In F.Y 2021-22, there are two types of Tax Regime for Individual and HUF as previous F.Y. 2020-21. A taxpayer may choose either the Old Tax Regime or the New Tax regime. If we talk about exemptions and deductions, then it can be said that most of the common exemptions and deductions are not available in the New Tax Regime. But deductions u/s 80CCD (2), 80JJAA etc. are eligible in the New Tax regime.

The list of deductions available in the Old Tax regime is given below, who are opt-in as Old Tax

Regime U/s 115 BAC.

80 C- Max Rs. 150,000 / -(80C, 80CCC and 80CCD (1) together)

1.Life insurance premium

2.PPF (Public Provident Fund) Investment

3.EPF (Employee Provident Fund)

4.NSC. (National Savings Certificate) Investment and interest earned

5.ELSS Mutual Fund (Equity Linked Savings Scheme)

6. Five-year tax deposit in a bank or post office

7.Post Office Senior Citizen Savings Scheme

8.Home Basic Principles of Payment

9. Children’s tuition fees

10. Deposit scheme in Sukanya Samridhi account

11.80CCC- LIC Any other life insurance company is considered for tax benefits to contributing to its anniversary plan or to receive a pension from the fund.

12.80CCD (1)- Approved to any person who deposits in his pension account (like NPS). The maximum allowable discount rate is 10% of salary (in case of taxpayer employees) or 10% of total income (in case of taxpayer self-employment).

13.80CCD(1b)-Additional deduction Up to Rs. 50,000/- NPS account. Contributions to Pension Fund are also eligible.

You may also, like- Automated Pan Card Application Form 49 A in Excel (Revised Format)

80D- Up to Rs. 25,000/- & Rs. 50,000/- for Senior citizens. Mediclaim / Health Insurance Premium

80E- Interest on Loan taken for Higher Education shall be deducted under this section.

80EE- Max Rs. Up to Rs. 50,000/-can claim an additional Tax Exemption from newly constructed or purchased deduction of up to Rs 50,000 on home loan interest payments.

80G- 100% (usually in case of government funds) or 50% (usually in case of private funds) Contribute to specific relief funds and charities. This discount can only be claimed if the contribution has been made by check or draft or in cash.

80GG- Up to Rs. 60,000/-who are not getting or have not received House Rent Allowance u/s 10(13A) at any time during the same financial year.

80 GGC- The discount amount should not exceed the taxable value. Political Any person can claim a waiver under this section if he makes a grant for a political party or electoral trust.

• Political parties must be registered with the Election Commission. Electoral trust must be registered.

Check Grants should be for bank checks, debit/credit cards, demand drafts, net banking etc. and should not be in cash.

80TTA - Exemption from Bank/Post Office Savings Account Interest Max Rs.10,000/-

80TTB- Max Rs. 50,000 / - Interest on a savings bank account, fixed bank account or post office deposit. Senior citizens can also enjoy this facility.

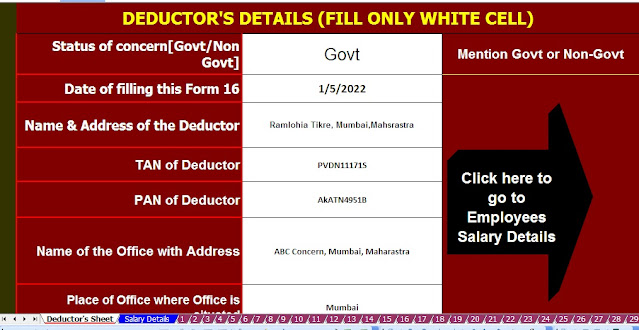

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21