Friday, 25 December 2020

Thursday, 24 December 2020

Those opting for new tax regime from the monetary year 2020-21 onward should present an additional Form 10-IE while presenting their income tax returns.

The (CBDT) notified a new Form to be filled by those opting for the new or old tax regime for the financial year 2020-21. This new Form notified by CBDT on 1st October 2020 is Form 10-IE.

You should document this Form at the hour of filling your income tax return (ITR) on the off chance that the taxpayer has picked the new or old tax regime U/s 115 BAC.

[This Excel Utility

prepare at a time your Income Tax as per your option U/s 115BAC perfectly +

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version) + Automated Calculation Income Tax

House Rent Exemption U/s 10(13A) + Individual Salary Structure as per the Gov

and Private Concern’s Salary Pattern + Automated Income Tax Revised Form 16

Part A&B for the F.Y.2020-21 + Automated Income Tax Revised Form 16 Part B

for the F.Y.2020-21]

Finance Minister Nirmala Sitharaman Introduced the new tax regime in the Budget 2020 . The new tax regime is discretionary, anybody opting for it needed to forego a large portion of the deductions accessible under the income tax law, for example, Section 80C, 80D, 80TTA for a deduction on investment account of any Bank or Post Office. The new tax regime, be that as it may, offers concessional tax rates.

A taxpayer is needed to decide on the new or old tax regime at the time of filling the ITR, according to newly-introduced Section 115BAC of the Income Tax Act, 1961. This will be done through the new Form 10-IE notified by CBDT.

Taxpayers need to take care of the Form 10-IE to pass on to the tax authorities that a new tax regime has been decided to filling their ITRs. As per the tax laws, any person who has business income will present the Form 10-IE before the due date of filling of the ITR on July 31 or sometime in the future in the time that the cutoff time is reached out by the public authority. Salaried people can fill this Form 10-IE e previously or/at the time of submit their option U/s 115 BAC in due time.

[This Excel Utility prepare at a time your Income Tax as per your option U/s 115BAC perfectly + Automated Income Tax Form 12 BA + Automated Calculation Income Tax House Rent Exemption U/s 10(13A) + Individual Salary Structure as per the Private Concern’s Salary Pattern + Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 + Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21]

Wednesday, 23 December 2020

As per the Budget 2020, introduced a New Tax Section 115 BAC, which means that the New Tax Regime and Old Tax Regime as you like you can choose the option Vide the new introduced Form 10-IE in this Budget.

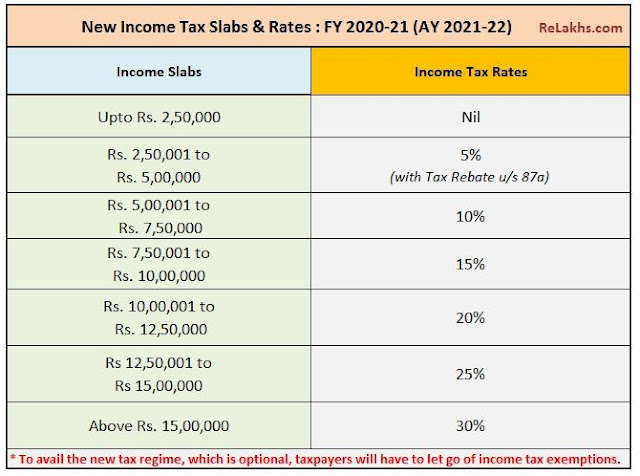

If you choose the New Tax Regime as well as new tax Slab for the financial year 2020-21, you can not availed any income tax exemptions as per the Income Tax Act 1961 except the NPS benefits and have no benefits in the new tax slab rate to the Senior Citizen. But if you choose the Old Tax Regime as well as Old Tax Slab then you can availed the all of benefits of the Income Tax As per the Income Tax Act 1961.Look the below New and Old Tax Slab for the F.Y.2020-21 as per U/s 115BAC.

However here is a unique Excel Based Form 16 Preparation Software, prepared as per the New Section 115 BAC for the Financial Year 2020-21.

Download Automated Income Tax Revised Master of Form 16 Part A&B for the Financial Year 2020-21 with new and old tax regime U/s 115 BAC. [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Feature of this Excel Utility:-

1) This Excel Utility Prepare at a time 50 Employees Revised Form 16 Part A & B [Who are not able to download Form 16 Part A from the TRACES PORTAL, they can use this Excel Utility.

2) In this Form 16 Part B have details of all the Income and Deductions as per New and Old Tax Regime

3) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

4) This Excel Utility has the all amended Income Tax Section as per Budget 2020

5) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

6) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

7) Automatic Convert the amount in to the in-words without any Excel Formula

Tuesday, 22 December 2020

- You must be a RESIDENT INDIVIDUAL; and

- Your Total Income, fewer Deductions, (under Section 80) is equal to or less than Rs 5,00,000.

- The rebate is limited to Rs 12,500. This means the total tax payable or Rs 12,500, whichever is lower, that amount will be the rebate under section 87A. [This rebate is applied to the total tax before adding the Education Cess (4%)]

Monday, 21 December 2020

Comprehend the insights regarding the subject Form 16. We will initially examine what is Form 16, at that point its parts, and its significance. To begin with, what is Form16? Every year your manager issues Form 16 endorsements

This is a declaration under Section 203 of the Personal Duty Act that gives insights concerning the expense sum that has been deducted by your manager that is called TDS. It additionally contains the subtleties of your compensation different livelihoods and tax reductions accessible and profited by you in the last monetary year. It has itemized data about the way of ascertaining pay according to the personal expense laws and assessment payable on it. May, 31 is the last date for your manager to give a Form 16 to you.

