Tax season is here again, and if you're a government employee in Maharashtra, you might already be feeling the pressure. Filing income tax doesn’t have to be a headache. Imagine a tool that does all the heavy lifting—like a personal assistant who understands the tax rules better than most. That’s what the Income Tax Preparation Software in Excel offers. It’s quick, reliable, and tailored for Maharashtra State employees. Let's break it down together, step by step.

Table of Contents

| Sr# | Headings |

| 1 | What is Income Tax Preparation Software in Excel? |

| 2 | Why is it Important for Maharashtra State Employees? |

| 3 | Key Features of the Excel-Based Software |

| 4 | What's New in the FY 2025-26 Version? |

| 5 | Step-by-Step Guide to Download the Software |

| 6 | How to Use the Software: A Beginner’s Guide |

| 7 | Error-Free Calculations: How It Saves You Time |

| 8 | Ensuring Compliance with Tax Rules and Sections |

| 9 | Who Developed the Software and Is It Safe? |

| 10 | Compatibility with Excel Versions |

| 11 | Customizable Options for Different Employee Types |

| 12 | Common Mistakes and How the Software Prevents Them |

| 13 | User Reviews and Testimonials |

| 14 | Troubleshooting Common Issues |

| 15 | Final Thoughts and Download Link |

1. What is Income Tax Preparation Software in Excel?

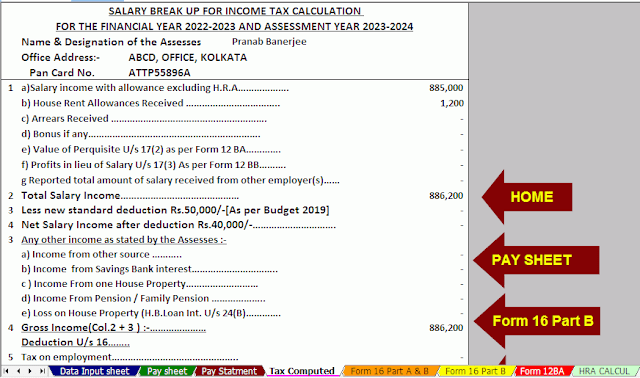

The Income Tax Preparation Software in Excel is a smart, spreadsheet-based tool that helps employees calculate and file their income tax accurately. Designed specifically for Indian taxpayers, especially government staff, this tool automates the entire tax computation process.

2. Why is it Important for Maharashtra State Employees?

If you work for the Maharashtra State Government, you deal with specific salary structures, allowances, and deductions. This software is built keeping those nuances in mind. It’s like having a tailor-made suit—it just fits better than a one-size-fits-all tool.

3. Key Features of the Excel-Based Software

Bold features, better benefits:

- Auto calculation of taxable income, deductions, and rebates

- Built-in formulas to ensure accuracy

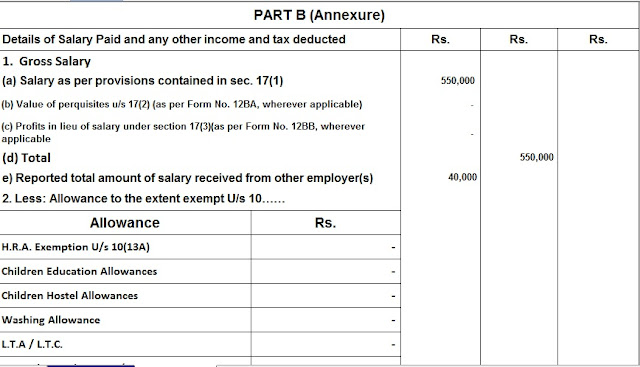

- Preloaded sections like 80C, 80D, HRA, LTA, etc.

