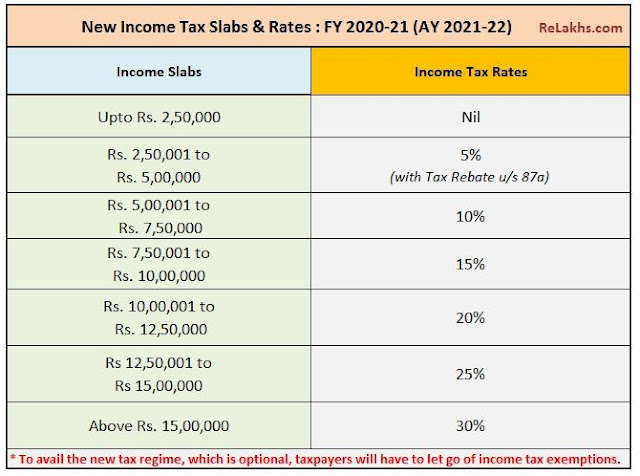

In Budget 2020 has introduced a New Tax System

New and Old Tax Regime U/s 115 BAC and also allow the taxpayers to opt-in

whether they can get the New Tax Regime or Old Tax Regime U/s 115 BAC for the

F.Y.2020-21. Those who willing to opt-in the Old Tax Regime they can get the benefits

of Tax Sections and those who willing to opt-in the New Tax Regime they can not get

any Tax Benefits as per the Income Tax Act 1961. In this article 6 top tax

benefits for the Old Tax Regime for F.Y.2020-21

1. Use HRA Exemption Effectively

HRA (House Rent Allowance), an allowance given with the salary

to the government and private employees. This allowance is to meet the

expenditure actually incurred on payment of rent. Income Tax Department gives

tax benefit on this allowance. It Does not consider the full amount as taxable

income.

To avail the utmost tax break on HRA, you ought to keep your HRA

50% of the essential salary and rent paid should be 20% quite of HRA.

2. Purchase a Dream Home by taking home equity credit

As a salaried person, you

can enjoy the tax-saving on home loan by purchasing a house. By this manner,

you'll own your dream home and avail the tax break also.

So, if you've got taken a

home equity credit, you'll save tax under three sections, viz. 80C, 24 and

80EEA.

Deduction on Repayment of

Principal Amount

Out of the home loan EMI,

the principal amount is eligible for a tax deduction up to Rs.1.5 lakh u/s 80C.

You must have an idea of the principal amount in the EMI. It changes

continuously, thus you ought to ask EMI schedule.

Deduction on Interest Paid on Home Loan U/s 24(b)

You can claim the tax

deduction of interest paid on home loan u/s 24(b) as well. The limit of this

deduction is Rs. 2 lakh for some cases. But, if you have taken the home loan

for a property which is not self-occupied, then there is no maximum limit of

deduction. Hence, you'll claim the entire interest amount u/s 24.

3. Ensure Retirement Pension Through the NPS

National Pension Scheme,

(NPS) maybe a retirement saving scheme. Any person can invest during this

scheme including salaried persons. You have to invest throughout your service

period. A part of your contribution also goes to the shares and bonds.

After retirement, you get

a lump-sum amount. Some amount is also used to give you a regular pension.

Let us see how you'll

save tax through NPS-

Your investment in the

NPS account is eligible for a tax deduction up to Rs.1.5 lakh.

Employer’s contribution

in NPS account u/s 80CCD (2)

The employer’s

contribution in your NPS account is also eligible for a tax deduction. But, the

total contribution should be 10% of your salary. The limit is 14% for the

central government employees.

Additional contribution in NPS account u/s 80CCD

(1B)

Besides the above

contributions, you'll deposit an additional amount in your NPS account. And may

get a further tax break up to ₹50,000. This deduction is available only if you

invest more than the prescribed amount. As you know that Employee has to

contribute 10% of their salary. The excess amount is eligible for this

deduction.

4. Invest in PPF

The most popular saving scheme of all of the taxpayers in India. The PPF scheme is designed

for long term saving. Thus you can use it for your Children’s higher education

and marriage as well.

5. Health Insurance for Hassle-free Treatment U/s 80D

Like, Life Insurance, the

government gives you the tax deduction benefit on health insurance as well. So,

invest in any health scheme for hassle-free treatment and avail the tax break

u/s 80D. This section gives you a chance to save tax up to Rs. 1 lakh. Let us

see how-

• If you pay a premium

against health policy for you and your family (including children), you can

claim a deduction of Rs.25,000.

• For dependent parents

with your family above 60 years, the limit of deduction enhances up to Rs.

50,000.

• The deduction may be up

to Rs. 75,000, if your parents are senior citizens. So, Rs.25,000 for you and

your family and extra Rs.50,000 for your parents.

• Moreover, if you and

your parents both are senior citizens, you can claim deduction up to Rs. 1

lakh.

6. Use Children Tuition Fees for Tax Deduction

You can save tax by

paying the tuition fees of your two children up to Rs.1.5 lakh u/s 80C.

Remember this deduction is available for the fee paid to the educational

institute from pre-primary to higher education.

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

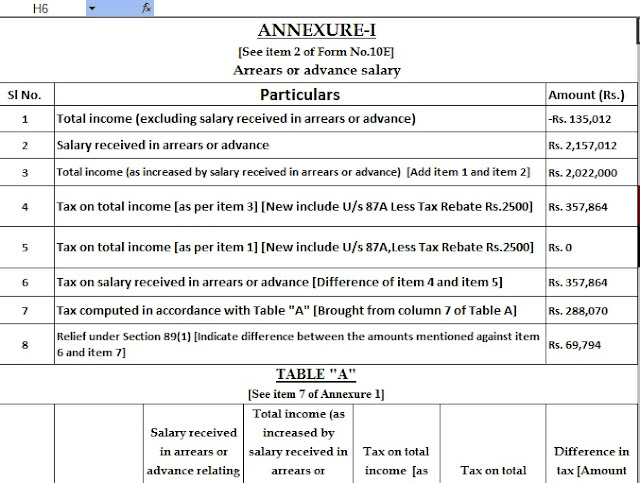

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet