim LTA exemption for an international trip?

No, the LTA exemption is valid only for travel within India. - What if I don’t travel during a financial year but have LTA in my salary?

In that case, LTA becomes taxable unless claimed and supported with proof of travel. - Can I claim LTA for more than one trip in a block?

Yes, but only two claims per block are exempted, regardless of the number of trips. - How can the Excel software help with LTA claims?

It automatically calculates LTA based on your salary structure and trip details, saving time and reducing errors. - Is the Excel-based Income Tax software suitable for both Govt and Non-Govt employees?

Absolutely. It includes pre-set salary templates and LTA rules for both categories.

16. Bonus Tip: How to Combine LTA with Other Exemptions

You can maximise your tax savings by pairing LTA with other available exemptions like:

- House Rent Allowance (HRA)

- Section 80C deductions (LIC, PPF, tuition fees, etc.)

- Section 80D for medical insurance

- Section 89(1) for arrear relief

The Income Tax Preparation software All in One in Excel includes modules for each of these exemptions, giving you a 360-degree tax-saving dashboard.

17. Why Excel is Still the Best for Tax Calculation

You might wonder, “Why not use online platforms or apps?”

Here’s why Excel wins:

- Offline access — No internet needed

- Customizability — Tailor sheets for individual salary structures

- Transparency — See every formula and calculation

- Portability — Easily email or archive

- No subscriptions — One-time download, lifetime use

It’s like having a tax expert in your laptop, minus the consultation fees.

18. Real-Life Scenario: LTA Claim Made Easy

Let’s say Priya, a software engineer in a private firm, travelled from Delhi to Kochi with her husband and two children in December 2025.

She opened the Income Tax Preparation software All in One in Excel, went to the LTA tab, entered:

- Travel dates

- Mode of transport (airfare – economy class)

- Total fare amount

- Family details

Boom! The software calculated her LTA exemption under Section 10(5) and reflected it in her tax computation sheet instantly. No manual formulas. No confusion.

19. Updates as per Budget 2025

The software is updated with the latest tax slabs and exemptions announced in Union Budget 2025, including:

- Standard Deduction revision

- Latest surcharge rates

- Applicable cess

- LTA block rules and alerts

This ensures 100% accuracy in your tax planning and filing.

20. How to Download and Use the Software

Follow these simple steps:

- Download the Income Tax Preparation software All in One in Excel from the official website or trusted sources.

- Enable macros (the software comes with built-in automation).

- Fill in your personal and salary details.

- Go to the LTA section and fill in your travel info.

- Automatically view the tax computation sheet and Form 16.

Yes, it’s that simple. You can even use it for multiple employees or different PAN holders.

21. How Employers Can Benefit from This Software

If you're in HR or manage payroll for a company, you’ll love these features:

- Generate tax reports for all employees

- Auto-calculate LTA exemptions for everyone

- Send Form 16 directly from Excel

- Comply with the latest TDS norms

- Save hours of manual work

Imagine doing the job of an entire payroll team with one spreadsheet.

22. LTA in the Old vs. New Tax Regime

If you opt for the new tax regime (Section 115BAC), LTA exemption is not available.

But under the old regime, the LTA exemption can be claimed. The software allows you to:

- Compare both regimes side by side

- Choose the better option

- Print a declaration form

This feature is a game-changer when making year-end decisions.

23. Keeping Records for Future Reference

Although you’re not required to submit LTA bills to the Income Tax Department, you must keep them safely for up to 6 years in case of scrutiny.

The software has a built-in document checklist where you can log:

- Travel ticket details

- Dates and destination

- Amount claimed

- Notes or references

This acts as a digital logbook of your LTA claims — neat, organised, and audit-ready.

24. A Tool for the Entire Financial Year

This Excel-based tool isn’t just for LTA — it’s your all-in-one tax planner for the full F.Y. 2025-26. Use it to:

- Track monthly salary

- Calculate TDS

- File Form 10E for arrears

- Plan deductions

- Print reports for ITR filing

It’s like a diary, calculator, and accountant — all in one file.

Conclusion: Travel More, Tax Less

Leave Travel Allowance gives you the perfect reason to pack your bags, unwind with family, and save on taxes — all at once. Don’t let complexity stop you.

With the Income Tax Preparation software All in One in Excel, you’ve got a trusted companion that takes the guesswork out of LTA and income tax planning for both Government and Non-Government employees.

So, this year, don’t just plan your holiday — plan your taxes too!

Additional FAQs

- What happens if I don’t submit proof for my LTA claim to the employer?

Your employer will treat LTA as a fully taxable component of your salary. - Can I use the Excel software only on Windows?

Yes, it works on both, as long as Excel supports macros and VBA. - Is there any limitation on the number of LTA entries in the software?

No, you can enter multiple journeys, but only two claims are exempted in a block. - Can the software handle salary structures with bonuses and incentives?

Absolutely. It includes options to add incentives, bonuses, arrears, and other allowances. - Where can I download this Income Tax Preparation software, all in one, in Excel?

You can get it from official tax solution providers or your organisation’s HR department. You may also request a download link from a trusted site, https://itaxsoftware.net or https://apnataxplan.in, or https://pranab.banerjee.com, or directly download from the link below

Download Automatic Income Tax Preparation Software All in One for the Government and Non-Government Employees for the F.Y.2025-26

[This Excel Calculator can prepare at a time your Tax Computed Sheet as per Budget 2025 + Inbuilt Salary Structure for both of Govt and Non-Govt Employees + Automatic Salary Sheet + Automatic calculation of H.R.A. Exemption U/s 10(13A + Automatic calculate Income Tax Arrears Relief Calculation U/s 89(1) with Form 10E + Automatic Form 16 Part A and B + Automatic Income Tax Form 16 Part B]