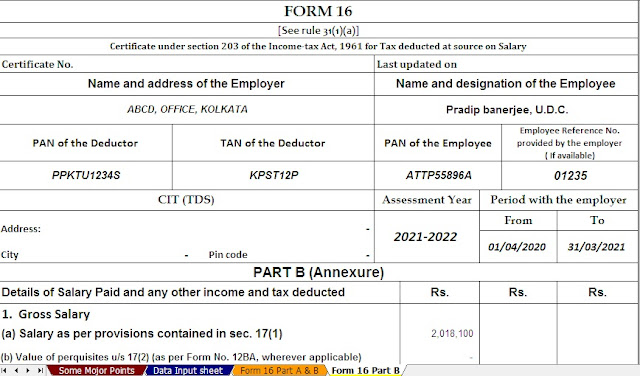

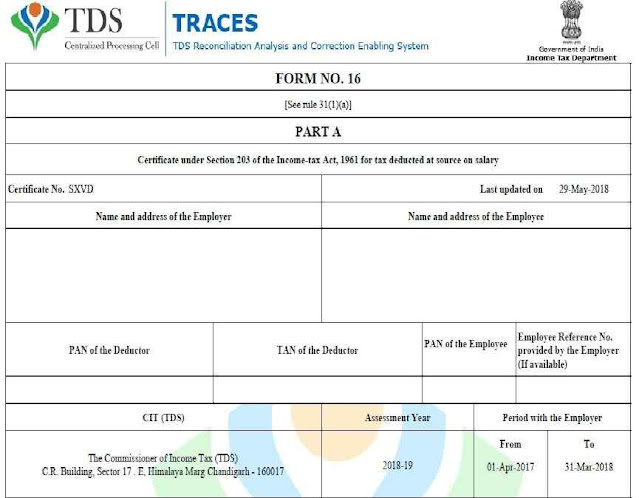

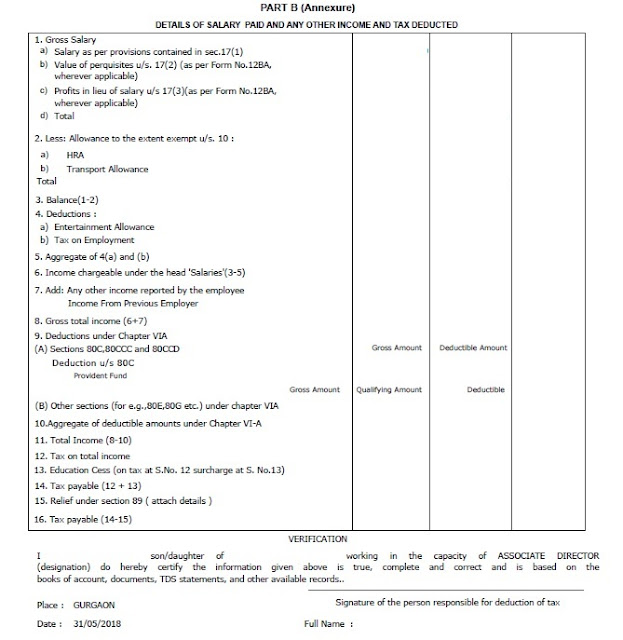

- Form 16 auto-fill based on your inputs

- Support for Old and New Tax Regimes

4. What’s New in the FY 2025-26 Version?

Each financial year brings changes, and this tool is updated accordingly. In the 2025-26 version, you’ll find:

- Updated tax slabs

- Adjusted rebate limits

- Improved UI with drop-downs and validations

- Enhanced security macros to protect your data

5. Step-by-Step Guide to Download the Software

Downloading this software is as easy as downloading a movie or song. Follow these steps:

- Go to the link below to download this Excel Utility

- Click on the “Download Excel Tool for FY 2025-26”

- Save the file to your device

- Enable Macros when prompted in Excel

- You're ready to go!

Always scan the file for safety and avoid downloading from unknown sites.

6. How to Use the Software: A Beginner’s Guide

If you're new to Excel tools, don't worry. Here's how to get started:

- Open the file in Microsoft Excel

- Fill in your personal details (Name, PAN, DOB, etc.)

- Enter your salary details and allowances

- Claim deductions under various sections

- Choose your preferred tax regime

- Hit calculate—and voilà!

7. Error-Free Calculations: How It Saves You Time

Manual tax calculation is like solving a Rubik’s cube blindfolded—tricky and error-prone. This software handles complex calculations with built-in logic, minimising human error. It ensures correct tax liability in just minutes.

8. Ensuring Compliance with Tax Rules and Sections

The Income Tax Act has more rules than a cricket match! This software incorporates the latest changes and ensures you’re compliant with:

- Section 80c (Investments)

- Section 10 (Allowances)

- Section 87a (Rebate)

- And more…

9. Who Developed the Software, and Is It Safe?

Most versions of this tool are created by tax professionals or retired government officers. They know the system inside out. While it's usually safe, ensure you download only from trusted sources to avoid malware.

10. Compatibility with Excel Versions

Good news! The tool works on:

- Excel 2007

- Excel 2010

- Excel 2013 and newer

Just make sure Macros are enabled for full functionality.

11. Customizable Options for Different Employee Types

Whether you're a teacher, clerk, police officer, or health worker, the software offers flexible input fields. Adjustments for allowances, leave encashment, and bonus calculations are also available.

12. Common Mistakes and How the Software Prevents Them

We often miscalculate HRA, forget to claim deductions, or enter wrong PAN details. This software has built-in checks that alert you if something is off. It’s like having a smart friend watching over your shoulder.

13. User Reviews and Testimonials

Many users call it a “lifesaver during tax season.” Employees say it saves them hours of paperwork and removes confusion around the New vs Old Tax Regime choice.

14. Troubleshooting Common Issues

Facing problems? Here’s what to do:

- Macro not working? Check your Excel settings

- Form not opening? Make sure you're using a compatible version

- Error in formula? Recheck the data input or download the latest file

15. Final Thoughts and Download Link

Don't wait till the last minute. Get your Income Tax Preparation Software in Excel for FY 2025-26 from the below given link now. It’s a time-saver, stress-buster, and smart way to stay compliant.

👉 Download Now from a Trusted Source

Conclusion

In today’s fast-paced world, nobody has time for complex tax forms and manual calculations. This Excel-based income tax software takes care of the grunt work so you can focus on what matters. It’s reliable, simple, and tailored for Maharashtra State Employees. If you're looking for a smoother tax filing experience in FY 2025-26, this tool is your go-to solution.

FAQs

1. Is the Excel-based income tax software free to use?

Yes, many versions are free, especially those shared by tax experts or government bodies.

2. Can I use this software if I switch to the New Tax Regime?

Absolutely! The software lets you choose between Old and New regimes easily.

3. What if I don’t know how to enable macros in Excel?

No worries! Just go to Excel options > Trust Centre> Enable Macros. A quick Google search can help, too.

4. Is this software suitable for pensioners or only working employees?

It's customizable and works for both employees and pensioners in Maharashtra.

5. How do I update the software next year?

Most creators release updates annually. Just visit the source website again for the next FY version.

Download Automatic Income Tax Preparation Software in Excel for the Maharashtra State Employees for F.Y. 2025-26

[This Excel Utility is mainly prepared for the Maharashtra State Employees with Automated income tax Computed Sheet + Automatic H.R.A. Exemption U/s 10(13A), Automatic Form 16 Part A&B and Part B as per Budget 2025]