Section 80U Deduction | Section 80U of income tax is a deduction for a person with a disability. This

the section provides a flat deduction for a person with a disability based on the severity of the disability,

regardless of the amount of expenses.

Conditions for receiving this deduction:

1. Taxpayers must be resident individuals.

2. He must have at least 40% disability.

3. The disability must also be certified by recognized medical institutions.

Tax deduction under section 80U?

*"a person with a severe disability" means -

(i) a person with 80% or more of one or more disabilities as specified in subsection (4) of section 56 of the Persons with Disabilities or

(ii) a severely disabled person as defined in section 2(o) of the National Autism, Cerebral Palsy, Intellectual Retardation and Multiple Disability Welfare Fund Act of 1999 (44 of 1999).

**"person with a disability" means a person identified in paragraph (t) of section 2 of the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act 1995 (1 of 1996) or paragraph (j ) Section 2 of the National Autism, Cerebral Palsy, Mental Retardation, and Multiple Disability Welfare Fund Act of 1999 (44 of 1999);

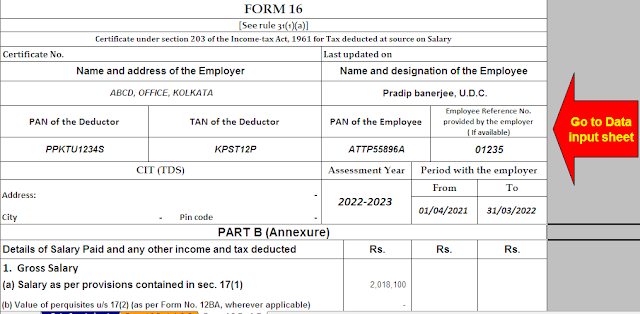

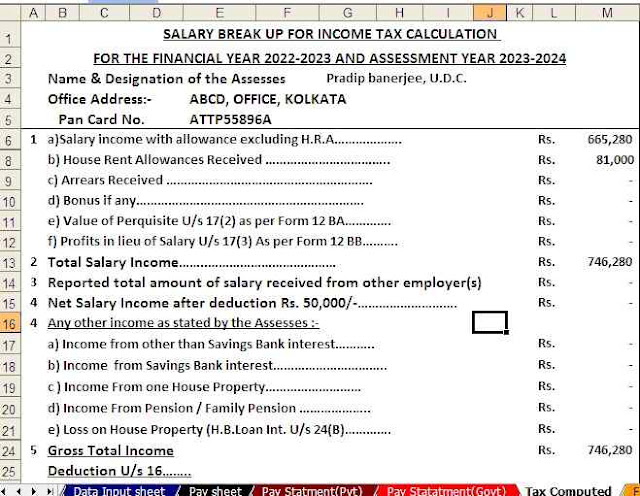

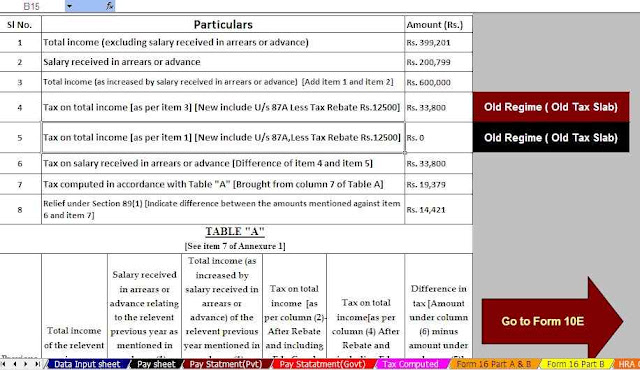

Download and Prepare at a time 50 Employees Form 16 Part A&B for the Financial Year 2021-22

What is the u/s 80U deduction available?

As above, the amount of the deduction depends on the severity of the disability. Thus, taxpayers with a disability of less than 80% receive a deduction of Rs 75,000, and taxpayers with a severe disability of 80% or more receive a deduction of Rs. 1,25,000 lakhs. The deduction is a fixed amount that is allowed as a deduction from taxable income.

