Income tax rebate U / s 87A up to 12,500/-. Currently, tax exemption is available for those whose income is not more than Rs. 5 lakh

The government has not changed the basic exemption limit of Rs 2.50 lakh for some time because the government does not want people to get out of the tax net and get exempted from filing ITRs.

At the same time, subsequent governments have offered tax breaks for taxpayers up to a certain income limit. At present, tax exemption is available for those whose income is not more than five lakh rupees. This discount is available under Section 87A. Discuss with us how this works for you.

What is the correct provision?

Section 87 was introduced in the Finance Act 2003 which changed from time to time. Currently, a separate taxpayer, who is a resident of India for income tax purposes, can claim tax exemption up to Rs. 2,000 / -. 12,500 as against his tax filing if your income is not more than five lakh rupees. However, the right to claim a waiver under section 87A is completely lost if you exceed the income limit.

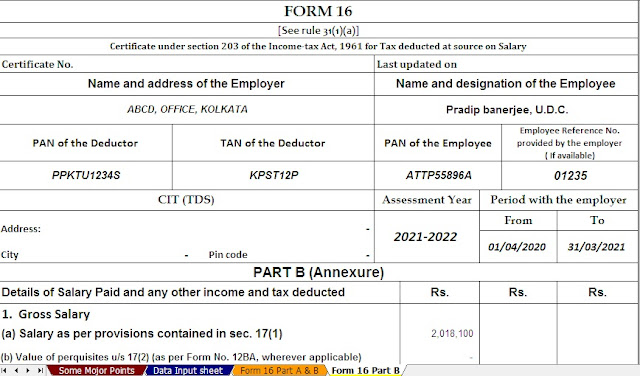

You may also, like- Download and Prepare One by One Revised Form 16 Part A&B and Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Anyone and everyone are not entitled to this discount. Although the basic exemption limit is Rs.12, 500/-. Whether residential or non-residential, the exemption under Section 63A is available to one person only and is applicable to all persons and HUFs only if he is a resident for income tax purposes. So not all HUFs and non-residents are entitled to this discount.

Any income must be considered for eligibility criteria

There is always confusion in the minds of taxpayers as to what income should be considered to be eligible for this discount. This is the final tax liability of your income. So to begin with, the income considered for this purpose is the income after all the old losses incurred against the current year's income.

Similarly, after such a set-off of losses, you will have to deduct from the net income all the discounts available under the various sections of the VIA chapter. Chapter VIA has clearance for various items under Section 80C (LIP, EPF, PPF, ELSS, Tuition Fee, Home Loan Repayment, etc.), Section 80CCD (NPS), Section 80D (Health Insurance), 80G (Grants). And 80 TTA and 80 TTB (bank interest).

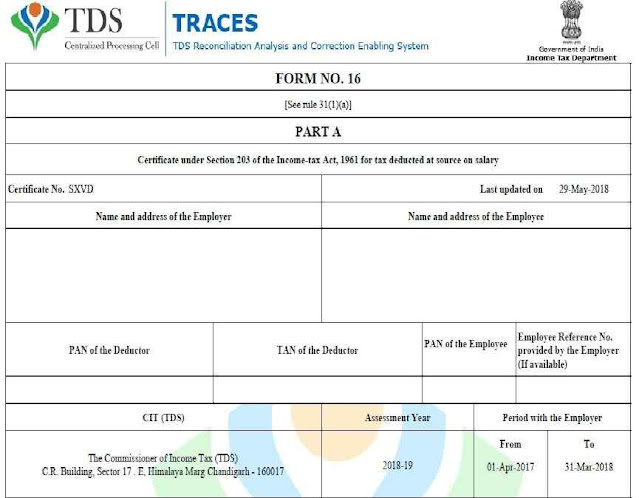

You may also, like- Download and Prepare One by One Revised Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

This exemption can be adjusted against any tax filing and cannot be adjusted

Not that a waiver of up to Rs 30,000 can be claimed against any of the 12,500 available under section 87A. Long term capital gain under section 112. (Equity-based projects of mutual funds in addition to shares applicable for long-term capital gain in case of sale of any capital assets other than listed 112 equity)) This discount is also available against the liability on which tax will be payable at a flat rate of 15%.

Please note that in addition to the listed equity shares, equity-based schemes of mutual funds are salable, payable 10 per cent initial deductible, you are not entitled to waive your tax liability in case of long term capital gains under section 112A which is Rs 2,000. 1 lakh rupees.

