Filing your income tax doesn’t have to be a stressful experience. Whether you're a government employee or working in the private sector, staying compliant with the latest tax laws can be time-consuming and confusing. But what if there were a tool that did it all for you?

Think of the Automatic Income Tax Preparation Software in Excel as your digital tax accountant. This all-in-one Excel utility for FY 2025-26 is designed to make income tax calculations, Form 10E, HRA exemptions, and even arrears relief U/s 89(1) simple and automatic. Whether you earn a government or private salary, this tool can take the headache out of tax time.

Table of Contents

| Sr# | Headings |

| 1 | What is Income Tax Software in Excel? |

| 2 | Why You Need This Excel-Based Tax Software? |

| 3 | Who Can Use This Software? |

| 4 | Key Features of the All-in-One Excel Utility |

| 5 | Tax Computed Sheet as per Budget 2025 |

| 6 | Inbuilt Salary Structure for Govt and Non-Govt Employees |

| 7 | Automatic HRA Exemption U/s 10(13A) |

| 8 | Auto-Fill Salary Sheet – No More Manual Work! |

| 9 | Arrears Relief Calculation U/s 89(1) with Form 10E |

| 10 | Auto-Fill Form 16 (Part A and B) |

| 11 | User-Friendly Interface: No Expertise Needed |

| 12 | Time-Saving Benefits for Busy Professionals |

| 13 | Compliance Made Easy |

| 14 | How to Download and Use the Software? |

| 15 | Conclusion and Final Thoughts |

1. What is Income Tax Software in Excel?

Income Tax Software in Excel is a smart utility built in Microsoft Excel that helps individuals prepare and compute their income tax return without hassle. It automates various tax calculations, ensuring accuracy and compliance with the latest rules for FY 2025-26.

2. Why You Need This Excel-Based Tax Software?

Why juggle multiple spreadsheets and rules when one Excel file can handle it all? This software simplifies everything—from your salary details to Form 16 generation—saving you hours of work and reducing the chance of error.

3. Who Can Use This Software?

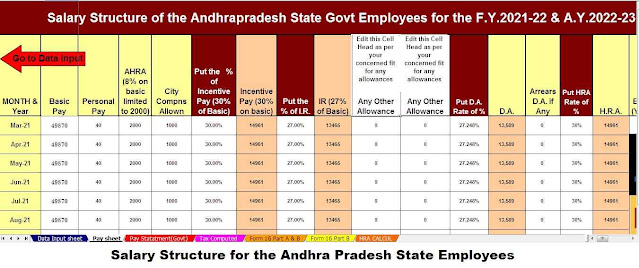

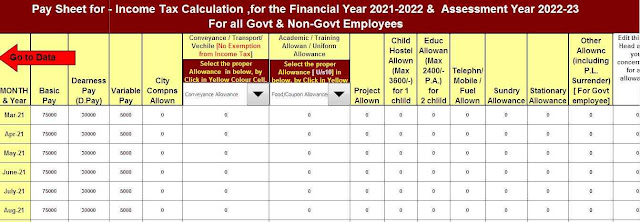

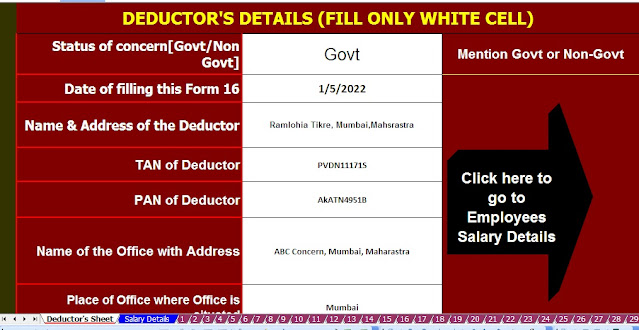

Whether you're a Maharashtra state government employee, a central government worker, or a private-sector employee, this tool has got you covered. Its dual salary structure means it adapts to both Govt and Non-Govt salary formats.

4. Key Features of the All-in-One Excel Utility

Here’s what makes this Excel software a must-have:

- Automatic Tax Computation as per Budget 2025

- Built-in salary templates

- Auto HRA calculation under Section 10(13A)

- Auto-filling of Form 10E for relief under Section 89(1)

- Auto generation of Form 16 Part A and B

5. Tax Computed Sheet as per Budget 2025

The software is already updated with all the latest Budget 2025 tax slabs and rules. It allows you to choose between the old regime and new tax regime, and automatically calculates your tax liability accordingly.

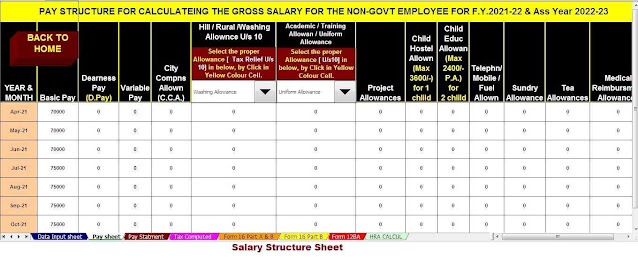

6. Inbuilt Salary Structure for Govt and Non-Govt Employees

Tired of inputting your salary data from scratch? This utility has preloaded salary formats—just pick your category (Govt or Non-Govt), enter basic details, and the rest gets auto-filled.

