Excel based Income Tax Preparation Software for the F.Y 2020-21–A.Y 2021-22 As per new and old tax regime U/s 115BAC

In Budget 2020 introduced two tax systems, somehow benefit certain income taxpayers and pull additional taxes on

certain taxpayers. In the middle class taxpayers is your Excel-based income tax

calculator can be used to calculate income tax on income from salaries,

pensions, gifts, fixed deposits, and bank interest and you will get the result

according to the result of your tax regime election.

Download

Automated Income Tax Preparation Excel Based Software All in One for

the Non-Government Employees for the F.Y.2020-21 as per New and Old Tax

Regime

Main Feature of this Excel

Utility are:-

1) Income

Tax Computed Sheet as per your Option New or Old Tax Regime

2)

Individual Salary Structure as per the Non-Government (Private) Employee’s

Salary Pattern

3) This

Excel utility prepares and calculating your income tax as per the New Section115 BAC (New and Old Tax Regime)

4) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

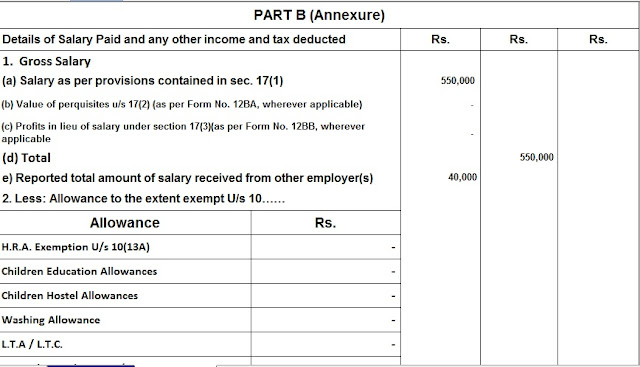

5) Automated

Income Tax Form 12 BA

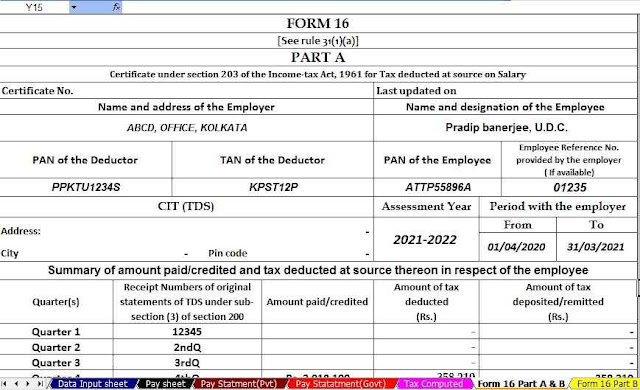

6) Automated

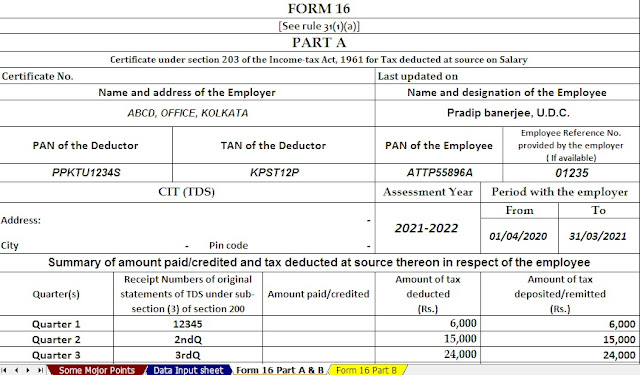

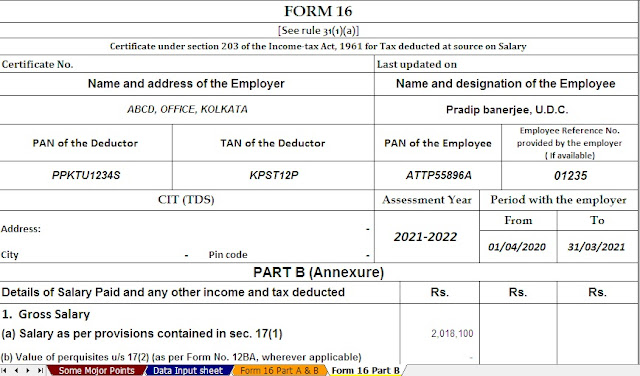

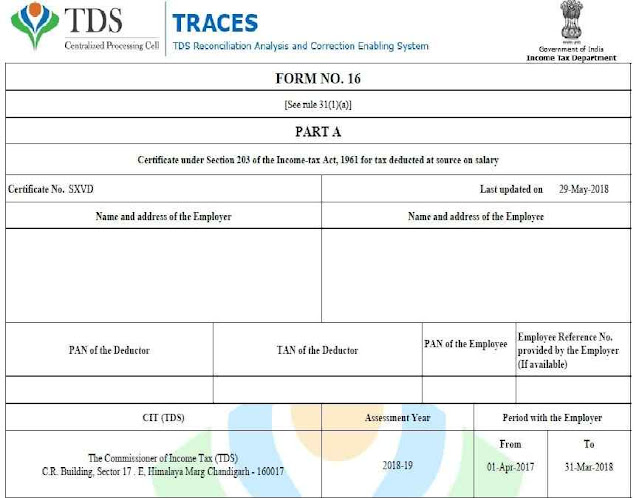

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

7) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

8) Individual Salary Sheet

9) Auto Calculate your House Rent Exemption

Calculation U/s 10(13A)

