How to save on salary taxes | You enter the ninth cloud as your bank balance grows. But you know

who else is excited to see their money grow? No, not to mention your family. This is the Department of

Income Tax.

Whether it's payroll tax or corporate income, no one likes to give away a portion of their income to the government, not even us. We found something interesting in this and today we shared it with you.

So, there are many cool ways to save on taxes on your income. After all, who wouldn't want to take home more?

We bet most of you are already familiar with section 80C of the Income Tax Act. But today our main goal will be to introduce you to options other than 80C. Let's dive in.

You may also like- Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

National Pension System (NPS)

NPS is a great option for tax savings and retirement planning. If you are self-employed or work for a company, this scheme is for you if you want to save more than 80 cents.

For self-employed persons: if you have used your 80C limit, you can save even more taxes by investing up to Rs 50,000. If you have not exhausted your 80C limit first, you can invest up to 20% of your gross annual income (1.5 lakh maximum limit) and then an additional Rs 50,000 for additional tax deductions.

For employees: The process is the same as for the self-employed if you have used your 80C threshold. If you have not exhausted your 80C limit, you can invest first up to 10% of your salary (maximum limit 1.5 lakh) and then an additional Rs 50,000 for further tax deductions.

Education loan repayment

An education loan is a boon for parents who want to educate their children at top recognized universities without liquid funds. But who knew it could also be a tax-saving tool?

House Rent Allowance

Section: 10 (13A) or 80GG

Do you live in a rented apartment? If you do so, you can take advantage of the tax exemption. But if you don't live in a rented apartment, you can skip this part. Also, if you choose to opt for the new tax regime from the fiscal year 2020-21, you are not eligible.

Both self-employed and employees are eligible for this benefit, as long as they do not live in their own homes.

If your employer does not pay HRA, you can choose the same path as a self-employed person to take advantage of the HRA exemption. If your employer pays for HRA at the time of tax calculation, the HRA exemption will be the lower of the HRA your employer pays you, the actual rent paid minus 10% of base salary OR 50% or 40% of base salary plus DA, depending on whether you live in a metropolitan or non-metropolitan city

You may also like- Automated Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Savings account interest

Interest on savings accounts at the post office, banks, or co-operative societies is taxed under income from other sources, although TDS is not deductible. A maximum amount of 10,000 rubles can be claimed as a deduction. This does not include interest received from the FD.

Home loans

Section: 24(B)

Thinking about buying a new home for your family? We have great news for you. How does it sound when we say that you can save on taxes on the percentage of your home loan? Fascinating, no?

The house is considered an asset to Indian families. But its construction is associated with high costs, especially with high-interest rates of credit institutions. If you are planning to apply for a mortgage loan, take advantage of an interest deductible of up to Rs 200,000. The threshold is the same if you are unable to live in the property for one reason or another, say for work in another city.

If the property on which the mortgage loan is being issued is leased or considered leased and is not independent, there are no restrictions on the amount of the deduction. You have the right to claim a tax deduction on all interest.

You must ensure that you complete the homeownership within 5 years of the loan. Otherwise, the amount of the deduction will be reduced to 30,000 rubles.

You may also like- Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

Home loan for first-time buyers

The feeling of owning a property for the first time is just wonderful. To make your experience even more amazing, the government has provided an extra incentive. Above the threshold of Rs 2,00,000 under section 24 and Rs 1,50,000 under 80C, first-time homebuyers may receive an additional tax deduction on the interest component of up to Rs 50,000.

The eligibility criteria for this are:

You must not own any other property prior to the date of approval or mortgage application.

The loan amount must be 35 lakhs or less

The cost of the house should not exceed 50 lakhs.

Health insurance premium

These days, getting a health insurance plan for you and your family members is a sign of love. In times of rising inflation, this is no longer an option. But did you know that it also helps you save on taxes?

The tax credit exemption is available for health insurance paid for yourself, your children, your spouse and your parents. You cannot claim benefits if the premium is paid to your brother, sister, or father-in-law.