What disadvantages are covered by section 80U?

The Following types are entitled Under Section 80U

• Musculoskeletal insufficiency: Refers to insufficiency of the muscles or bones of the joints, resulting in severe limitation of limb movement.

• Poor vision: people with visual impairment that cannot be completely corrected with surgery or standard refraction correction. People with this disability can still use their vision with other devices.

• Blindness: - Blindness means no vision at all or when the field of vision is limited to an angle of 20 degrees or worse, or visual acuity less than 6160 on the Snellen scale after corrective lenses.

• Cured leprosy: - People who have been cured of leprosy but still suffer from a disability where they have lost sensation in their legs or arms and have palsy of the eyelids and eyes. It also includes the elderly or people with extreme deformities that prevent them from engaging in any useful activity.

• Mental retardation: people with incomplete or interrupted development of mental abilities, resulting in a subnormal level of intelligence.

• Autism: Autism spectrum disorder is associated with brain development that affects how a person perceives and communicates with others, causing problems in social interaction and communication.

• Cerebral palsy: A cerebral palsy is a group of movement disorders that appear in early childhood. Signs and symptoms vary from person to person and over time but include poor coordination, tense muscles, weak muscles, and tremors. There may be problems with sensitivity, vision, hearing and speech.

• Mental illness: This includes other mental disorders.

A taxpayer is not considered to have a major disability if he or she suffers from a disability equal to or greater than 40% but less than 80%. However, if the taxpayer suffers from a disability of 80% or more, this will be considered a severe disability.

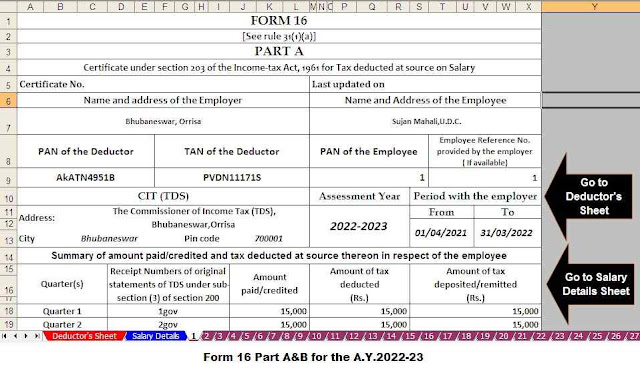

Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

How do I get a Section 80U deduction?

The person applying for the deduction must provide a copy of the certificate issued by the medical institution in the prescribed form, along with the engineer. There is practically no need to attach any documents to the ITR, it is advisable to keep the document at hand.

Please note that a medical certificate confirming the disability received is required. The certificate must be prepared by a recognized medical institution in the prescribed format, which is contained in Form 10-IA. The form can be found on the Indian income tax website.

So it simply means that if you make a deduction under this section, keep a certificate with you that you can get from an authorized physician.

It is also a good idea to keep your prescription and medical card in case the IRS requests them in the future.

The medical certificate must contain information about the disability of the taxpayer.

The certificate of disability has a certain period of validity. If the certificate expires in any fiscal year, a deduction for that fiscal year can be claimed using the expired certificate. However, beginning in the next fiscal year, you will need to use a new certificate to receive your Section 80U deduction in the following year.

Section 80U and section 80DD and 80DDB

Section 80U and section 80DD is often confused because both sections allow deductions for persons with disabilities. However, the main difference between these sections is that while Section 80U provides for deductions for a taxpayer with a disability, Section 80DD allows deductions if the taxpayer has a dependent with a disability.

In the case of an individual, the dependent may be a spouse, children, parents or siblings, and in the case of a HUF, a member of the HUF. In addition, a Section 80DD deduction is permitted if the taxpayer has incurred medical, drug, tuition, or rehabilitation costs for a disabled dependent. Therefore, both sections have different meanings and tax implications and should not be confused with one.

Whereas pursuant to Section 80DDB, if an Individual or HUF incurs any cost of treating Certain Diseases for themselves or a relative, they may receive a tax credit.