Highlights the changes in the income tax in this financial

year 2020-21

A new direct tax dispute resolution

F.Y 2020-21 has been introduced under the "Dispute is the World

Boundary". No penalty will be levied if the taxpayers pay by March 31,

2020. Here only the disputed tax has to be paid.

An additional period of 1 year

under Section 80EEA is extended to avail additional INR 1.5 lakh discount. It

can not approved if you choose the new

tax regime.

Dividend Distribution Tax (DDT) has been withdrawn.

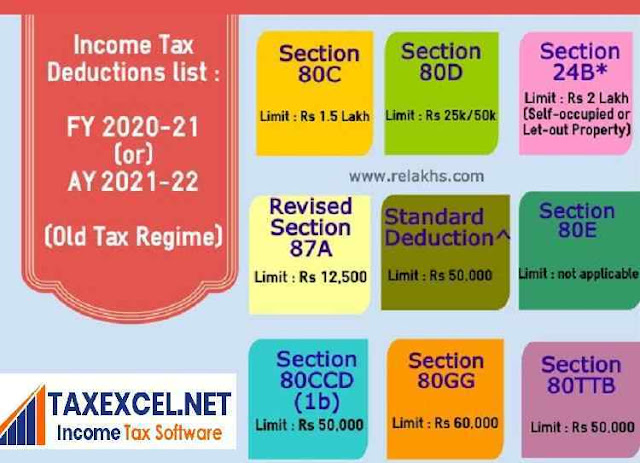

If you have new tax charges LTA,

HRA, transportation, other special allowances [Section 10 (14)], Standard deduction, interest on housing loan (Section 24), Chapter VI discount (80C, 80D,

80E and so on ) On) (excluding sections 80CCD (2) and 80JJA) is not allowed.

Download

Automated Income Tax Preparation Excel Based Software All in One for

the West Bengal Government Employees for the F.Y.2020-21 as per New and

Old Tax Regime

Main Feature of this Excel

Utility are:-

1) Income

Tax Computed Sheet as per your Option New or Old Tax Regime

2)

Individual Salary Structure as per the West Bengal

Government Employee’s Salary Pattern as per ROPA 2019

3) This

Excel utility prepares and calculating your income tax as per the New Section

115 BAC (New and Old Tax Regime)

4) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet

8) Auto Calculate your House Rent Exemption

Calculation U/s 10(13A)

Old tax regime vs. new tax regime

The question is whether the old tax

system is better for the common man than the new tax discipline, any change in

the tax slab directly or indirectly affects the salaried person, in this regard

it is very indispensable to understand the advantages and disadvantages of your

choice.

Whether a taxpayer can choose

between two tax systems in each financial year as his financial benefits and

income for that year. Ans:- Yes you can.

Which tax regime is better?

There are different case studies of

different scenarios for individuals who are paid at different pay levels under

the current tax duty and the new proposed tax system.

If a salaried employee does not claim a waiver.

In the above case, the new tax

discipline looks attractive, except that "if the individual claims are

exempted under section 50C, 60D, HRA exemption, LTA exemption and interest

exemption on loans taken up to the allowable limit for self-occupied property,

the election criteria change." Will be. "

Salaried persons claim maximum

deduction / waiver, considering Rs.1.5 lakh U/s 80C and Rs. 25,000 U/s 80D to

the below 60 years of age and Rs 50,000/- for the Senior Citizen above 60 years

of age.

All types of exemptions /

deductions change the whole picture of the tax system for the individual, but

it is very clear. In the case of the above INR alone, more than 15 lakh +

taxpayers will benefit from the new government.

Advantages and Disadvantages if you choose Old Regime

You can take advantage of all the discounts

and discounts as usual.

If you are under a higher tax slab,

the old regime is a better option. This will allow you to get rid of all the

discounts

Pros:-

The old not only saves taxes but

increases your wealth corpus

Income above Rs 5 lakh has forced

you to pay tax under the new regime, but under the old regime, all exemptions

and rebates filter your taxable income and pull you out of the tax.

Cons:-

Old rules conditionally force you

to use discounts to save tax, otherwise, you will have to pay taxes. There are

many categories that require additional tax knowledge which is somewhat

difficult for people from other streams.

Download Automated Income Tax Preparation Excel Based Software

All in One for the Government & Non-Government Employees for the

F.Y.2020-21 as per New and Old Tax Regime

This Unique Software All

in One prepare at a time your

1) Income

Tax Computed Sheet as per your Option New or Old Tax Regime

2)

Individual Salary Structure as per the Government & All Private Employee’s

Salary Pattern

3) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

4) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

5) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

6) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

7) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

8) Individual Salary Sheet

9) Auto Calculate your House Rent Exemption

Calculation U/s 10(13A)