Housing Loan Interest Deduction - Section 24B| Section 24b of the Income Tax Act allows for the

deduction of interest on mortgage loans from taxable income. The said loan must be taken for the

purchase or construction or repair or reconstruction of residential property.

This deduction is allowed on an

accrual basis, not the payment. In other words, interest due for the year is

allowed as a deduction whether or not it is paid.

The deduction may be claimed for

two or more home loans. The deduction may also be claimed for two or more

households.

To claim the deduction under this

section, a person must own the house and the loan must also be in his or her

name.

Interest inclusions/exclusions

Interest includes service fees,

brokerage, commission, prepayment fees, etc.

Interest/fines on unpaid interest will

not be allowed as a deduction.

Type of loan for which the

deduction is allowed

The deduction will be allowed

regardless of the nature of the loan, whether it is a home loan or a personal

loan from any person/institution. The loan must be used for the construction,

purchase or repair/reconstruction of the house.

If a person, instead of taking out

a loan from a third party, pays the sale price to the seller in instalments

with interest, then that interest is also allowed.

Maximum deduction limit

These deduction limits apply per

appraised and not per property. Therefore, if a person owns two or more homes,

the total deduction for that person remains the same.

1) On rented property / Considered

leased - Rs. 2 million

2) Self-Occupied House (SOP) - Rs.

2 million

Interest in the

pre-construction/acquisition period

Pre-construction/acquisition period

interest is allowed in five equal instalments from the year of completion of

home ownership. This deduction is not allowed if the loan is used for repairs,

renovations or reconstruction.

The pre-construction/acquisition

period begins on the loan date and ends on the last day of the previous fiscal

year in which construction is completed.

Deduction in case of co-borrower

If the mortgage loan is taken

together, the deduction is allowed to each co-borrower in proportion to his

share of the loan. To make such a deduction it is necessary that the said

co-borrower is also co-owner of that property. If the beneficiary is a co-owner

but is paying off the entire loan, he or she can claim the deduction of the

entire interest paid by the beneficiary.

The deduction limit in the case of

Autonomous Property is applied individually to each co-borrower. In other

words, each co-borrower can claim a deduction of up to Rs. 2 lakhs/Rs. 30,000.

No limits apply to the leased property.

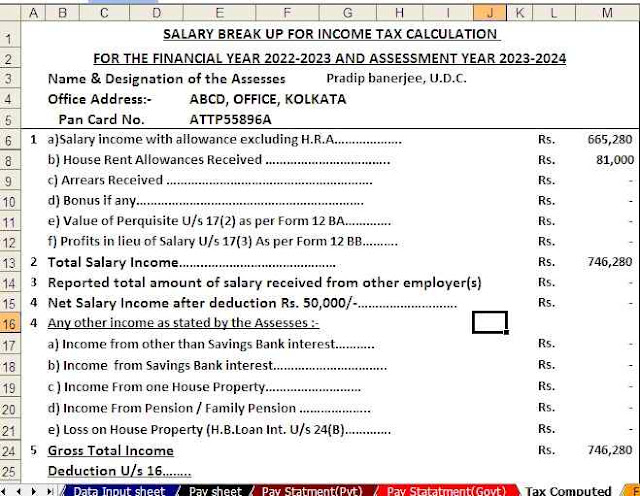

Interest deduction with HRA

The HRA pursuant to section 10(13A)

and the interest deduction may be used simultaneously, even if the home

owner is in the same city where you reside in a rental property.

Form 12BB must be filed with the employer if you want your employer to consider a deduction under this section and therefore deduct lower TDS