Have you received a salary hike or arrears for past financial years? Wondering how much extra tax you’ll need to pay? Don’t worry. There’s a smart and simple solution — the Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E in Excel for the Financial Year 2025-26. This tool helps salaried individuals compute their tax relief in minutes.

Tax arrears can feel like unexpected guests — they show up late and bring an extra burden. But with the right calculator, you can stay one step ahead. In this guide, we’ll walk you through everything you need to know about downloading and using this powerful Excel-based calculator.

Table of Contents

| Sr# | Headings |

| 1 | What Is Income Tax Arrears Relief U/s 89(1)? |

| 2 | Why Form 10E Is Mandatory Before Claiming Relief |

| 3 | Who Needs the Income Tax Arrears Relief Calculator? |

| 4 | Benefits of Using an Automatic Calculator |

| 5 | Key Features of the Excel-Based Calculator |

| 6 | Step-by-Step Guide to Download the Calculator |

| 7 | How to Fill in the Calculator Properly |

| 8 | Common Mistakes to Avoid While Using the Calculator |

| 9 | How to Submit Form 10E Online |

| 10 | Practical Example for Better Understanding |

| 11 | Tips for Accurate Data Entry |

| 12 | When Should You Use Section 89(1) Relief? |

| 13 | What Happens If You Skip Filing Form 10E? |

| 14 | Comparing Manual vs Automatic Calculations |

| 15 | Final Thoughts and User Testimonials |

1. What Is Income Tax Arrears Relief U/s 89(1)?

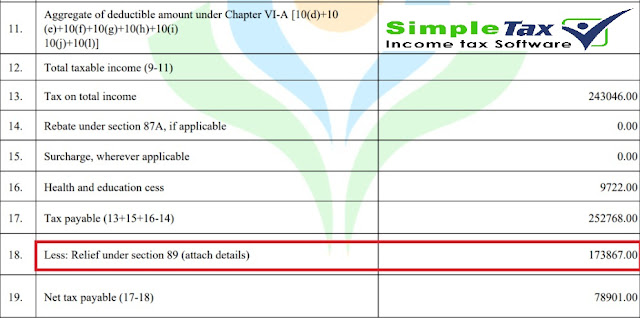

Section 89(1) of the Income Tax Act allows relief if you’ve received any portion of your salary or pension in arrears or advance. It prevents you from paying higher taxes due to income bunching up in one year.

2. Why Form 10E Is Mandatory Before Claiming Relief

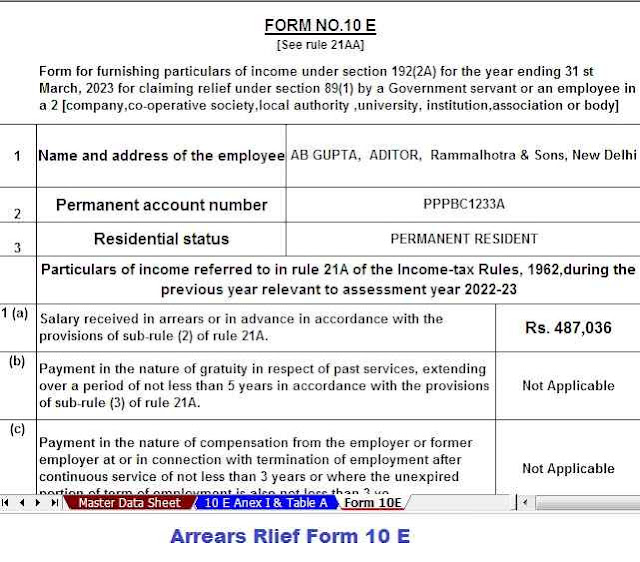

Form 10E is a declaration form you must file before claiming tax relief under Section 89(1). Without this form, the income tax department may reject your claim, even if you’re eligible. Think of it as the official permission slip that lets you claim your rightful tax benefit.

3. Who Needs the Income Tax Arrears Relief Calculator?

If you're a government or private employee, retired pensioner, or even a teacher who received delayed increments or payments, this calculator is your best friend. It simplifies your complex arrears data into actionable figures.

4. Benefits of Using an Automatic Calculator

Using the Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E offers several advantages:

- Saves Time: No manual calculations.

- Accuracy: Reduces chances of human error.

