Income Tax Preparation Software in Excel All in One for the Non-Govt Employees for the F.Y.2022-23

Income tax tables and rates remain unchanged in the fiscal year 2022-2023. No changes to the Budget for Individual Taxpayers for 2022 have been announced. Taxpayers will be able to pay taxes under the old or new tax regime. Under the new Tax Regime, tax is levied on taxpayers at preferential rates, but significant tax deductions and exemptions are not allowed. However, income tax deductions and exemptions are available under the old tax system, but the tax rate is high. Individuals need to evaluate their tax liability under both tax systems in order to determine the ideal tax system for them. The old tax system can be beneficial for those interested in using most of the deductions and exemptions. Whereas, the new tax system could be ideal for middle-income groups with small, non-tax-oriented investments.

Budget 2022: key takeaways

The tax credit of up to Rs 12,500 under Section 87A is still available for individuals with taxable income up to Rs 5 lakh per annum. This means that individuals with an income of up to Rs 5 lacs will not incur any tax liability in the 2022-23 fiscal year and 2023-2024 valuation. A standard deduction of Rs 50,000 is also available under the old tax regime. Income tax deductions under sections 80C-80U are available under the old system for employees.

Employees can significantly reduce their tax liability by taking advantage of tax deductions under the old tax system for the fiscal year 2022-23. In fact, individuals with an income of up to Rs 13 lakh can qualify for full tax exemption by taking advantage of all eligible deductions for the 2022-23 financial year.

Income tax deduction and exemption up to Rs 1,50,000 is available for individuals under Section 80C. Section 80CCC and 80CCD (1) are included in Section 80C with an aggregate deductible ceiling of INR 1,50,000/-. Investments that qualify for deduction and exemption under Section 80C include investments in the Public Reserve Fund (PPF), the National Savings Certificate (NSC), the Equity Savings Scheme (mutual funds), Life Insurance and etc.

State Reserve Fund: One of the most popular small savings schemes among individuals. PPF offers guaranteed returns along with tax incentives. Interest is reported quarterly and interest accrues annually. Investments are provided with a fixed period of 15 years.

ELSS Funds: The equity savings scheme has the shortest lock-up period of 3 years. The investment is deductible under section 80C. Investments in mutual funds can bring higher returns than debt instruments. However, investments in the capital market are subject to volatility. Therefore, investors need to make an informed decision.

Best Equity Savings Scheme for Investment: EF 2022-23

National Savings Certificate (NSC): NSC has a 5-year blocking period. Investments are eligible for tax deductions. However, interest earned is taxable. Investment interest is announced quarterly.

Life insurance plans. Premiums paid on life insurance policies are also deductible under section 80C. The premium paid by self, spouse, dependent children and any member of an undivided Hindu family is eligible for a deduction. The post-maturity benefit is tax-free in most cases.

Senior Savings Scheme (SCSS): This scheme is designed specifically for seniors and offers the highest returns among small savings schemes. The duration of the program is 5 years with the possibility of extension up to 8 years. Under this scheme, persons over 60 years of age can make deposits.

Sukanya Samriddhi Yojana (SSY): The scheme aims at the welfare of the girl. A parent or guardian of a girl under the age of 10 is eligible to join the program. The regime applies to a maximum of 2 girls (3 in the case of twins). The maximum deduction under this scheme is Rs 1,50,000.

Income Tax Tariffs and Rates for Fiscal Year 2022-23

The mortgage principal repayment is also deductible along with the registration fee and stamp duty paid on the property. However, the allowance is capped at a maximum deduction limit of INR 150,000/-. Provided that the Individual does not transfer the property before the expiration of 5 years from the Fiscal year in which it was acquired. A registration fee and stamp duty deduction are also available for individuals who have not applied for a mortgage.

Income tax deductions U/S 80 CCD (1b)

Deposit up to Rs 50,000 - eligible for deduction under section. The deduction is greater than the available U.S. Section 80C deduction for deposits made in the National Pension Scheme (NPS) and Atal Pension Yojana (APY).

Individuals can invest in these pension schemes to qualify for tax deductions up to a maximum of Rs 50,000/-.

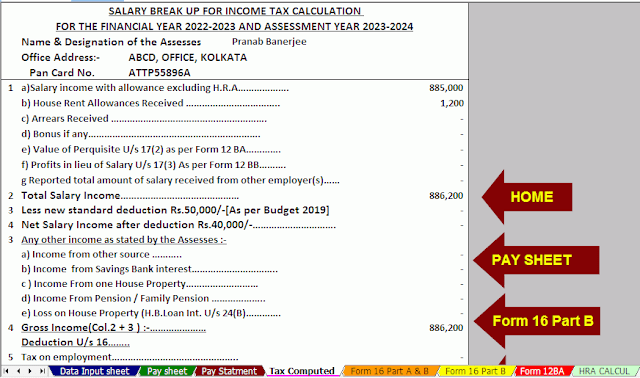

Feature of this Excel Utility:-

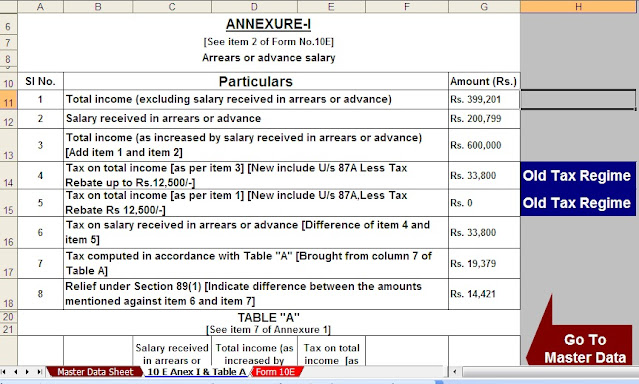

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

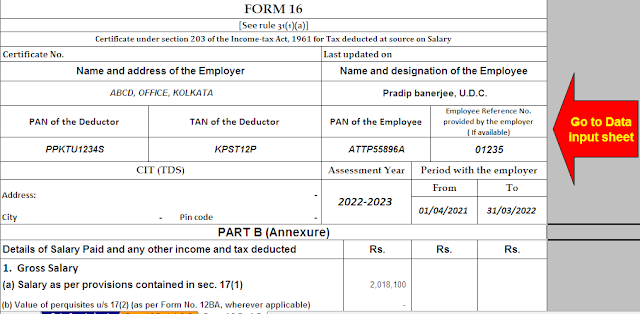

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula