Introduction

Taxes often feel like a puzzle, right? You sit with numbers, receipts, and rules that keep changing. But here’s the good news—Section 115BAC New Tax Regime for FY 2025-26 tries to make things easier by giving you simpler slabs and lower rates. Yes, there’s a catch—you give up most deductions and exemptions. But for many taxpayers, the trade-off works.

In this article, we’ll break down the Income Tax Section 115 BAC for F.Y.2025-26 in plain language. We’ll cover the latest tax slabs, available deductions, exemptions, benefits, and how it compare with the old regime. To make it practical, we’ll also show you how to calculate taxes using an Automatic Income Tax Preparation Excel Software, which makes the process almost effortless.

Let’s dive in!

Table of Contents

Sr# | Headings |

1 | What is Section 115BAC and Why It Matters? |

2 | New Tax Regime 2025 – An Overview |

3 | Tax Slabs Under Section 115BAC for FY 2025-26 |

4 | Tax Slabs for FY 2024-25 (Comparison) |

5 | Who Can Opt for Section 115BAC? |

6 | Major Deductions Allowed in the New Regime |

7 | Exemptions Still Available |

8 | Deductions & Exemptions Not Allowed |

9 | Old vs. New Tax Regime: Detailed Comparison |

10 | Understanding Rebate Under Section 87A |

11 | Switching Between Old and New Regimes |

12 | Tax Planning Tips for Section 115BAC |

13 | Practical Examples – When New Regime Wins |

14 | Practical Examples – When Old Regime Wins |

15 | Automatic Income Tax Preparation Excel Software |

16 | Conclusion |

17 | FAQs |

1. What is Section 115BAC and Why It Matters?

Section 115BAC introduced the New Tax Regime with reduced tax slabs. In return, you need to give up most of your deductions and exemptions. Think of it as choosing between a buffet (old regime with many tax-saving dishes) and a set meal (new regime with fewer choices but lower prices).

The best part? You can decide each year which regime to pick—except in some cases for business income.

2. New Tax Regime 2025 – An Overview

Starting FY 2025-26, the New Regime under Section 115BAC has become the default tax regime. That means if you don’t actively choose the old regime, the system automatically applies the new one.

This regime is particularly attractive for those who don’t have large investments or expenses eligible for deductions. It reduces compliance stress, as you don’t need to track multiple exemption proofs.

3. Tax Slabs Under Section 115BAC for FY 2025-26

Here’s the latest slab structure:

Tax Rate | |

Up to ₹4,00,000 | Nil |

₹4,00,001 – ₹8,00,000 | 5% |

₹8,00,001 – ₹12,00,000 | 10% |

₹12,00,001 – ₹16,00,000 | 15% |

₹16,00,001 – ₹20,00,000 | 20% |

₹20,00,001 – ₹24,00,000 | 25% |

Above ₹24,00,000 | 30% |

This clearly lowers tax liability for middle-income earners, especially those between ₹8–15 lakh.

4. Tax Slabs for FY 2024-25 (Comparison)

In FY 2024-25, the slabs were slightly different:

Tax Rate | |

Up to ₹3,00,000 | Nil |

₹3,00,001 – ₹7,00,000 | 5% |

₹7,00,001 – ₹10,00,000 | 10% |

₹10,00,001 – ₹12,00,000 | 15% |

₹12,00,001 – ₹15,00,000 | 20% |

Above ₹15,00,000 | 30% |

The FY 2025-26 update increases the basic exemption to ₹4 lakh and softens the burden across slabs.

5. Who Can Opt for Section 115BAC?

· Applicable for: Individuals and Hindu Undivided Families (HUFs).

· Not applicable for: Companies, partnership firms, LLPs.

· Condition: If you want the old regime, you must opt for it while filing your return.

Business income taxpayers have stricter rules—they need to file Form 10-IEA and can switch back only once.

6. Major Deductions Allowed in the New Regime

Although most deductions vanish, some still remain:

· Employer’s contribution to NPS under Sec. 80CCD(2) – up to 14% of salary.

· Additional employee cost deduction (80JJAA).

· Agniveer Corpus Fund deduction (80CCH).

