Deduction Section 16 of the Income-tax Act, 1961, provides for exemption from income-to-income tax under the heading 'salary'. It provides standard discounts, entertainment allowances and discounts for professional taxes. With this discount, a salaried taxpayer can deduct his taxable salary income from the tax. Furthermore, with the recent revisions to the standard discount, the benefits of this category have been further expanded.

Moreover, there is no hassle of providing bills to make it absolutely easy to claim for travel and treatment. In this article, we will cover each cut of the bar under paragraph 16 with the figure on the calculation. Standard exemption from salary under section 16 (IA) Standard exemption is allowed under section 16 (IA) of the Income-tax Act. 1961 instead of the standard discount Money transport allowance and Rs 15000 medical treatment has been reimbursed in the budget - in 2018 our Finance Minister Jaitley introduced it. Budget - 2018 Transport allowance and Rs 40,000 in place of medical refunds have been provided for standard discount. No taxpayer is required to submit any bill or proof of expenditure for this Rs 40,000 discount. That's 40,000

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Money arranges flat discounts. Later in the Interim Budget 2017, the amount of Rs 40,000 the deduction was increased to Rs 50,000. So 201.-1. The deduction for the financial year was Rs 40,000 and the discount will be Rs 50,000 from F-2017 from F.Y. 2021. The standard deduction is also available for pensioners.

The CBDT issued an explanation clarifying the need for a standard deduction on pensioners. The pension received by a taxpayer from his previous employer will be taxable under the heading “salary”. Since the pension received is taxed under the heading ‘Salary’, the exemption will also be available for pensioners under section 16.

The amount of exemption under section 16 for standard exemption is Salary received or Rs. 50,000/- whichever is less.

Entertainment Allowance Under Section 16 (ii) Entertainment Allowance is first included in the salary income and then a discount is given on the basis of several criteria. This allowance must be paid to the employer as an entertainment allowance to the taxpayer in particular must be an allowance paid. Entertainment Allowance for Government Employees For Central Government and State Government employees, the lowest of the following exemptions are available: 20% of basic salary Rs.5000 / - In order to determine the amount of allowance paid as entertainment allowance in a financial year, a taxpayer must ensure fulfilment of the following statement. :

Salary must be any other allowance should not include, benefits received from the employer or perquisites received. Basically, the salary must be the total amount received without considering any other benefits.

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21[This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]

Entertainment Allowance for a Private Employee Exemption against Entertainment Allowance for Private Employees not allowed.

Only central or state government employees are eligible for this exemption. In addition, employees of local authorities and statutory corporations are not eligible for this exemption.

Professional tax on employment under section 16 (iii) or tax exemption on employment under section 16(ia) of the Income-tax Act is permitted.

Here you must keep in mind the following points when calculating exemptions against professional tax as a taxpayer is allowed as a rebate under section16 for the amount of tax on employment or professional tax: Exemption from tax paid by the employer Eligible is Here, the amount paid to the employer as the professional tax will be included as a prerequisite for the total salary. The same amount will be allowed as exemption later under section 16. Under section 16 of the Income-tax Act, there is no upper or lower limit for exemption.

The exemption depends only on the actual amount of professional tax. However, no state government can lend more than 25 2,500 a year as professional tax. The only tax payable is exempt and not interest or late fee for non-payment or non-payment of professional tax.

Download Automated Income Tax Preparation Excel Based Software All in One for the Government & Non-Government (Private) Employees for the F.Y.2020-21 and A.Y.2021-22

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Update Version)

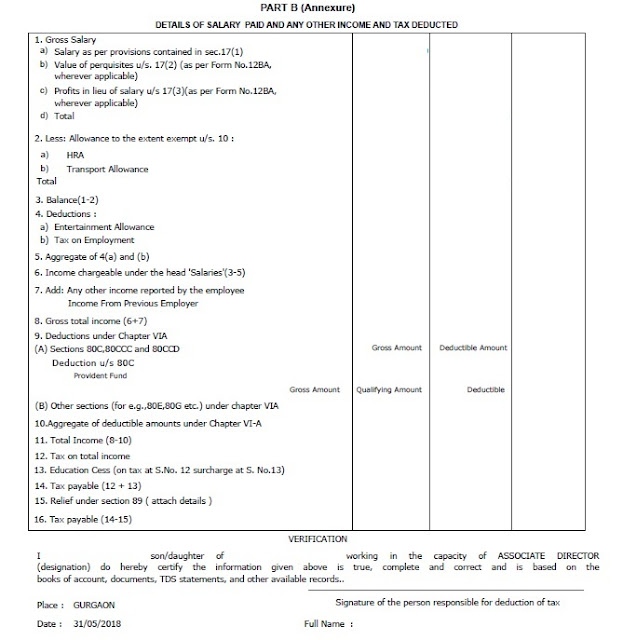

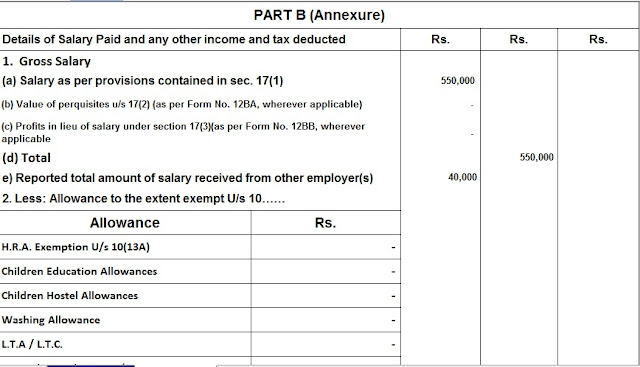

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21