Introduction

Tax planning often feels overwhelming, right? However, every salaried person constantly looks for legitimate ways to reduce taxable income while staying compliant with the Income Tax Act. Among several deductions, Section 80TTA stands out as a small yet effective benefit. It allows you to claim an exemption on savings account interest, directly lowering your tax liability.

Meanwhile, preparing taxes manually usually leads to stress and errors. Fortunately, the Automatic Income Tax Preparation Software All-in-One in Excel for F.Y.2025-26 simplifies everything. With this tool, you save time, ensure accuracy, and claim deductions such as 80TTA effortlessly.

Understanding Section 80TTA

Section 80TTA, introduced under the Income Tax Act, provides relief on savings account interest.

- Eligibility: Individuals and Hindu Undivided Families (HUFs) qualify for this deduction.

- Maximum Limit: You can claim up to ₹10,000 per financial year.

- Applicable Accounts: Savings accounts with banks, post offices, and co-operative banks.

Applicability for F.Y.2025-26

As per the Budget 2025, Section 80TTA continues to apply. Salaried persons and HUFs may claim up to ₹10,000 on savings account interest. However, senior citizens cannot use this section because they must claim under Section 80TTB, which offers higher deductions.

Benefits of Section 80TTA

You should care about 80TTA because:

- It directly reduces taxable income.

- It promotes savings as a financial habit.

- It provides relief, especially for those with modest earnings.

Exclusions under Section 80TTA

Not all interest qualifies. Therefore, you cannot claim deductions for:

- Fixed deposit (FD) interest

- Recurring deposit (RD) interest

- Corporate bond or debenture interest

- Senior citizen claims (covered under Section 80TTB)

Practical Example of 80TTA Calculation

Assume you earned ₹14,000 interest from savings accounts in F.Y.2025-26.

- Eligible deduction: ₹10,000 (under 80TTA)

- Taxable portion: ₹4,000

Thus, instead of paying tax on ₹14,000, you only pay on ₹4,000. Although this deduction looks small, it creates a big difference when you combine it with other exemptions.

Role of Automatic Income Tax Preparation Software

Manual tax calculations often cause mistakes. Conversely, Excel-based All-in-One Tax Software ensures accuracy. With this tool, you can:

- Generate salary sheets automatically

- Calculate HRA exemptions instantly

- Incorporate deductions like 80TTA automatically

- Prepare ready-to-file tax computation sheets

Features of All-in-One Excel Software

This Excel software suits non-government employees perfectly. Moreover, it offers:

- Pre-built salary structures

- Automatic HRA exemption under Section 10(13A)

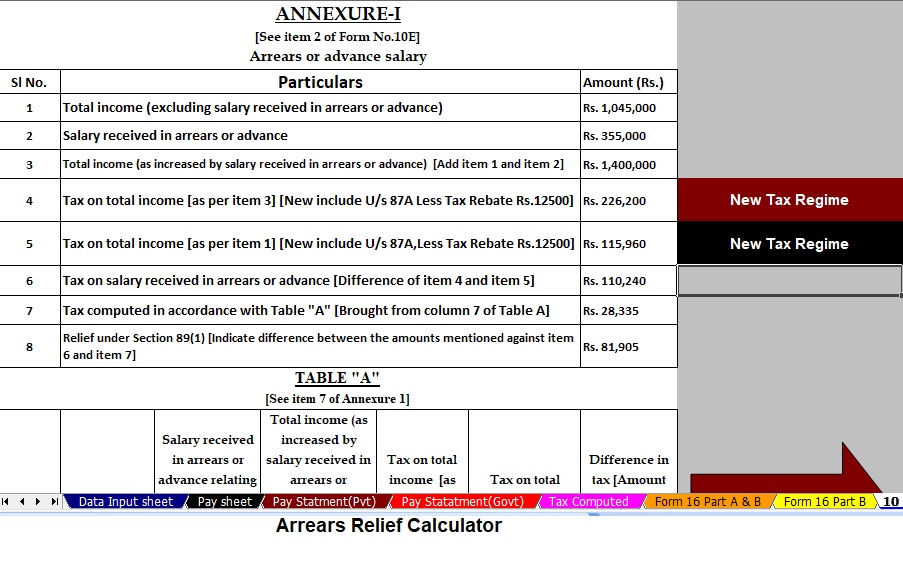

- Auto-prepared Form 10E for arrears relief (Section 89(1))

- A consolidated tax computation sheet

Step-by-Step Guide to Using Excel Tax Software

Follow these steps to prepare your taxes easily:

- Download the Excel Tool from the below given link.

- Enter salary details by inputting your pay structure.

- Add savings account interest for the year.

- Apply Section 80TTA exemption; the tool auto-deducts ₹10,000.

- Review the tax sheet to see your revised liability.

In this way, you minimise errors and save valuable time.

Common Mistakes Taxpayers Make

You should avoid these mistakes to ensure smooth tax filing:

- Skipping savings account interest reporting.

- Claiming deductions meant for senior citizens under 80TTB.

- Exceeding the ₹10,000 cap.

Importance of Claiming 80TTA Properly

If you fail to claim correctly, you may receive income tax notices. Therefore:

- Collect yearly interest certificates from banks.

- Maintain records for future reference.

- Ensure deductions are applied only once across all accounts.

Comparison with Other Deductions

Section 80TTA works well with deductions like 80C (PF, LIC, ELSS) and 80D (health insurance). Unlike 80C, which requires specific investments, 80TTA applies automatically since your savings account already qualifies.

Conclusion

Section 80TTA may appear small, but it plays a significant role in reducing taxable income. By combining it with other deductions, you can lower your liability substantially. Thanks to the Automatic Income Tax Preparation Software All-in-One in Excel for F.Y.2025-26, claiming this deduction has never been easier.

Smart tax planning isn’t only about big deductions—it’s about not missing the small ones. So, use Section 80TTA wisely and let Excel software handle the heavy lifting.

FAQs

Q1. Who can claim a deduction under Section 80TTA?

Individuals below 60 years and HUFs with savings account interest can claim it.

Q2. Can NRIs claim 80TTA benefits?

Yes, NRIs with savings accounts in Indian banks qualify.

Q3. What is the maximum deduction limit?

The limit is ₹10,000 per financial year.

Q4. Does 80TTA apply to joint accounts?

Yes, but each holder must claim proportionately.

Q5. What is the difference between 80TTA and 80TTB?

80TTA applies to individuals and HUFs below 60 with a ₹10,000 limit, whereas 80TTB applies to senior citizens with a higher ₹50,000 limit.

👉 Download the Automatic Income Tax Calculator All-in-One for Non-Government Employees in Excel for the F.Y.2025-26 and enjoy these powerful features:

- Firstly, this Excel Calculator prepares your Tax Computed Sheet as per Budget 2025.

- Moreover, it includes an inbuilt salary structure for non-government employees.

- In addition, it generates an automatic salary sheet for simple record-keeping.

- Furthermore, it calculates H.R.A. exemption U/s 10(13A) instantly.

- Next, it automatically prepares Income Tax Form 12BA without mistakes.

- Also, it generates Automatic Form 16 Part A and B for compliance.

- Finally, it prepares the Automatic Income Tax Form 16 Part B, making filing smooth.