· Standard deduction of ₹75,000 for salaried and pensioners.

· Exemptions on gratuity, leave encashment, and voluntary retirement.

7. Exemptions Still Available

Even under Section 115BAC, you can enjoy:

· Transport allowance for specially-abled employees.

· Travel allowance for job-related movement.

· Daily allowance for duty-related work.

· Gifts up to ₹50,000.

· Family pension deduction up to ₹25,000.

8. Deductions & Exemptions Not Allowed

What disappears in the new regime?

· 80C investments (PF, ELSS, Life Insurance).

· 80D health insurance premiums.

· HRA and LTA.

· Interest on self-occupied home loan.

· Professional tax and entertainment allowance.

This makes the regime less attractive for heavy investors and property owners.

9. Old vs. New Tax Regime: Detailed Comparison

Deduction/Exemption | Old Regime | New Regime (115BAC) |

80C (PF, ELSS, LIC) | Available | Not Available |

HRA | Available | Not Available |

Standard Deduction | ₹50,000 | ₹75,000 |

80D (Health Insurance) | Available | Not Available |

Home Loan (Self-occupied) | ₹2,00,000 | Not Available |

Clearly, the new regime benefits those who don’t rely on deductions.

10. Understanding Rebate Under Section 87A

For FY 2025-26:

· If taxable income ≤ ₹7 lakh → Rebate ₹25,000.

· If taxable income ≤ ₹5 lakh (old regime) → Rebate ₹12,500.

· New regime 2025-26 expands rebate to ₹60,000, making it more attractive for low-income earners.

11. Switching Between Old and New Regimes

· Salaried employees: Can switch every year while filing ITR.

· Business income taxpayers: Can switch only once in their lifetime back to the new regime after opting out.

So, salaried individuals enjoy more flexibility.

12. Tax Planning Tips for Section 115BAC

· Compare both regimes before finalising.

· If you claim fewer deductions → New regime suits you.

· If you invest heavily (insurance, PF, ELSS, NPS) → Old regime saves more.

· Use an Excel-based Income Tax Software to calculate accurately.

13. Practical Examples – When New Regime Wins

Example: Salary = ₹12.5 lakh, low deductions.

· Old regime tax = ₹1,31,851

· New regime tax = ₹79,300

Savings: ₹52,551 under Section 115BAC.

14. Practical Examples – When Old Regime Wins

Example: Salary = ₹10 lakh, with HRA + Health Insurance deductions.

· Old regime tax = ₹49,941

· New regime tax = ₹44,200

Here, old regime saves ₹5,741, making it more beneficial.

15. Conclusion

The Income Tax Section 115 BAC for F.Y.2025-26 offers relief through simpler slabs and reduced rates. It’s best for those who don’t claim many deductions. On the other hand, the old regime still shines if you maximize exemptions and investments.

The smart move? Compare both regimes each year and pick the one that minimizes your tax liability. And don’t forget—using an Automatic Excel Tax Calculator makes the job faster and error-free.

16. FAQs

Q1. What is Section 115BAC in simple terms?

Section 115BAC gives taxpayers the option to pay lower taxes under the new regime but without most deductions and exemptions.

Q2. Can I switch between old and new regimes every year?

Yes, salaried individuals can switch every year, but those with business income have restrictions.

Q3. What is the rebate under Section 115BAC for FY 2025-26?

Individuals with income up to ₹7 lakh get up to ₹60,000 rebate under the new regime.

Q4. Is HRA allowed in the new tax regime?

No, HRA is not available under Section 115BAC.

Q5. How does Excel-based tax preparation software help?

It automates tax computation, HRA exemption, arrears relief, and Form 16 generation—saving both time and mistakes.

Download Automatic Income Tax Preparation Excel Software for theF.Y.2025-26 as per Budget 2025-26

To save time and errors, you can use Automatic Excel-based Tax Software.

Features include:

· Auto Tax Computation as per Budget 2025.

· Inbuilt Salary Structures (Govt & Non-Govt).

· Automatic Salary Sheet generation.

· Auto HRA Exemption under Sec. 10(13A).

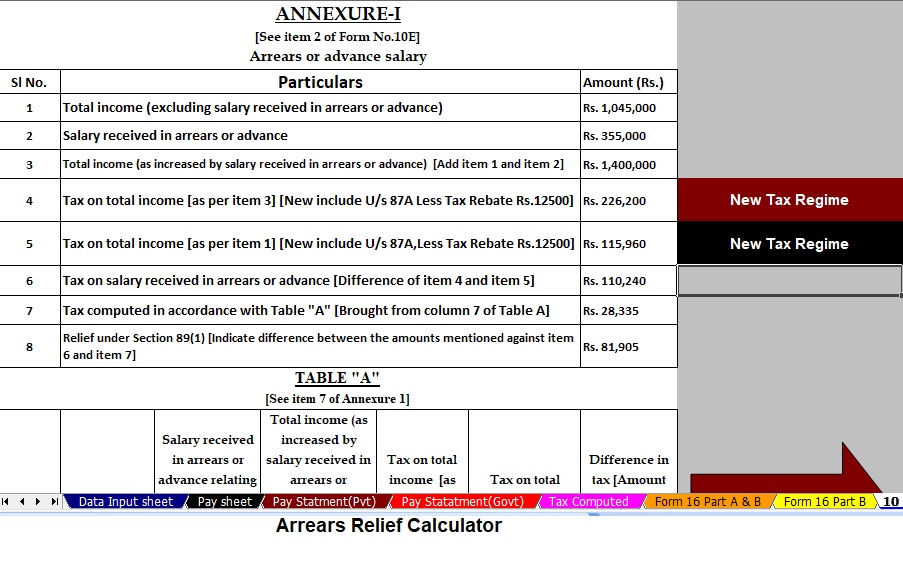

· Income Tax Arrears Relief U/s 89(1) with Form 10E.

· Automatic Form 16 (Part A & B).

This tool is like a tax calculator on steroids, simplifying everything for salaried employees.

Download Automatic Income Tax Preparation Excel Software for F.Y. 2025-26 as per Budget 2025-26

To save valuable time and avoid costly errors, simply use the Automatic Excel-based Tax Software. Moreover, this tool not only calculates taxes but also streamlines the entire process.

Key features include:

· It automatically computes tax as per Budget 2025.

· It provides inbuilt salary structures for both Government and Non-Government employees.

· It generates salary sheets instantly without manual effort.

· It calculates HRA exemptions automatically under Section 10(13A).

· It prepares arrears relief calculations under Section 89(1) along with Form 10E.

· It creates Form 16 (Part A & Part B) automatically.

In short, this software acts like a power-packed tax calculator on steroids, and therefore, it makes tax preparation effortless for salaried employees.

First of all, filing taxes can feel overwhelming when you try to manage everything manually. However, with the Automatic Excel-based Tax Software, you can complete the process quickly and accurately. Instead of wasting hours on calculations, you simply enter your details and let the tool do the rest.

Secondly, the software works as per Section 115BAC New Tax Regime for F.Y. 2025- 26 Which means you always stay updated with the latest rules. Whether you belong to the Government sector or the Non-Government sector, the inbuilt salary structure makes it easy to fit your income into the right tax brackets.

How Does It Simplify Your Work?

· Instead of calculating manually, the tool automatically computes your tax liability as per the latest Budget 2025.

· Rather than preparing multiple sheets, you instantly generate an automatic salary sheet in just a few clicks.

· Moreover, you no longer need to worry about missing exemptions—because the software calculates HRA exemptions under Section 10(13A) for you.

· Additionally, if you have arrears, the software prepares relief under Section 89(1) along with Form 10E automatically.

· Finally, when you finish your calculations, the tool creates Form 16 (Part A & B) without any extra effort.

A Game-Changer for Salaried Employees

In conclusion, this software doesn’t just help—it transforms how you file taxes. Think of it as having a personal tax assistant in Excel format. By combining accuracy with automation, it reduces stress, saves time, and ensures you never miss out on essential compliance requirements.

So, if you want to stay stress-free this year, download the Automatic Income Tax Preparation Excel Software for F.Y. 2025-26 and experience how simple tax filing can become.