Introduction

The Budget 2025 has brought new changes to the New Tax Regime, making it more appealing for salaried individuals. Many people are still confused—“Can I claim deductions under the new regime?” The answer is yes, but with certain limits.

If you’re a salaried employee for F.Y. 2025-26, you should know exactly what benefits you can get. And the easiest way to calculate everything? Using Income Tax Preparation Software All-in-One in Excel—a smart, user-friendly tool that automates your tax calculation without complicated formulas.

In this guide, we’ll break down the deductions available in the new tax regime, explain how they work, and show you how Excel-based tax software can save you hours of stress. Think of it as having a financial GPS—guiding you straight to maximum savings without wrong turns.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the New Tax Regime 2025 |

| 2 | Key Features of the New Tax Regime |

| 3 | Who Should Opt for the New Tax Regime? |

| 4 | Deductions Allowed in the New Tax Regime |

| 5 | Standard Deduction for Salaried Persons |

| 6 | Deduction for EPF and NPS Contributions |

| 7 | Leave Travel Allowance (LTA) Benefit |

| 8 | Employer’s Contribution to NPS |

| 9 | Transport Allowance for Differently-Abled Employees |

| 10 | Family Pension Deduction |

| 11 | How Automatic Income Tax Preparation Software All-in-One in Excel Works |

| 12 | Step-by-Step Process to Use the Excel Software |

| 13 | Advantages of Using Excel-Based Tax Preparation Tools |

| 14 | Common Mistakes to Avoid in Tax Filing |

| 15 | Final Tips for Maximising Your Savings |

1. Understanding the New Tax Regime 2025

The New Tax Regime, introduced in 2020 and enhanced in Budget 2025, offers lower tax rates but with limited deductions compared to the old regime. It’s designed for simplicity—fewer exemptions, fewer calculations, and faster filing.

2. Key Features of the New Tax Regime

- Lower tax slabs compared to the old regime.

- Standard deduction introduced for salaried individuals.

- Limited deductions but faster, easier compliance.

- No need to submit multiple proofs for most exemptions.

3. Who Should Opt for the New Tax Regime?

You may benefit from the new regime if:

- You don’t have significant tax-saving investments.

- You want faster, paperless filing.

- Your annual income is moderate, and you prefer lower rates over multiple deductions.

4. Deductions Allowed in the New Tax Regime

While most traditional exemptions like 80C, 80D, and HRA are unavailable, you still get:

- Standard deduction for salaried employees.

- Employer’s contribution benefits.

- Specific allowances for special categories.

5. Standard Deduction for Salaried Persons

Budget 2025 retains the ₹75,000 standard deduction for salaried individuals and pensioners. This is automatically applied—no paperwork required.

6. Deduction for EPF and NPS Contributions

While your own contribution to EPF or NPS is not deductible under most sections in the new regime, your employer’s contribution to NPS (up to 10% of salary) is still exempt.

7. Leave Travel Allowance (LTA) Benefit

LTA is not generally available in the new regime—unless specified for government employees in special cases. Always check with your HR before claiming.

8. Employer’s Contribution to NPS

Under Section 80CCD(2), your employer’s contribution to NPS up to 10% of basic + DA is deductible even in the new regime.

9. Transport Allowance for Differently-Abled Employees

Differently-abled employees get a transport allowance exemption of ₹3,200 per month, even under the new regime.

10. Family Pension Deduction

If you receive a family pension, you can claim the lesser of:

- ₹15,000

- Or one-third of the pension amount

11. How Automatic Income Tax Preparation Software All-in-One in Excel Works

This Excel-based software is pre-programmed with the latest tax rules from Budget 2025. You simply enter:

- Salary details

- Allowances

- Deductions (if any)

It instantly calculates your tax liability—just like a calculator on steroids, but without the risk of human error.

12. Step-by-Step Process to Use the Excel Software

- Download the latest version from the link below

- Enter personal details (Name, PAN, etc.).

