Introduction

The Savings Bank Interest earns is the amount paid to an entity for lending its money or letting another entity use its funds. On a bigger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

Such income is usually taxable, however,

the Income Tax gives surely rebate on such income. Such exemption is

distinguished for people and senior citizens separately.

How can the senior citizens in India have

increased rebate from income tax?

In India,

the bulk of older persons face financial hardship in adulthood as most of them

aren't during a position to earn their livelihood.

Their savings, if any, aren't enough to satisfy their day-to-day expenses,

particularly the medical expenses. Senior Citizen with good net-worth value are

in search of excellent short-term

financial getting to earn an honest income from their finance. The Income Tax

law has given them much of rebates to the senior citizens in India with the view to mitigating

their issues.

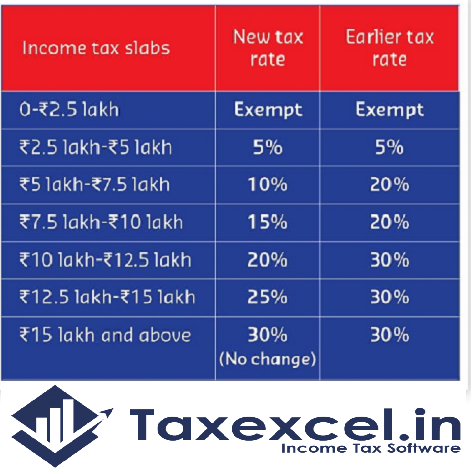

The basic tax exemption limit for normal citizens below 60 years aged is Rs 2.5

lakh during a financial year. Apart for The Senior Citizens, the rebate limit is Rs 3,00,00/-, while for

Super Senior Citizens, the limit is Rs 5 lakh.

So, an oldster doesn’t need to pay any tax or file ITR just in case the annual

income is up to Rs 3 lakh and no TDS is deducted

during the financial year. Similarly, an impressive oldster is exempted from

paying tax and filing ITR if his/her annual income is up to Rs 5 lakh and no

TDS is deducted.

Which persons can be taken

into account as a Senior Citizen in India?

According to the law, an oldster

is a private resident between the age bracket of 60 to 80 years, as on the Maturity

Day of the previous financial year.

Which persons can be taken into account as a most senior citizen in India?

A super oldster is a private resident who is above 80 years, as on the Judgment

Day of the previous financial year.

Is Interest Income Taxable?

Interest income from Fixed Deposits is

taxable. It's covered under the top, ‘Income from Other Sources’ in your tax

return.

Senior citizens receiving interest income from FD's, checking account and

recurring deposits can avail tax exemption of up to Rs 50,000 annually under Section 80 TTB. This is a often by way

of an amendment vide Finance Act 2018.

What is Section 80TTB?

Section 80TTB which was applicable

w.e.f. The first day of April 2018 may be a provision whereby a taxpayer who

may be a resident oldster, aged 60 years and above at any time during a

financial year shall demand a rebate of below of Rs Fifty Thousand or an amount

from a specified income from his gross total income for that same financial

year.

Specified income is any of the

next income in aggregate:

1. Interest on bank deposits (savings or fixed);

2. Interest on deposits held during a co-operative society engaged within the

business of banking, including a co-operative land mortgage bank or a

co-operative exploitation bank; or

3. Interest on post office deposits

Senior citizens shall not

demand deduction under section 80TTA

This section 80TTA entitled to get a rebate

of Rs 10,000 on interest income. This deduction is out there to a personal and

HUF.

This deduction is allowed on interest earned —

1. From a bank account with a bank

2. From bank account with a co-operative society carrying on the business of

banking

3. From bank account with a post office

Earlier, this deduction was available to everyone no matter their age, i.e., to

individuals aged below 60 years, senior citizens, and super senior citizens.

However, with effect from the financial year 2018-19, The Senior Citizens shall

not demand deduction under this section. In

the Budget 2018, U/s 80TTA has been amended which restricts senior citizens

from claiming any deductions on interest

received on checking account either with bank or post office under this

particular section. However, they will claim deduction up to Rs 50,000 for

interest received from a bank account and glued deposit with banks and post

office under the newly inserted section, i.e., section 80TTB.

Let us ask the below summary

to seek out what interest incomes are taxable, and what are exempt:-

Conclusion:-

Interest income on a tough and fast Deposit — The interest income on a tough and fast Deposit is taxable,

and one possesses to pay taxes as per the applicable tax slab rates. The bank

deducts TDS as this income, also TDS is deducted only interest income exceeds

Rs 10,000 in any given financial year. The rebate limit for senior citizens is

Rs Fifty Thousand U/s 80TTB. It can also be entitled to a rebate on TDS by

filing Form 15G (15H for senior citizens) if your overall taxable income from

all sources is below the respective exemption limit.

Interest income on a bank account – Interest income on bank account up to Rs

10,000 (Rs 50,000 for senior citizens), is exempt. Any interest income on

Savings account exceeds Rs A Thousand will be taxable as per applicable slab

rates. However, calculate the rebate limit of interest income from all the

accounts will be added, Bank Savings Accounts, post office Savings Accounts,

and co-operative bank Savings Accounts.