Presently we'll talk about the parts of Form 16 Section of Form 16 causes us to comprehend the assessment paid, likely expense discount we can get, and can likewise help in better duty arranging, we can do it one year from now, and above all, can likewise, help us to document your personal government forms Form 16 includes essentially of two-part

First is Form 16 Part - A, this is the means by which Section A looks. It contains our own data like our name, address, bosses name and address and of both of our manager, and receipt number of TDS instalment. This data helps the personal assessment division to monitor cash stream from our own just as our bosses account. What's more, the business' gives data like appraisal year. It gives a synopsis of TDS deducted by the business for our sake. This sum is deducted by the business from our compensation consistently as assessment and credits the equivalent to the annual expense office to know why this TDS is deducted.

The main data To some Form 16 Part- A:- Assessment allowance account number of boss and complete TDS deducted, as both of this data must be accurately referenced in our annual expense form, so that if there is any tax reduction, we can get that..

Presently how about Form 16 Part B:-

This Form 16 Part -B, gives significant data that you need to record your annual government form. Above all else, the all-out compensation is given by the business in the monetary year is referenced, at that point essential or advantages is an extra advantage gave by the business. Notwithstanding the compensation.

It is any advantage conceded liberated from cost, or at concessional rates, for example, lease free home, motorcar office, advances at sponsored rates, and so forth. They are the sum paid by the business, notwithstanding pay to meet some help prerequisites such house lease stipend, Live travel recompense, movement remittance, youngsters' schooling remittance and so on stipend can be completely available. Mostly or non-available. Here the representative has just HRA recompense, which is completely charged deductible. For this situation, and consequently is deducted from all-out compensation before charge estimations, we jump on a home advance interest instalments according to Section 24 of the Income Tax Act.

So subsequent to deducting all the cost remittances and cash paid on home credit revenue EMI, we get our cross pay. At that point, allowances are uncovered derivations incorporate those under the part, 80 C, 80CC, and it is CCD whose complete total deductible under these separate segments should not go past rupees 1.5 lakhs.

Download Automated Income Tax Salary

Certificate Master of Form 16 Part-B for the F.Y.2020-21 [This Excel Utility

Prepared at a time 50 Employees Form 16 Part-B]

Feature of this Excel Utility:-

1) This Excel Utility Prepare at a time 50 Employees Form 16

Part B

2) This Excel Utility Calculate your Tax as per the new section 115 BAC

3) You can use the Tax Calculation as New or Old Tax Regime U/s

115 BAC

4) Automatic Convert amount into the In-words, without any

Excel Formula.

5) In this Excel Utility have all the modified Section as per

the Budget 2020

Friday, 18 December 2020

As per the West Bengal Finance

Department has changed the Pension Form Single Comprehensive Form in a new

modified format vide Notification No. 416-F, Dated 09/08/2019. Some of the

particulars added in this New Form, which will be more transparent. And also

this Format will be required after 01/01/2016 as per the New 6th Pay Commission

(As per ROPA 2019)

Download the Revised and New SingleComprehensive Form PDF Format

Free Download the Automated New Revised Single Comprehensive Form

with necessary all Pension Related Papers. No need to fill this form as

manually, just download this Excel Based Software and input your required

particulars and prepare the All papers of Pension for the West

Bengal Government Employees As per ROPA 2019

Main Feature of this Excel Utility:-

Automatic prepare your All Papers for Pension with All Pension + Gratuity + Commuted Pension Amount + Gratuity Amount with Automated Single Comprehensive Form in New Format + This Excel Utility comes after 01/01/2016 ( After ROPA 2019)

Budget 2020 has introduce a New Section 115 BAC for the Financial year 2020-21 and you have opt-in a Option about New and Old Tax Regime through the New introduces Form 10-IE in the time of Income Tax Filling

In this Section have an option for you can opt-in as Old Tax Regime (Old Tax Slab) and another is New Tax Regime (New Tax Slab)

If you chose the New Tax Regime, you can not avail any Income Tax Benefits except the New Tax Slab. Or If you are chose the Old Tax Regime, you can choose the all income tax benefits as per the Income Tax Act 1961.

This option can be given through a Newly Introduced Option Form 10-IE by the CBDT As per the new section 115 BAC.

Download Automated Income Tax Salary Certificate Revised Form 16 Part A&B for the Financial Year 2020-21 as per U/s 115 BAC (Old and New Tax Regime) [This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

let's discus about the form 16. Form 16 is your salary TDs certificate. If your income from salary for the financial year is more than the basic exemption limit of rupees 2.5 lakh your employer will deduct TDs on your salary and deposited with the government.

If you have disclosed your income from other heads to your employer, he or she will consider your total income for TDs deduction form 16 has two parts. Part A and Part B, you should informed to your employer, like name and address pan and tan details, the period of employment details of TDs deducted and deposited with the government.

In Part V includes details of salary paid other income deductions allowed tax payable etc.. While form 16 is only for your salary form 16 is applicable for TDs on income, other than salary. For example, form 16 shall be issued to you.

When a bank deducts TDs on your interest income from fixed deposits for TDs deducted on Insurance Commission and four TDs deducted on your rent receipts, all the details of form 16 are also available on Forms 26 AS. Form 16 is issued annually, while form 16 eight is issued quarterly.

Conclusion:- As per the CBDT Notification that the Income Tax Form 16 must be download from the Traces Portal in the Income Tax Department. And the Form 16 part B can be prepared by the Employer of the Government and Non- Government concerned.

Download Automated Income Tax Salary Certificate Revised Form 16 Part A&B for the Financial Year 2020-21 as per U/s 115 BAC (Old and New Tax Regime) [This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]