- Fill salary breakup from your Form 16.

- Add employer contributions if applicable.

- Review the auto-generated tax report.

13. Advantages of Using Excel-Based Tax Preparation Tools

- Accuracy – No manual miscalculations.

- Time-saving – Complete tax in minutes.

- Budget-friendly – No expensive software needed.

- Offline access – No internet required.

14. Common Mistakes to Avoid in Tax Filing

- Choosing the wrong tax regime.

- Forgetting employer NPS contributions.

- Missing the family pension deduction.

- Not using updated tax software.

15. Final Tips for Maximising Your Savings

- Compare both regimes before filing.

- Use Income Tax Preparation Software All-in-One in Excel to avoid errors.

- Keep all payslips and proof documents handy.

Conclusion

The New Tax Regime 2025 offers simplicity, but you still need to know the deductions you can claim. By combining your knowledge with Income Tax Preparation Software All-in-One in Excel, you can file confidently and save more. Think of it as your financial co-pilot—keeping you on the right track without turbulence.

FAQs

- Can I claim 80C deductions under the new tax regime?

No, most deductions under 80C are not available in the new regime. - Is the standard deduction available in the new regime?

Yes, salaried employees get a ₹75,000 standard deduction. - Does the Excel tax software work for both regimes?

Yes, it can calculate tax for both old and new regimes. - Can I use the software without the internet?

Yes, Excel-based tax software works offline. - Is the new tax regime better than the old one?

It depends on your income and deductions—compare both before deciding

Download Auto Calculate Income Tax Preparation Software All in One in Excel for Government and Non-Government Employees for the Financial Year 2025-26 as per Budget 2025

Features of this Excel Utility:

- This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (covering both the New and Old Tax Regime).

- This Excel utility lets you choose between the New and Old Tax Regime.

- This Excel utility provides a unique salary structure for both Government and Non-Government Employees.

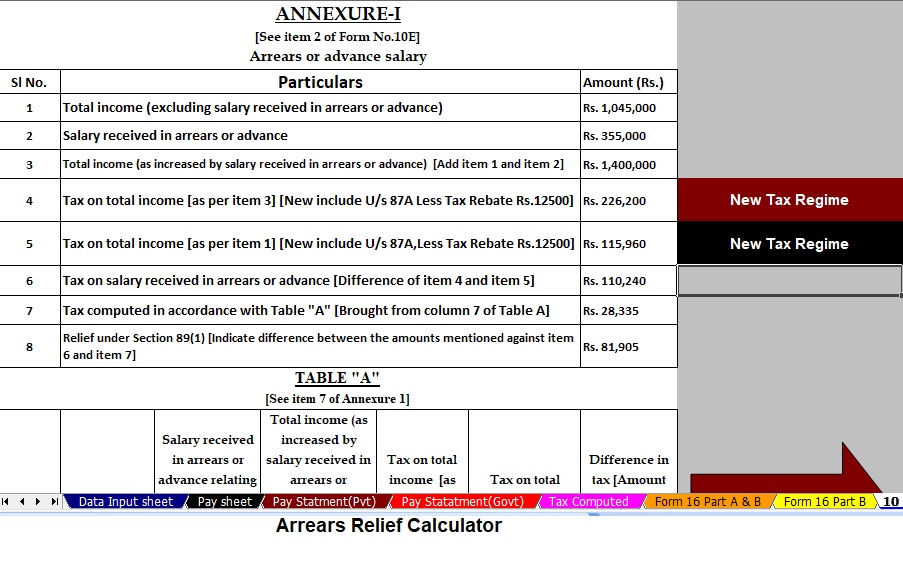

- This Excel utility includes an Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E, covering the F.Y. 2000-01 to F.Y. 2025-26 (Updated Version).

- This Excel utility generates an Automated Income Tax Revised Form 16 Part A&B for the F.Y. 2025-26.

- This Excel utility produces an Automated Income Tax Revised Form 16 Part B for the F.Y. 2025-26.