You may also like- Automated Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]

Section 80C

We've saved this for last, as almost everyone knows about it. Investments under this section are eligible for a tax deduction of up to Rs 1,50,000. Options:

1) Equity Savings Scheme (ELSS)

2) Term deposit (FD)

3) National Pension Scheme (NPS)

4) Unit Linked Insurance Plan (ULIP)

5) Sukanya Samriddhi Yojana

6) National Savings Certificate

7) Seniors Savings Scheme

8) Insurance

9) State Pension Fund (NPF)

Feature of this Excel Utility:-

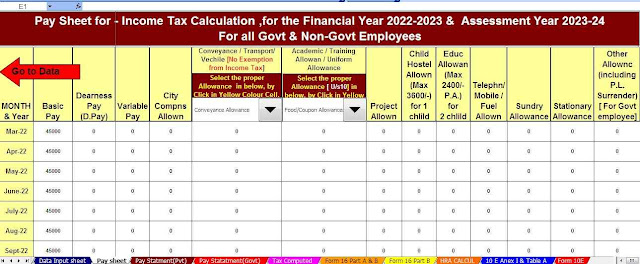

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

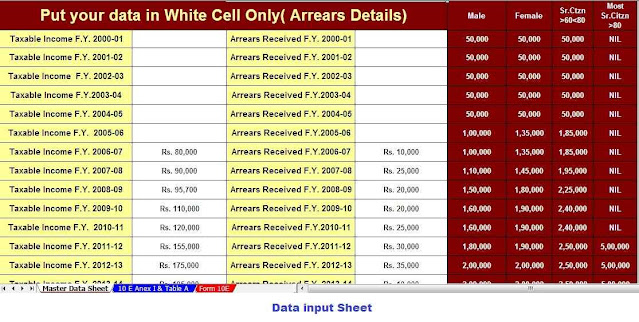

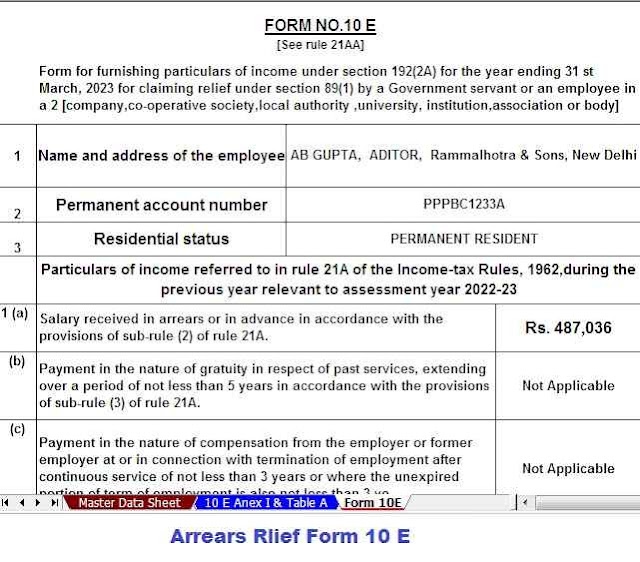

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

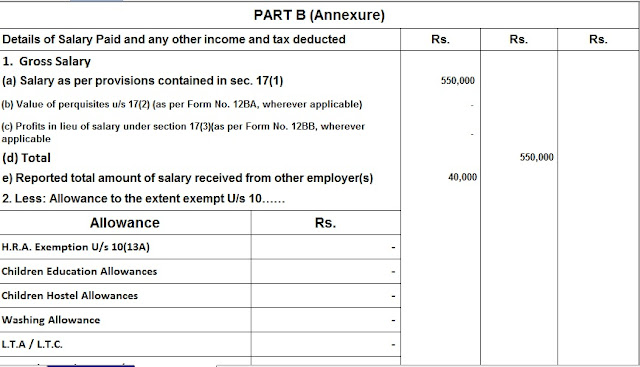

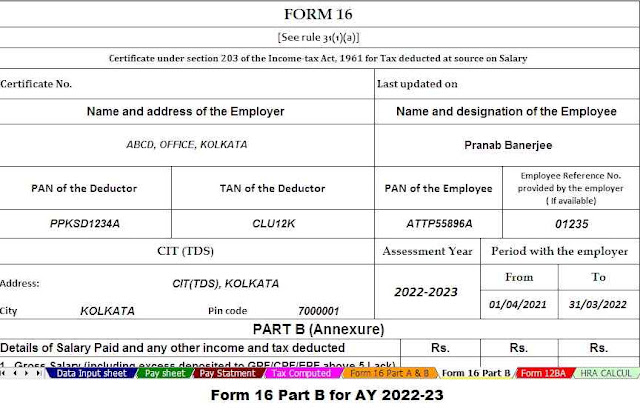

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23