Public Provident Fund: PPF varies from Rs. 26 Lack if you invested Rs. 1000/- per month, but how? First, it is recommended that you start investing in PPF at a very young age. Suppose you start investing at the age of 20, you can run it until you achieve 60 years.

New Delhi: The Public Provident Fund (PPF) the scheme, launched by the National Savings Corporation in 1968, aimed to develop small savings as a viable investment option. PPF will give very good results in the long run if you choose your intelligent term.

The Public Provident Fund currently offers an interest rate of interest. 1%. A minimum of rupees five hundred (500/-) and a maximum of rupees One lack fifty thousand(1.5 Lack) per annum may be deposited in a PPF account. Deposits can be made up to a maximum of 12 transactions.

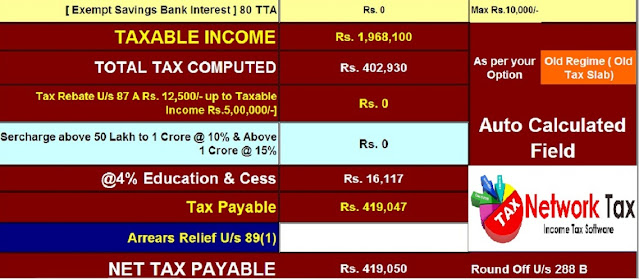

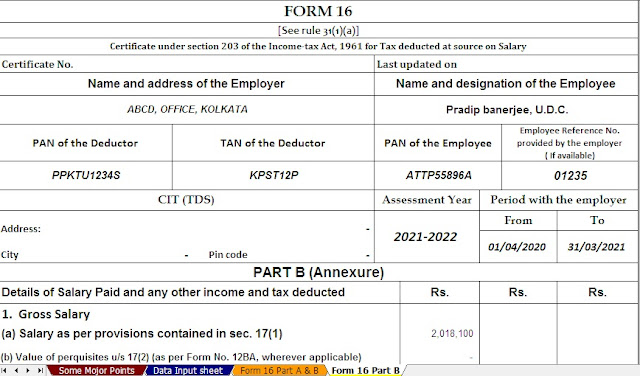

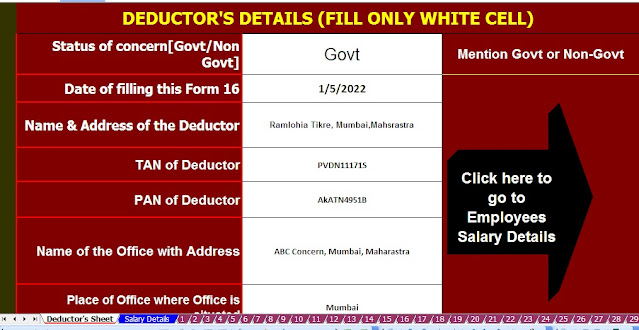

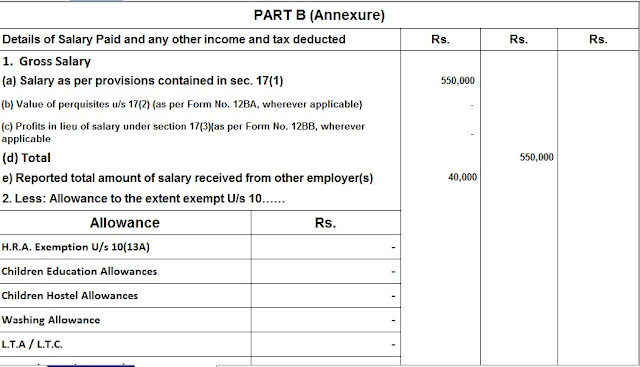

You may also require: A unique & handy Excel Based Automated Income Tax Revised Salary Certificate preparation Form 16 Part A&B for the F.Y. 2020-21[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B- who are not able to download the Form 16 Part A from the Income Tax Department’s TRACES PORTAL, they can use this Utility]

The key to a good harvest is to start saving from an early stage and continue in a disciplined manner. If you invest even a thousand rupees a month in a public provident fund, it will give you millions in the long run. Here is an approximate calculation of how you can earn more than Rs 26 by investing a small amount of Rs 1000 per month in PPF.

A PPF account matures within 15 years, after which you can either withdraw all your money or extend the PPF account for blocks for every 5 years.

Check the following calculations: Rs.1000 invested in PPF changes to Rs.26 lakhs

First, it is recommended that you start investing in PPF at a very young age. Suppose you start investing at the age of 20, you can run it until you achieve 60 years.

1. Investment for the first 15 years

If you continue to deposit Rs.1000 per month for 15 years, you will deposit Rs.1.80 lakh. In the mentioned amount, you will get Rs 3.25 lakh after 15 years. Your interest rate on this 7.1 rate will be Rs 1.45 lakh.

2. PPF has been extended for 5 years

Now you increase your PPF for 5 years and if you continue to invest Rs.1000 per month, after 5 years the amount will increase by Rs.3.25 lakhs to Rs.532 lakhs.

3. PPF again increased for the second time for 5 years

After 60 months (5 Years), if you re-invest the PPF again for the next 60 months (5 years) and continue investing Rupees one thousand, then after the next 60 months (5 years) the money in your PPF account will increase to Rs.8.24 lakhs.

4. PPF has been extended for the third time for five years

If you extend this PPF account for the third time for 5 years and continue to invest Rs.1000, the total investment the period will be 30 years and the amount in the PPF account will increase to Rs.12.36 lakhs.

You may also required: A unique & handy Excel Based Automated Income Tax Revised Salary Certificate preparation Form 16 Part A&B for the F.Y. 2020-21[This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B- who are not able to download the Form 16 Part A from the Income Tax Department’s TRACES PORTAL, they can use this Utility]

5. PPF has increased for the fourth time in five years

If you extend the PPF account for another 5 years after 30 years and invest Rs.1000 per month in the 35th year, the money in your PPF account will increase to Rs.18.15 lakhs.

PP. The PPF has extended for the fifth time for five years

After 35 years, you extend the PPF account for another five years and continue to invest Rs.1000 per month, in the 40th year, the money in your PPF account will increase to Rs.226.32 lakhs.

So, the Rs.1000 you started investing at the age of 20 will be Rs.26.32 lakhs till retirement.

Prepare at a time 100 Employees Form 16 Part B for theF.Y.2020-21 as per new and old tax regime U/s 115 BAC [This Excel Utility handy and easy to generate just like as an Excel file]