According to the new Budget 2020, introduced a new Section 115 BAC in this section any a taxpayer can pick in their Option As new and old Tax Regime. Likewise, the Move has introduced a new Option Form 10-E for selecting the taxpayer's option as new or old tax regime U/s 115 BAC.

Note That:- On the off chance that you like New Tax Regime, you can not have

the option to entitled any Income Tax benefits. In any case, on the off chance

that you pick your option as Old Tax Regime, you can get the all Income Tax Advantages.

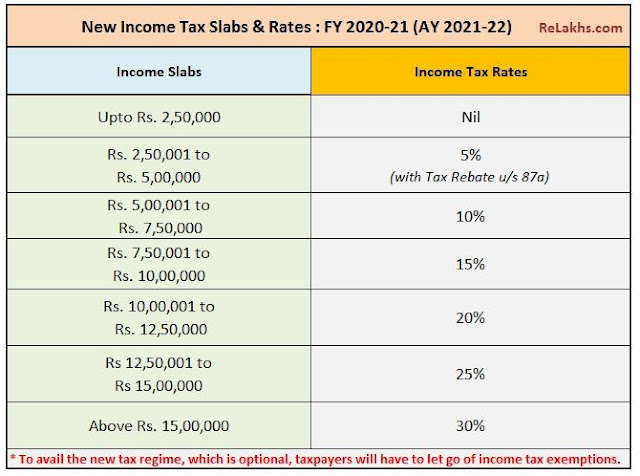

In the Budget has introduced two kinds of Income Tax Slab is given below:-

Yet, in new Tax Slab has not benefited to the Senior Resident.

According to the New Income Tax Section 115 BAC introduced in Budget 2020. According to Section 115 BAC, you should give your option as you pick in as New Tax Regime or Old Tax Regime in the newly endorsed Form 10-IE. In the event that you pick the New Tax Regime you can not profit this exclusion U/s 80 TTA or on the off chance that you pick the Old Tax Regime, at that point you can benefit this Exception U/s 80 TTA

Except Section 80CCD (2) (Entitle if the option is New Tax Regime)

Under this section, supervisor responsibility on account of the agent in exhorted benefits plans like EPF, NPS, and/or Super Remark Account can be affirmed up to Rs.7.5 lakh limit.

A business can contribute a total equal to 12% of the specialist's fundamental month to month pay to his/her EPF account. Furthermore, a business can contribute a total identical to 10% of the specialist's crucial remuneration to the Level I account of NPS (For Central Government Delegates it is by and by 14% of Fundamental + DA amazing from first April 2019). In a superannuation account, a business can contribute a constraint of Rs 1.5 lakh exonerated from tax in a monetary year.

Imply the point by point post on NPS Tax Favorable circumstances at "NPS Tax Preferences 2020 – Sec.80CCD (1), 80CCD (2) and 80CCD (1B)".

Feature of this Excel Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

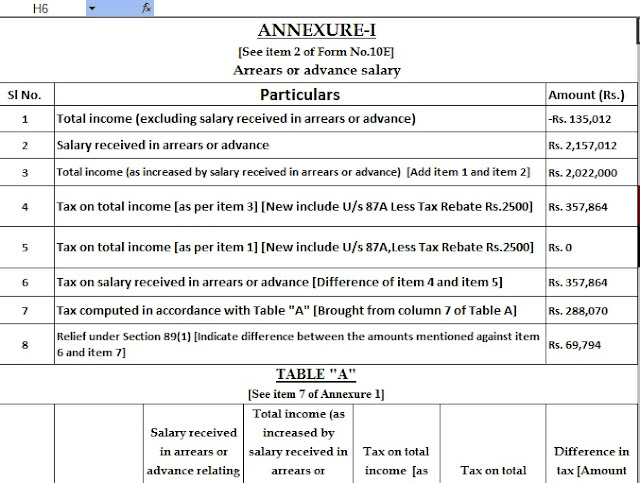

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount into the in-words without any Excel Formula