Introduction

When it comes to saving taxes, every salaried employee—whether from the government or private sector—wants to make the most of available deductions. One such beneficial provision under the Income Tax Act is Section 80CCD(1B). If you’ve ever wondered how to save extra tax beyond the basic limits of Section 80C, then this section is your golden key.

Imagine having a tool that not only helps you understand these deductions but also prepares your taxes automatically. That’s exactly what the Automatic Income Tax Preparation Software/Calculator All in One in Excel for F.Y. 2025-26 does—it simplifies tax planning for both government and non-government employees.

Before we dive deeper, let’s explore this topic step by step.

Table of Contents

| Sr# | Headings |

| 1 | Understanding Section 80CCD(1B) |

| 2 | Importance of Section 80CCD(1B) in Tax Planning |

| 3 | Eligibility Criteria under Section 80CCD(1B) |

| 4 | Maximum Deduction Limit under Section 80CCD(1B) |

| 5 | Difference between Section 80CCD(1) and 80CCD(1B) |

| 6 | NPS – The Backbone of Section 80CCD(1B) |

| 7 | Benefits of Investing in NPS for Salaried Employees |

| 8 | How to Claim Deduction under Section 80CCD(1B) |

| 9 | Step-by-Step Example of Tax Savings |

| 10 | Introduction to Automatic Income Tax Preparation Software |

| 11 | Features of the All-in-One Excel-Based Calculator |

| 12 | How to Use the Excel-Based Calculator |

| 13 | Benefits for Government Employees |

| 14 | Benefits for Non-Government Employees |

| 15 | Final Thoughts and Conclusion |

1. Understanding Section 80CCD(1B)

Section 80CCD(1B) was introduced by the Government of India to promote investment in the National Pension System (NPS). It provides an additional deduction of ₹50,000 over and above the ₹1.5 lakh limit under Section 80C.

In simple words, this section encourages taxpayers to build a retirement corpus while reducing their tax burden. The best part? Both government and non-government employees can claim this benefit.

2. Importance of Section 80CCD(1B) in Tax Planning

When we talk about tax planning, many people stop at Section 80C. However, Section 80CCD(1B) goes a step further. By investing in NPS under this section, you can not only save more taxes but also secure your future financially.

Think of it like adding an extra layer of protection to your tax-saving armour—every bit helps, especially in the long run.

3. Eligibility Criteria under Section 80CCD(1B)

To claim benefits under Section 80CCD(1B):

- You must be an individual taxpayer (resident or non-resident).

- You must have contributed to the National Pension System (NPS).

- The contribution should be made from your own income.

This section is not available to Hindu Undivided Families (HUFs), ensuring that the benefit remains personal to the investor.

4. Maximum Deduction Limit under Section 80CCD(1B)

The maximum deduction available under this section is ₹50,000. This is over and above the ₹1.5 lakh limit of Section 80C.

So, if you fully utilise both, your total tax deduction can reach ₹2,00,000. Isn’t that a smart move for a taxpayer?

5. Difference between Section 80CCD(1) and 80CCD(1B)

| Particulars | Section 80CCD(1) | Section 80CCD(1B) |

| Applicability | Employees and self-employed | Individuals contributing to NPS |

| Deduction Limit | Up to ₹1.5 lakh | Additional ₹50,000 |

| Included under Section 80C | Yes | No, separate benefit |

| Objective | Promote retirement savings | Encourage extra investment in NPS |

This clear distinction makes 80CCD(1B) a bonus opportunity for extra savings.

6. NPS – The Backbone of Section 80CCD(1B)

The National Pension System (NPS) is a government-backed retirement savings scheme. It allows individuals to invest regularly in a mix of equity, corporate bonds, and government securities.

Under Section 80CCD(1B), any voluntary contribution to NPS qualifies for the additional ₹50,000 deduction.

You can think of NPS as a long-term bridge to your retirement goals—strong, steady, and reliable.

7. Benefits of Investing in NPS for Salaried Employees

There are several advantages to investing in NPS:

- Tax Efficiency: Additional ₹50,000 deduction under 80CCD(1B).

- Flexible Contributions: You can invest any amount anytime.

- Market-Linked Growth: Earn better returns over time.

- Retirement Security: Build a pension corpus for post-retirement life.

With these benefits, NPS becomes a must-have investment option for every salary earner.

8. How to Claim Deduction under Section 80CCD(1B)

Claiming this deduction is simple:

- Open an NPS Account (Tier I).

- Contribute to your account using net banking, UPI, or offline mode.

- Collect the contribution receipt from your NPS portal.

- Declare the investment under Section 80CCD(1B) in your income tax return (ITR).

And that’s it! You can now enjoy your tax savings with confidence.

