Tax Saving Tips|

1. Tuition fees:

The Income Tax Act of 1961 provides for a deduction under section 80C of the Income Tax Act for the payment of children's schooling. This tax savings option is available in Section 80C as well as other investments such as PPF, NSC, ELSS, etc. Tuition fees paid to any registered university, college, school or educational institution are deductible up to Rs. 1.5 thousand.

In addition, only tuition fees are deductible under the Income Tax Act. Any other fee such as a donation, development fee, etc., even if paid to such an institution, is non-deductible.

The income tax law allows both parents to claim a deduction up to the amount they paid. Thus, if the total amount paid by the parents is 1 Lakh rupees, of which the father paid 40,000 rupees and the mother paid 60,000 rupees, then both of them can claim this amount individually as they pay.

You may also like- Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

2. National Pension Scheme (NPS)

The NPS or National Pension Scheme has become a popular investment product for income tax savings. This is a tax-saving option that is available to both public and private employees. This allows the contributor to building retirement housing along with a regular monthly income. The amount invested by the depositor is invested in various schemes, including stock markets.

There are two types of NPS accounts: level 1 and level 2. A level 1 account has a lockout period until the subscriber reaches the age of 60. Contributions made by a Tier 1 subscriber are deductible in accordance with sections 80CCD(1) and 80CCD(1B). Level 2 accounts are voluntary, allowing the subscriber to withdraw money at any time. However, contributions to Tier 2 accounts are not tax-deductible.

Under the provision of Section 80CCD, an individual may claim a deduction of up to Rs. 1.5 Lakh investment in NPS. In addition, a new section 80CCD(1B) was introduced which offered an additional deduction of up to Rs. 50,000/- for contributions made by individual contributors to the NPS.

3. Section 80D health insurance premiums:

You can claim a tax deduction of up to 10,000,000 rubles. 25,000 in respect of the following contributions:

The premium is paid to maintain health insurance covering yourself, your spouse, or dependent children.

You may also like- Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

Any contribution to central government health programs.

Any other scheme may be notified by the central government as eligible for the deduction.

To take care of emergency medical care, health insurance is considered the safest investment option. This allows the taxpayer to enjoy benefits on two fronts. First, have an insurance policy in case of a medical emergency. Secondly, the tax relief is in accordance with the income tax law for investing in an investment product.

In addition to the above, an additional deduction for parents' insurance of Rs. 25,000 if under 60 or Rs. 50,000 if they are over 60. If an individual and their parents are over 60 years of age, the maximum deduction available under this section will be Rs. 100000.

4. Student loan repayment

The Income Tax Act provides a tax credit for repaying a loan as a tax deduction under section 80E of the Act. You must remember that this tax savings option is available to the payer of the loan. After using the student loan, the interest paid on the student loan is tax-deductible for a maximum period of 8 years or the interest is refunded, whichever comes first.

Depending on who pays the EMI for student loans, the parent or child may qualify for the deduction. The Section 80C deduction is only available if you take out a loan from a financial institution and not from family members. You can claim a tax deduction from the year the return began.

The tax authorities grant the borrower a moratorium for up to one year from the date of completion to start repaying the loan. This gives the taxpayer enough time to manage their finances and claim the deduction once they start paying off the loan.

For example, if a taxpayer repays their student loan within 5 years of the due date, the tax credit will only be available during that 5-year period. Under section 80E, this relief must be claimed for 8 years before taxpayers can take advantage of it. Borrowers should note that their repayment may exceed 8 years, but in such cases, they will not receive a Section 80E tax credit after the 8th year.

Feature of this Excel Utility:-

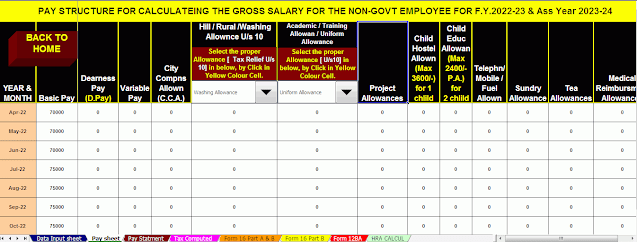

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure W.B.Govt Employee’s Salary Structure.

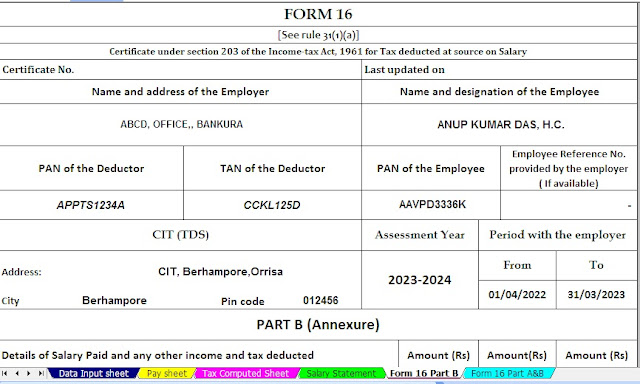

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

7) Individual Salary Sheet