Section 80GG is an uncommon arrangement under Chapter VI-A of the Income Tax Act, 1961, which gives tax respite to the individuals who don't benefit house rent stipend. To get qualified for tax derivation under this section, an individual must dwell in a rented property. Besides, his/her manager ought not to give home rent recompense (HRA) as a component of the month to month pay.

Section 80GG allowance is material to qualified salaried and independently employed experts. Hence, if an individual works a business, he/she is similarly as fit for claiming this specific tax allowance as the salaried partners may be.

Tax

payers to Eligible to Claim Tax Deductions under Section 80GG?

As expressed beforehand, one must meet certain essentials to benefit tax derivations under this particular section of the ITA. Recorded beneath are a portion of the components that an individual must satisfy to claim Section 80GG allowance.

I. Only individuals and Hindu Undivided Family (HUF) are qualified to claim these tax allowances. Organizations or different undertakings can't benefit a similar tax limits after paying rent in a given monetary year.

II. Individuals who are either salaried experts or independently employed can exploit this arrangement. In the event that one has no income to talk about, he/she is excluded from looking for Section 80GG income tax benefits, regardless of whether he/she pays the rent.

III. Those looking to profit this tax refund need to present a properly filled Form 10BA to the public authority already. This Form is an affirmation that the individual recording it doesn't claim profit by a self-involved property in any area.

IV. Section 80GG of Income Tax Act is explicitly intended for who don't get home rent remittance from their managers. On the off chance that an individual's compensation incorporates HRA installment, he/she is ineligible to claim income tax discounts identified with lodging rent.

V. If the yearly rent sum surpasses Rs.1 lakh, the taxpayer should present a duplicate of the mortgage holder's PAN card to claim tax benefits under Section 80GG of Income Tax Act. Remember that this PAN card must have a place with the property proprietor where one lives on rent.

VI. An individual must not have claimed HRA whenever during the financial year for which he/she is claiming the tax advantage under Section 80GG. This is a vital point for the individuals who have changed managers in the most recent year. Regardless of whether one didn't get HRA for a significant bit of the year, getting the equivalent for simply a month excludes his/her from claiming this yearly relief.

Individuals dwelling with their parents in a property possessed by their parents are likewise qualified to claim Section 80GG advantages. To do this, one would need to consent to a rental arrangement with his/her parents. Also, the sum appeared as rent will be taxable when the parents document their yearly taxes.

How

are Deductions Under Section 80GG Calculated?

Tax derivations under this section depend on Tax Rule 2A. According to Section 10(13A), minimal sum from the accompanying counts is viewed as a non-taxable income.

Rs.5000 every month or Rs.60000 per year.

The yearly rent sum short 10% of the taxpayer's changed all out income.

25% of the changed all out income for a year.

least from them is viewed as the Section 80GG allowance material. Allude to the accompanying table to learn two particular instances of tax derivations dependent on different income and rent installments –

Form

10BA: How to Do It Correctly?

The Form 10 BA is basic for anyone hoping to get Section 80GG tax benefits. Here are a portion of the subtleties that one must fill in Form 10BA before accommodation –

Full address with postal code

Name and PAN of the assessee

Mode of installment

Tenure of residency in months

Rental sum

Address and name of the property proprietor

Declaration expressing that the assessee, his/her life partner or minor kid don't possess some other private property

PAN number of the rented property's proprietor is required if the measure of rent surpasses Rs.1 lakh in some random monetary year.

Feature of this Excel Utility:-

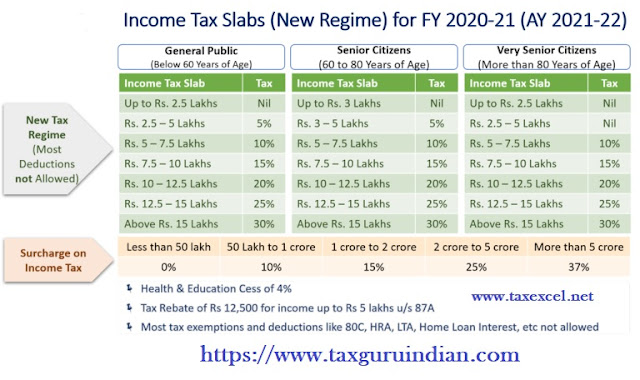

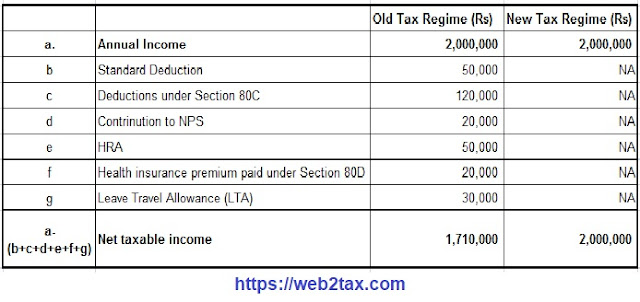

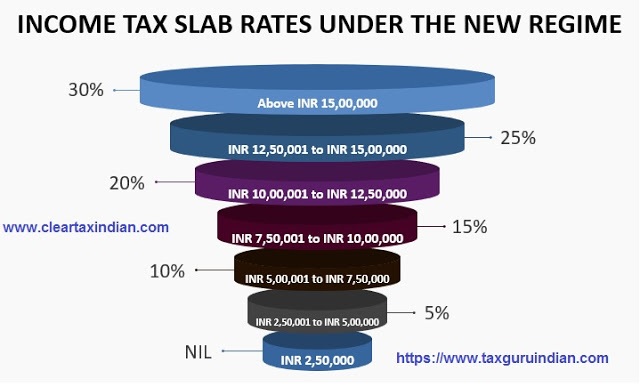

1) This

Excel utility prepares and calculate your income tax as per the New Section 115

BAC (New and Old Tax Regime)

2) This Excel

Utility has an option where you can choose your option as New or Old Tax Regime

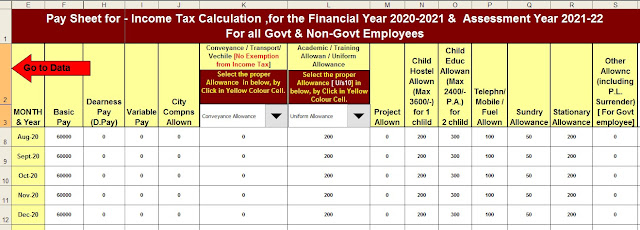

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet