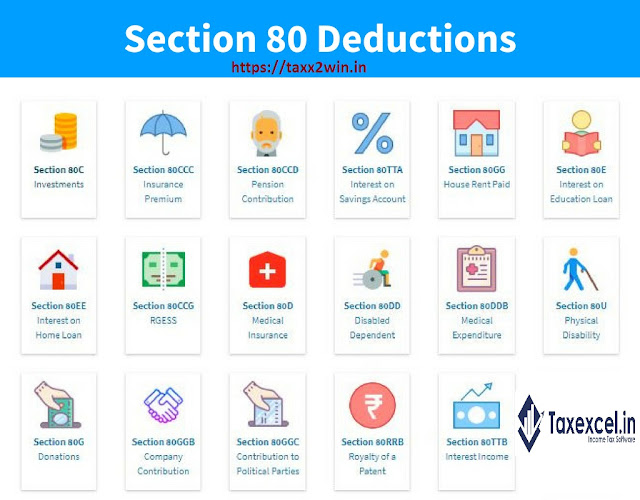

Income tax deduction on chapter VIA for the F.Y.2022-23 | The income tax department, in order to

encourage savings and investment among taxpayers, has provided several deductions from taxable

income under Chapter VI A deductions. With the 80C being the most famous, there are other

deductions that are beneficial for taxpayers to reduce their tax liability. Let's try to understand this

deduction in detail:

Section 80C - Investment Reduction

Section 80C is one of the most popular and preferred sections by taxpayers because it allows you to reduce your taxable income by making tax savings investments or incurring eligible expenses. Allows a maximum deduction of Rs 1.5 lakh annually from the total income of the taxpayer.

These benefits can be used by both individuals and HUF. Companies, partnerships, and LLPs cannot take advantage of this reduction.

You may also like- Automated income Tax Form 16 Part B Preparation Software in Excel for the F.Y.2021-22[This Excel Utility Prepare at a time 50 Employees Form 16 Part B]

Section 80C along with subsections, 80CCC, 80CCD (1), 80CCD (1b) and 80CCD (2).

It is important to note that the overall limit, including the subsection for requesting a deduction, is Rs 1.5 lakh except for an additional deduction of Rs 50,000 which is permitted u/s 80CCD (1b)

Section 80CCC - Insurance Premium / Section 80CCD - Pension Contribution

Investments that qualify for tax deductions

80C enlisted deductions for investments made in PPF, EPF, LIC premiums, capital savings schemes, payment of the principal amount for home loans, stamp duty and registration fees for property purchases, Sukanya smriddhi yojana (SSY), National Savings Certificate (NSC)), Senior Savings Plan (SCSS), ULIP, FD Tax Savings for 5 years, Infrastructure Bonds etc

80CCC Discount on Life Insurance Annuity Plans. The 80CCC allows reduced payments for annuity pension plans. The pension received from the annuity or the amount received on the return of the annuity, including any interest or bonus earned on the annuity, is taxed in the year it was received.

You may also like- Automated income Tax Form 16 Part A&B Preparation Software in Excel for the F.Y.2021-22[This Excel Utility Prepare at a time 50 Employees Form 16 Part A&B]

80CCD (1) Deduction for NPS employee contributions under section 80CCD (1) Maximum allowable deduction from at least the following

• 10% of salary (if the taxpayer is an employee)

• 20 & of total gross income (for self-employed)

• Rs 1.5 Lakh (allowable limit u/s 80C)

80CCD (1b) Deduction for NPS Additional deduction of Rs 50,000 is allowed for the amount deposited in the NPS account

80CCD (2) Withholding of employer contributions NPS is allowed for deductions of up to 10% of base salary plus the number of benefits in this section. The benefits in this section are only allowed for employees and not for the self-employed.

Here are some investment options that are allowed as a deduction of u/s 80C. Not only do they help you save on taxes, they also help you grow your money.

Section 80C Piece List

Investment options Medium interest Freezing period for risk factors

ELSS Fund

NPS Scheme

ULIP 8%

FD tax savings

PPF 7.10% 5 years Low

Sukanya Samriddhi Yojana 8.4% Until the girl reaches the age of 21 years

(partial withdrawals are allowed after reaching the age of 18) Low

You may also like- Automated income Tax Form 16 Part B Preparation Software in Excel for the F.Y.2021-22[This Excel Utility Prepare at a time 100 Employees Form 16 Part B]

Section 80 TTA - Savings Interest

Subtraction from the total gross income for interest on a checking savings account

If you are an individual or a HUF, you can request a deduction of up to Rs 10,000 from the interest income from your savings account at a bank, cooperative or post office. Include savings account interest in other income.

The 80TTA -discount is not available for interest income from fixed deposits, recurring deposits, or interest income from corporate bonds.

Section 80GG - House rent paid

Deductions for paid house rent where HRA is not accepted

a. An 80GG share deduction is available for rent paid when the HRA is not accepted. Taxpayers, spouses or minors may not have residential accommodation at work

b. Taxpayers may not own residential property for their own use elsewhere

c. Taxpayers have to live on rent and pay rent

d. Deductions available to all individuals

The available deductions are the following minimums:

a. Rent paid minus 10% of total adjusted income

b. Rs 5,000/- per month

c. 25% of total adjusted revenue

Total adjusted gross income is obtained after adjusting the total gross income for certain deductions, exempt income, long-term capital gains, and income relating to non-residents and foreign companies.

From fiscal 2016-17, the available reduction was increased to Rs 5,000 per month from Rs 2,000 per month.

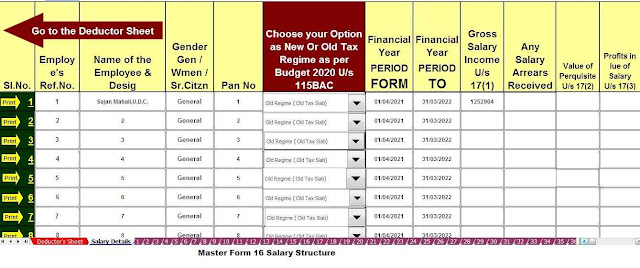

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

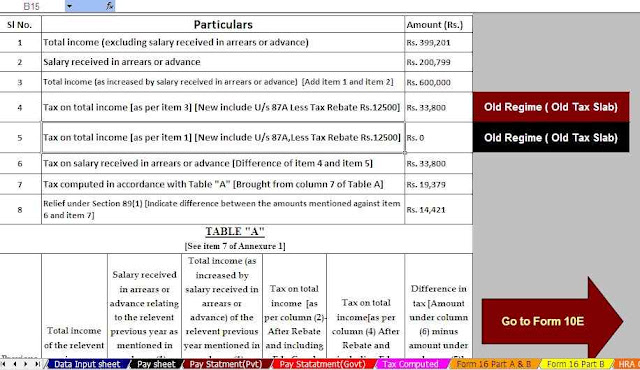

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

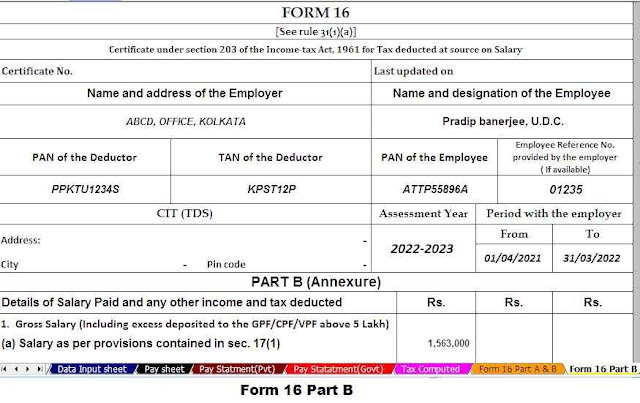

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23