7. Automatic HRA Exemption U/s 10(13A)

Claiming HRA can be confusing, right? The tool auto-calculates your HRA exemption based on your city of residence, rent paid, and salary details, ensuring you're not missing any benefits.

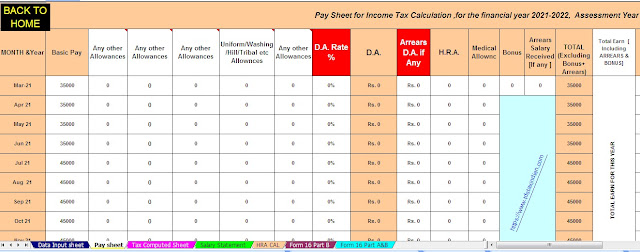

8. Auto-Fill Salary Sheet – No More Manual Work!

Manual data entry can lead to mistakes. This Excel tool automatically fills your salary sheet, breaking down each component like basic pay, allowances, deductions, etc., in a clear format.

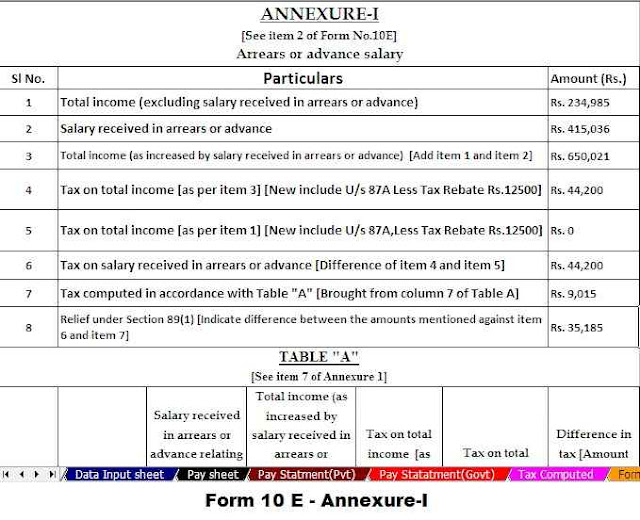

9. Arrears Relief Calculation U/s 89(1) with Form 10E

Getting salary arrears? You’ll need to calculate relief under Section 89(1) and submit Form 10E. This software calculates the relief amount and fills Form 10E for you automatically.

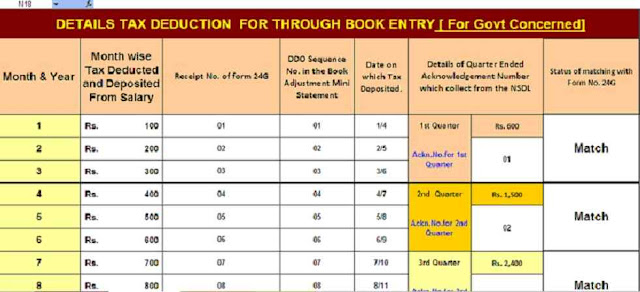

10. Auto-Fill Form 16 (Part A and B)

Need to submit Form 16? The tool generates Form 16 Part A and B instantly. This is a lifesaver during filing season when time and accuracy are critical.

11. User-Friendly Interface: No Expertise Needed

You don’t need to be an Excel wizard. The software is designed for anyone with basic Excel knowledge. Clear instructions and dropdown options make navigation a breeze.

12. Time-Saving Benefits for Busy Professionals

This tool is like hiring a virtual assistant. Instead of wasting hours on tax calculations, you can finish everything in under 30 minutes, allowing you to focus on what really matters.

13. Compliance Made Easy

Government forms and sections can be a maze. This software keeps you 100% compliant with Income Tax Act provisions like Section 10(13A), 89(1), 80C, and more.

14. How to Download and Use the Software?

Downloading is simple; click on the download link provided below and open the Excel utility. All instructions are provided on the first sheet—just follow them step-by-step.

15. Conclusion and Final Thoughts

In today's fast-paced world, nobody wants to get stuck in endless paperwork or confusing calculations. The Automatic Income Tax Preparation Software in Excel offers a practical, reliable, and easy solution for salaried individuals—government or private—to stay compliant and save time during the FY 2025-26 tax season. It’s not just software—it’s your tax partner!

Frequently Asked Questions (FAQs)

1. Can this software be used by pensioners or senior citizens?

Yes, as long as their income sources align with the built-in formats. They can also benefit from automatic tax computation.

2. Does the software support both the Old and the New Tax Regimes?

Absolutely! You can choose your preferred regime, and it will compute tax accordingly based on the Budget 2025 updates.

3. How is this different from online tax-filing platforms?

This Excel utility gives you offline access, more control, and doesn’t require internet connectivity to work.

4. Is Form 10E submission mandatory for relief under Section 89(1)?

Yes, and this software auto-fills Form 10E, helping you stay compliant and avoid IT department notices.

Download Automatic Income Tax Preparation Software in Excel All-in-One for Govt and Non-Govt Employees with Form 10E for FY 2025-26

[This Excel Utility can prepare at a time Tax Computed Sheet as per Budget 2025 + inbuilt Salary Structure for both Govt and Non-Govt Salary Structure + Auto Calculate H.R.A. Exemption U/s 10(13A) + Auto fill Salary Sheet + Auto calculate Arrears Relief Calculation U/s 89(1) with Form 10E + Auto fill Form 16 Part A and B + Auto fill Form 16 Part B for F.Y.2025-26]