- Built-in Logic: Handles multiple years’ data.

- Free to Use: Most Excel-based tools are available at no cost.

5. Key Features of the Excel-Based Calculator

The calculator is designed with user-friendly fields, drop-down menus, and pre-filled formulas. Here are some features:

- Compatible with Excel 2007 and above

- Integrated Form 10E format

- Handles multiple arrears years

- Auto-relief computation

- Printable output

6. Step-by-Step Guide to Download the Calculator

- Download from the link below.

- Locate the "Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E" for FY 2025-26.

- Click on the download link.

- Save the Excel file to your computer.

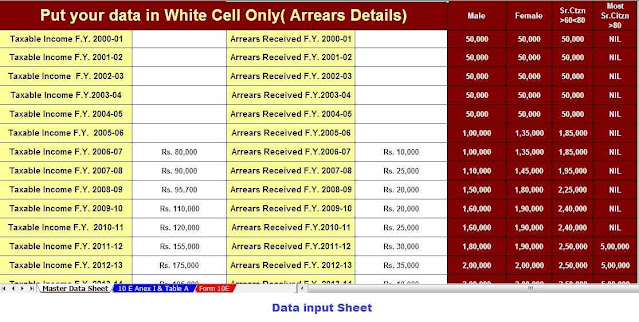

7. How to Fill in the Calculator Properly

Once downloaded:

- Enter your basic details like name, PAN, and employer info.

- Input arrears received year-wise.

- Fill in your previous income details for the respective years.

- Let the calculator auto-generate the relief figures.

8. Common Mistakes to Avoid While Using the Calculator

Avoid these pitfalls:

- Skipping Form 10E submission

- Entering incorrect assessment years

- Using old or outdated calculator versions

- Not verifying TDS entries

9. How to Submit Form 10E Online

To submit Form 10E:

- Visit the Income Tax e-Filing portal

- Log in with your PAN credentials.

- Navigate to e-File > Income Tax Forms > File Income Tax Forms

- Select Form 10E and fill in the details.

- Submit and download the acknowledgement.

10. Practical Example for Better Understanding

Imagine Mr. Sharma received an arrear of ₹1,20,000 in FY 2025-26 for FYs 2022-23 and 2023-24. Without relief, this bumps him into a higher tax bracket. Using the calculator, he splits the arrear and saves nearly ₹8,000 in tax through Section 89(1).

11. Tips for Accurate Data Entry

- Double-check salary slips and Form 16.

- Use exact dates and amounts.

- Match figures with TDS statements.

- Recalculate before finalising.

12. When Should You Use Section 89(1) Relief?

Whenever you receive:

- Salary/pension arrears

- Advance salary

- Commuted pension

- Gratuity paid late

Use Section 89(1) to offset tax unfairness caused by income being bunched together.

13. What Happens If You Skip Filing Form 10E?

You may still file your ITR, but your claim under Section 89(1) will be denied. Even if the tax relief is shown in Form 16, the CPC will ignore it without a filed Form 10E. Don’t miss it!

14. Comparing Manual vs Automatic Calculations

| Manual Method | Automatic Calculator |

| Time-consuming | Time-saving |

| Risk of errors | Auto-verified formulas |

| Complex for common users | Easy for all |

| No print format | Printable results |

15. Final Thoughts and User Testimonials

Hundreds of users have reported significant time savings and peace of mind using the Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E. Don’t let tax stress weigh you down. Let Excel do the heavy lifting.

Conclusion

Tax arrears can create confusion and stress, but you don’t need to navigate them alone. With the Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E, you can simplify your calculations, file accurately, and claim what’s rightfully yours. Be proactive — download the calculator today and experience hassle-free tax filing for the Financial Year 2025-26.

FAQs

1. Can I use this calculator if I work in the private sector?

Yes, both private and government employees can use this calculator to claim tax relief on arrears.

2. Do I need to file Form 10E every year?

Only in the year you are claiming arrears relief. No need to file if there’s no arrears income.

3. Can I edit the calculator formulas?

It’s not recommended unless you’re confident with Excel. The pre-filled formulas are optimised for accuracy.

4. Will the tax department reject my claim if I forget Form 10E?

Yes, skipping Form 10E will result in the denial of your 89(1) tax relief claim, even if it's mentioned in Form 16.

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E in Excel for the F.Y.2025-26