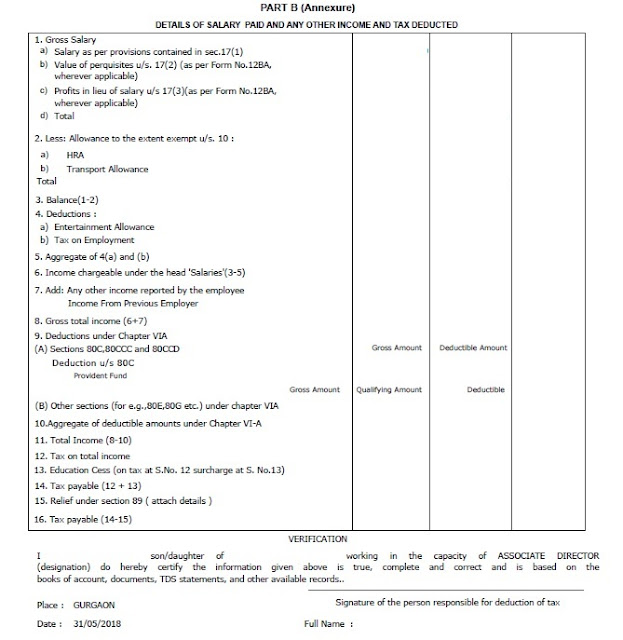

You may also, like- Download and Prepare at a time 50 Employees Form 16 Part B and Form 16 Part B for theF.Y.2020-21 as per new and old tax regime U/s 115 BAC

How the discount actually works

People generally have the idea that if their income does not exceed the magic number of Rs. 5 lakhs, they will not have to pay any tax. This is because the tax rate for general income ranges from Rs 2.5 lakh to Rs 5 lakh and the taxable duty on 5% over Rs 2.50 lakh comes to Rs 12,500 respectively.

However, you will still have to pay some tax on your income, not more than five lakhs, even if your income is more than 15% (short-term capital gain) or 20% (another long-term capital gain). For your income earnings, one lakh out of five lakh listed shares have one lakh short-term capital gains and the balance is your regular income.

You will be liable for a duty of Rs. 2,25,000, which includes Rs. 7,500 (5% over 1.50 lakhs) +15,000 (15% over 1 lakh short-term capital gains). 12500 / - after discount you get Rs. 10,000 / - and earnings even when your income is not more than five lakhs.

You may also, like- Download and Prepare at a time 100 Employees Form 16 Part B and Form 16 Part B for theF.Y.2020-21 as per new and old tax regime U/s 115 BAC

Please note that in addition to listed equity shares, equity-based schemes of mutual funds are salable, payable 10 per cent initial deductible, in the case of long-term capital gains under section 112A you are not entitled to waive your tax liability which is Rs 2,000. 1 lakh rupees.

Please note that in addition to listed equity shares, equity-based schemes of mutual funds are salable, payable 10 per cent initial deductible, in the case of long-term capital gains under section 112A you are not entitled to waive your tax liability which is Rs 2,000. 1 lakh rupees.

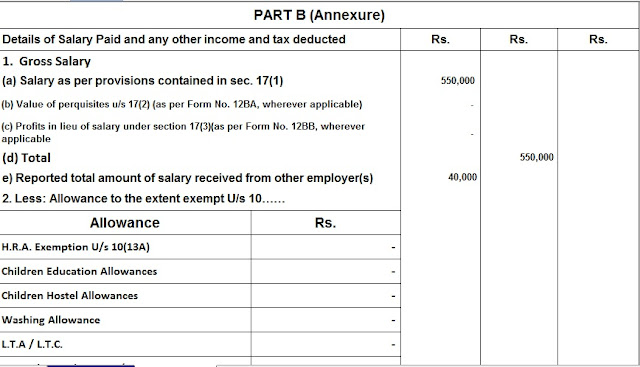

You may also, like- Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

How the discount actually works

People usually have the idea that if their income is not more than five lakh rupees, they will not have to pay any duty. This is because the tax rate for general income ranges from Rs 2.5 lakh to Rs 5 lakh and the taxable duty on 5% and above Rs 2.50 lakh comes to Rs 12,500 respectively.

However, you will still have to pay some tax on your income, not more than five lakhs, even if your income is more than 15% (short-term capital gain) or 20% (another long-term capital gain).

You have one lakh short-term capital gains on one lakh listed shares for an income of five lakh rupees and this is your regular income. You will be liable for a duty of Rs. 2, 25,000,