9. Step-by-Step Example of Tax Savings

Let’s take an example:

Mr. Raj, a non-government employee, invests ₹1,50,000 under Section 80C and ₹50,000 in NPS under Section 80CCD(1B).

Total Deduction = ₹2,00,000.

If his income falls under the 30% tax bracket, he saves ₹15,000 in taxes just by using Section 80CCD(1B).

That’s like getting paid for planning smartly!

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6243" align="alignnone" width="745"]

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6243" align="alignnone" width="745"] Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6224" align="alignnone" width="1011"]

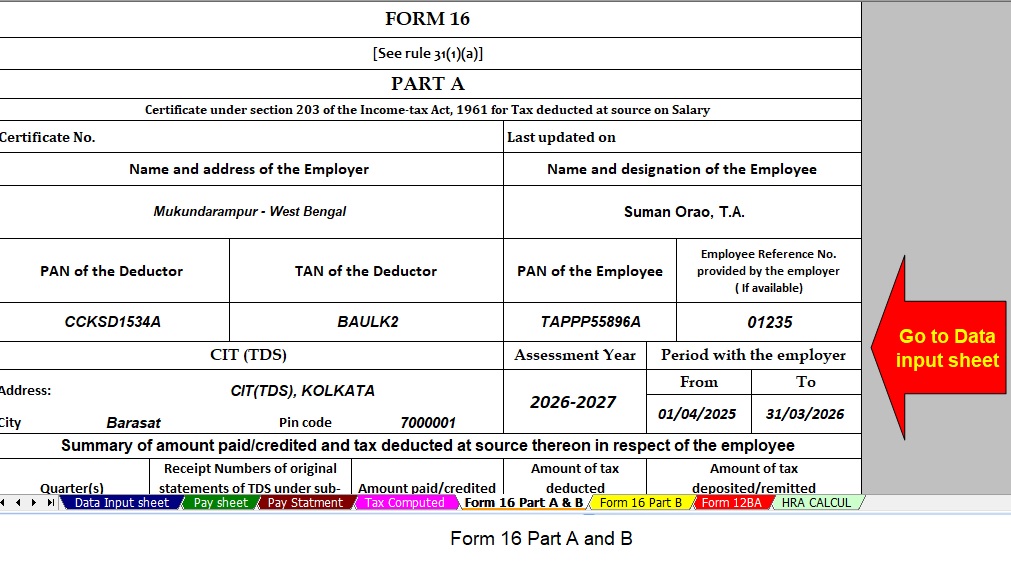

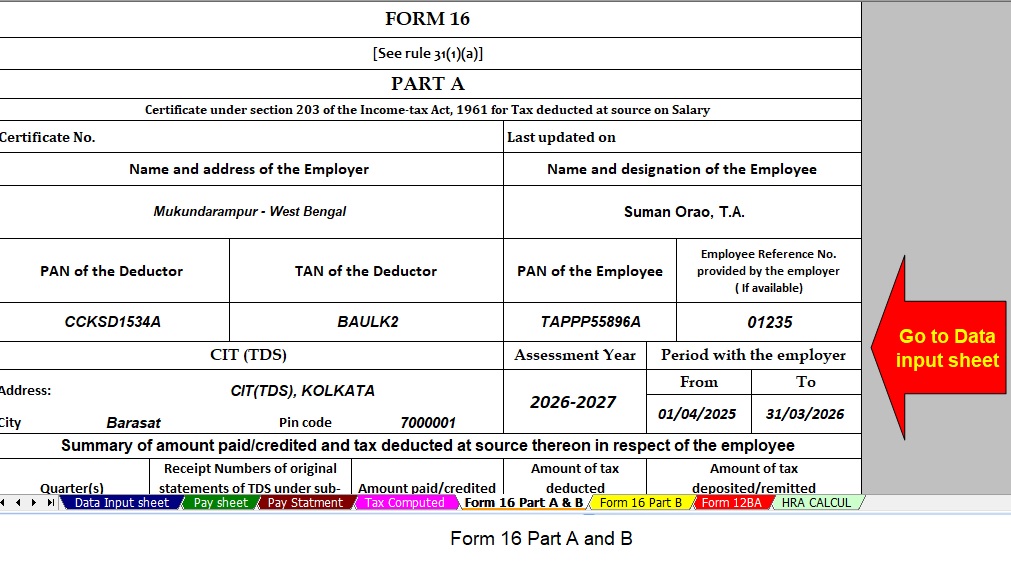

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6224" align="alignnone" width="1011"] Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption][caption id="attachment_6208" align="alignnone" width="1026"]

Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption][caption id="attachment_6208" align="alignnone" width="1026"] Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption]

Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption]

Key Features of the Excel-Based Tax Preparation Utility

1. Dual Regime Option

You can easily select either the New or Old Tax Regime under Section 115BAC. Moreover, the software instantly compares both regimes and highlights which one saves you more tax. Furthermore, it empowers you to make smarter financial decisions with just one click.

2. Customised Salary Structure

The software automatically adapts to your specific salary format, whether you work for a Government or Non-Government organisation. Additionally, it customises your inputs to minimise manual entries and reduce human errors. Besides, this automation saves valuable time and ensures consistent accuracy across every calculation.

3. Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]

The utility precisely calculates arrears relief for all financial years from 2000–01 to 2025–26. In addition, it automatically generates Form 10E for direct submission, eliminating the need for complex manual entries. Consequently, you can enjoy accurate and hassle-free tax relief computations every time.

4. Updated Form 16 (Part A & B)

The software automatically prepares the Revised Form 16 (Part A & B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains fully compliant with the latest tax rules and formats. Therefore, you can confidently submit your documents without worrying about compliance errors.

5. Simplified Compliance

The tool performs quick and error-free tax calculations using advanced built-in formulas. Furthermore, it removes the need for manual corrections, which enhances both accuracy and efficiency. Finally, you can prepare and finalise your income tax return with complete confidence and speed.

11. Features of the All-in-One Excel-Based Calculator

Here’s what makes this tool stand out:

- Covers All Deductions: Including Section 80C, 80D, 80CCD(1B), etc.

- Automatic Tax Calculation: Based on current income tax slabs.

- Form 10E Integration: Helps in arrears and relief calculations.

- Separate Sheets: For government and private employees.

- Printable Reports: Generate Form 16 and summary sheets easily.

In short, this Excel-based software is a one-stop solution for salaried taxpayers.

12. How to Use the Excel-Based Calculator

Using the calculator is as simple as 1-2-3:

- Download the Excel file. From the above link

- Enter your salary details, deductions, and investments.

- Get your automatic computation with total tax payable and savings.

It’s almost like having your personal tax assistant inside Excel!

13. Benefits for Government Employees

For government employees, this software is especially useful. It includes:

- Updated HRA and DA calculations.

- Form 10E for relief on arrears.

- Easy comparison between old and new tax regimes.

This means you can make the best decision about which regime suits your income better.

14. Benefits for Non-Government Employees

Non-government employees can also enjoy several advantages:

- Auto-calculation of PF, NPS, and Professional Tax.

- Support for both monthly and annual salary structures.

- Customizable deductions for accurate results.

It ensures that private sector professionals save time, money, and stress.

15. Final Thoughts and Conclusion

In today’s fast-paced world, smart tax planning is essential. Section 80CCD(1B) empowers you to save more while securing your future through NPS. And with the help of the Automatic Income Tax Preparation Software/Calculator, managing taxes becomes effortless and precise.

Remember, every rupee saved in taxes is a step closer to financial freedom. So, why not make the most of it today?

Frequently Asked Questions (FAQs)

- What is Section 80CCD(1B) under the Income Tax Act?

Section 80CCD(1B) allows an additional tax deduction of ₹50,000 for contributions made to the National Pension System (NPS). - Who can claim deduction under Section 80CCD(1B)?

Any individual taxpayer, whether a government or private employee, can claim this deduction by contributing to NPS. - Is Section 80CCD(1B) part of Section 80C?

No, it’s an additional deduction over and above the ₹1.5 lakh limit under Section 80C. - How can I claim the deduction in my ITR?

You must provide your NPS contribution details under Section 80CCD(1B) in your Income Tax Return form. - Can I use the Automatic Income Tax Calculator to compute my total savings?

Yes! The Excel-based calculator automatically includes deductions under Section 80CCD(1B) and shows your net taxable income.

Why Choose the Automatic Income Tax Preparation Software All-in-One in Excel?

You should choose this Automatic Income Tax Preparation Software because it makes tax computation simple, accurate, and time-saving. Moreover, it’s specifically designed for Government and Non-Government employees for the Financial Year 2025–26, ensuring full compatibility with the latest tax rules. Furthermore, it minimises manual work while maximising precision, which helps you file your income tax returns effortlessly.

Additionally, this Excel-based utility provides built-in formulas, automatic comparisons, and real-time updates, making it a perfect tool for anyone who wants to save time and stay compliant. Therefore, whether you are a salaried government official or a private sector employee, you can confidently rely on this calculator to handle all your tax needs.

Comprehensive Coverage for Both Old and New Tax Regimes

This All-in-One Excel Calculator supports both the Old and New Tax Regimes under Section 115BAC. Moreover, the software allows you to switch between the two instantly and see which one gives you the highest savings. In addition, it performs an in-depth comparison, showing detailed calculations for both regimes side by side.

Consequently, you can make an informed decision based on your income, deductions, and personal financial goals. Likewise, it ensures you never miss out on any potential tax benefit. Besides, the calculator follows the latest Income Tax Slabs for F.Y. 2025–26, ensuring every computation remains fully up-to-date.

