The provisions of

Section 80TTA of the tax Act could also be read as under:-

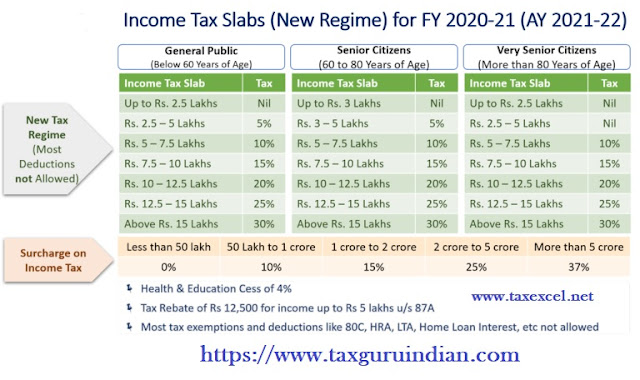

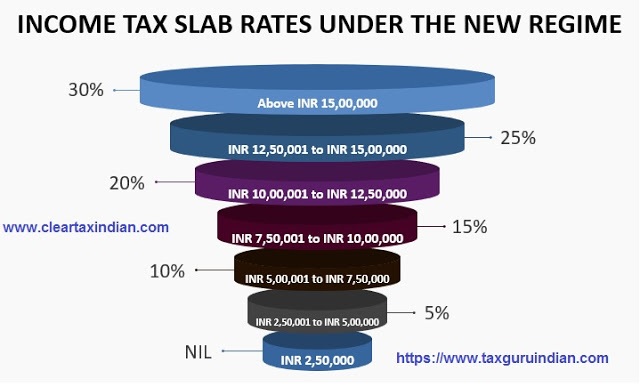

Also it is noted that as per the New Income Tax Section 115BAC introduced in Budget 2020. As per the Section 115 BAC you should give your

option as you opt-in as New Tax Regime or Old Tax Regime in the newly

prescribed Form 10-IE. If you choose the New Tax Regime you can not avail this

exemption U/s 80 TTA or if you choose the Old Tax Regime then you can avail

this Exemption U/s 80 TTA.

Exemption interest on deposits within

the savings accounts as per the provisions of Section 80TTA.

Where the gross total income of an assessee (other

than the assessee mentioned in section 80TTB for Senior citizens), being a

private or a Hindu undivided family, includes any income by way of interest on

deposits (not being time deposits) during a bank account with—

1. Banking Concerned: Interest earned from a Savings

Bank to which the Banking Regulation Act, 1949 (10 of 1949), applies (including

any bank or banking institution mentioned in section 51 of that Act);

2. Co-operative Society: Savings Interest earned from

a co-operative society (including a

co-operative land mortgage bank or a co-operative exploitation bank); or

3. Post Office: Savings Interest earned from a Post

Office as defined in clause (k) of section 2 of the Indian Post Office Act,

1898 (6 of 1898),

If the above conditions are satisfied the subsequent

deductions are going to be allowed as per Section 80TTA:

A. during a case where the quantity of such income

doesn't exceed within the aggregate Rs.10,000/- the entire of such amount; and

B. in any other case,

Rs.10,000/-

Further where the income mentioned during this

section springs from any deposit during a bank account held by, or on behalf

of, a firm, an association of persons or a body of individuals.

No deduction shall be allowed under this section in

respect of such income in computing the entire income of any partner of the

firm or any member of the association or any individual of the body.

You may also like the Automated Income TaxH.R.A. Exemption Calculator U/s 10(13A)

Applicability of

deduction under section 80TTA?

Section 80TTA Exemption from tax on saving account

interest up to an amount of Rs.10,000/- (Ten Thousand) only. So, it's

considerably clear that Section 80TTA allows saving of tax on interest income

earned from “Savings Accounts” only.

Thus, Section 80TTA does not allow other interest

income received from Banks, financial organization’s from other deposit such as

Recurring Deposits, Fixed Deposits, Company Deposits are not eligible for

getting the benefits of Section 80TTA deduction.

A private or a member of HUF can claim deduction of

tax on interest income up to Rs.10,000/– received from the following:

From a saving account

maintained in a Bank;

From savings account

maintained in a Post office;

From a saving account maintained with a Co-operative

Society completing banking business.

But interest earned from Fixed Deposits, Recurring

Deposits, Term Deposits maintained with Banks, financial organization’s,

Co-operative Societies, Post office, are not eligible for tax deduction under

this section.

You may also like the Automated Income Tax Allin One Value of Perquisites U/s 17(2)

Who can claim 80TTA

Deduction?

As per the provisions of Section 80TTA only

individual and members of Hindu Undivided Family can claim deductions of

Rs.10,000/- for interests earned on deposits held within the savings accounts

only.

Further, it should be kept in mind that 80TTA

deduction is allowed for a maximum amount of Rs.10,000 for interest income

earned from all the bank account altogether maintained in the name of the

assesses.

Is 80TTA applicable for

non residents?

As per Section 80TTA, there are not any restrictions

on Non-residents to say tax exemption on interest income earned from bank

account . However, the utmost amount of deduction is restricted to Rs.10,000

only combining all bank account together.

Can we claim both 80TTA and

80TTB?

The answer is simply No. U/s 80TTB is applicable only

for the Senior Citizens only. As per Section 80TTB, a senior citizen is allowed

to claim deduction Under Section 80TTB up to a maximum amount of Rs.50,000 in a

year,

So, in simple words, the tax Act doesn't allow one to

availed exemption of both under Section 80TTA and 80TTB respectively. Senior

citizens claiming deduction only U/S 80TTB can't enjoy the advantages given under

section 80TTA.

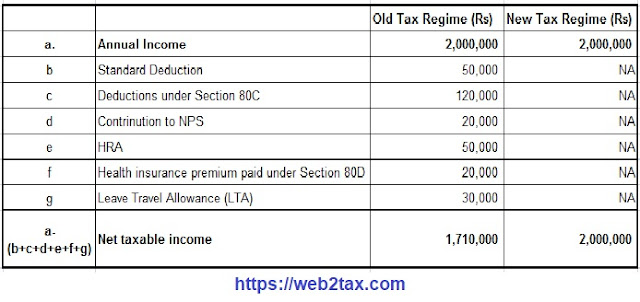

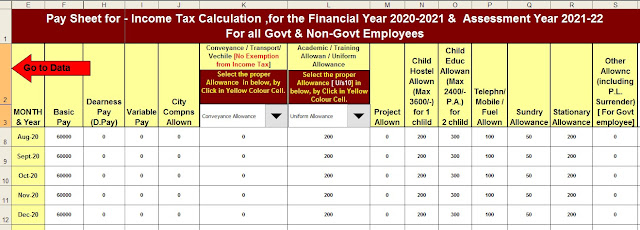

Download Automated Income Tax Preparation Excel Based Software All in One for the Government andNon-Government (Private) Employees for the Financial Year 2020-21 and Assessment Year 2021-22 U/s 115BAC

Feature of this Excel

Utility:-

1) This

Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This

Excel Utility has the all amended Income Tax Section as per Budget 2020

3)

Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4)

Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5)

Individual Salary Structure as per the Govt and Private Concern’s Salary

Pattern

6)

Individual Salary Sheet

7)

Individual Tax Computed Sheet

8)

Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9)

Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10)

Automatic Convert the amount in to the in-words without any Excel Formula