Time-Saving Automation and Accuracy

Unlike manual calculations that often lead to confusion or errors, this Excel-based software performs every step automatically. Furthermore, it updates every figure as soon as you input your salary and deductions. Consequently, the process becomes faster, smoother, and completely error-free.

Additionally, because the software is built with verified tax formulas, you can trust the accuracy of its results. Moreover, you can print detailed tax reports, saving valuable time during documentation and submission. Therefore, this automation not only enhances your tax preparation but also reduces the stress of last-minute filing.

Automatic Relief Calculation under Section 89(1) and Form 10E

The software also includes a powerful Automatic Arrears Relief Calculator under Section 89(1) with integrated Form 10E. Moreover, it helps you calculate arrear relief for salary differences from the F.Y. 2000–01 to 2025–26. In addition, the system automatically generates Form 10E, which you can directly attach to your income tax return.

Consequently, this feature ensures that your arrear-related tax relief is accurate and legally compliant. Likewise, it prevents overpayment or underpayment of taxes due to arrears, thereby protecting your financial interests.

Upgraded Form 16 Generation (Part A & B) And Part B

The Automatic Income Tax Preparation Software instantly generates Form 16 (Part A & B) and Part B in line with the latest tax norms. Moreover, it ensures that every entry, such as gross salary, deductions, and taxable income, is placed in the correct format. Additionally, you can print or share this Form 16 directly for submission.

Likewise, this saves both time and effort while ensuring that all your records stay in perfect order. Therefore, government and non-government employees can depend on it for precise and professional documentation.

Smart Compliance with Zero Manual Errors

In today’s fast-paced environment, accuracy and compliance are critical. Consequently, the All-in-One Excel Tax Calculator ensures that your income tax computations are quick, accurate, and compliant with government regulations. Moreover, advanced inbuilt formulas automatically detect errors, helping you maintain accuracy without extra effort.

Additionally, you can review every calculation in real-time, ensuring full transparency and control. Therefore, the risk of manual error becomes almost zero, which enhances both efficiency and confidence in your tax filing process.

Compatibility and Ease of Use

You don’t need to be a tax expert or Excel professional to use this software. Furthermore, the user-friendly design makes it suitable for everyone, from entry-level employees to senior officers. Additionally, the tool works seamlessly on most versions of Microsoft Excel, ensuring smooth performance without additional installations.

Besides, it requires minimal system resources, so you can run it easily on your desktop or laptop. Consequently, it becomes a convenient and accessible solution for every taxpayer. Moreover, you can save multiple versions of your calculations and revisit them whenever necessary.

Benefits for Government Employees

Government employees enjoy specific advantages while using this tool. Moreover, it includes built-in fields for HRA, DA, and TA calculations, making it extremely useful for central and state government staff. In addition, it provides Form 10E and arrear relief options that align with government salary structures.

Furthermore, it allows you to compare the old and new tax regimes, so you can select the one that maximises your take-home income. Therefore, government employees can easily calculate their taxes without needing professional help.

Benefits for Non-Government Employees

Private-sector professionals can also gain significant benefits. Moreover, the calculator supports diverse pay structures, including monthly and annual formats. Additionally, it helps compute deductions like EPF, Professional Tax, and NPS contributions automatically.

Furthermore, it generates clear reports that you can share with your HR or accounting department. Consequently, it saves both time and money by eliminating the need for manual verification or expensive software. Therefore, this tool becomes an ideal companion for non-government employees who want efficiency and accuracy in one place.

Conclusion

In conclusion, the Automatic Income Tax Preparation Software All-in-One in Excel for F.Y. 2025–26 is an essential tool for every salaried individual. Moreover, it simplifies the complex process of tax computation and ensures full compliance with Indian tax laws. Additionally, its intelligent automation, dual-regime comparison, and arrear relief calculation make it one of the most reliable tax utilities available.

Therefore, whether you are a Government or Non-Government employee, you can confidently download and use this tool to prepare your taxes quickly and accurately. Furthermore, its real-time accuracy and ease of use ensure that you never miss a deduction or make an error again. Finally, it’s more than just a calculator—it’s your personal tax assistant for a stress-free financial year.

Salary Structure[/caption]

Salary Structure[/caption]

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6243" align="alignnone" width="745"]

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6243" align="alignnone" width="745"] Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6224" align="alignnone" width="1011"]

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel[/caption][caption id="attachment_6224" align="alignnone" width="1011"] Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption][caption id="attachment_6208" align="alignnone" width="1026"]

Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption][caption id="attachment_6208" align="alignnone" width="1026"] Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption]

Section 80CCD(1B) | With Automatic Income Tax Preparation Software/Calculator All in One for the Government and Non-Government Employees for F.Y. 2025-26[/caption]