Section 80TTA of the Information Technology Act provides a tax deduction for interest income from

personal savings. To help you claim your Section 80TTA Income Tax Act deductions, we will discuss

your eligibility, threshold, inclusions, and exclusions in detail.

What is a section 80TTA deduction?

Section 80TTA deduction was established in 1961 and provides for a deduction of up to Rs. 10,000. This law applies to individual savings in banks and individual savings groups under the HUF (Hindu Undivided Family). However, it is ineffective with respect to income from interest on term or term deposits.

Interest Income Deductible under Section 80TTA

Savings income from the following institutions is tax-deductible under section 80TTA of the Income Tax Act:

Bank

Banking cooperative society

Post Office

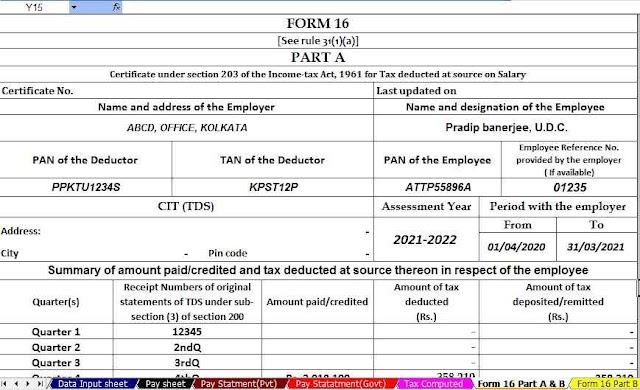

You may also like- Automated Income TaxForm 16 Part B for the F.Y. 2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

What is the maximum allowable deduction under section 80TTA?

The maximum applicable deduction of 80TTA is Rs. 10,000 per year, i.e. any excess of the amount of savings income will be taxable. Here, the calculation is based on the amount of interest accrued from one or more savings accounts of different banks.

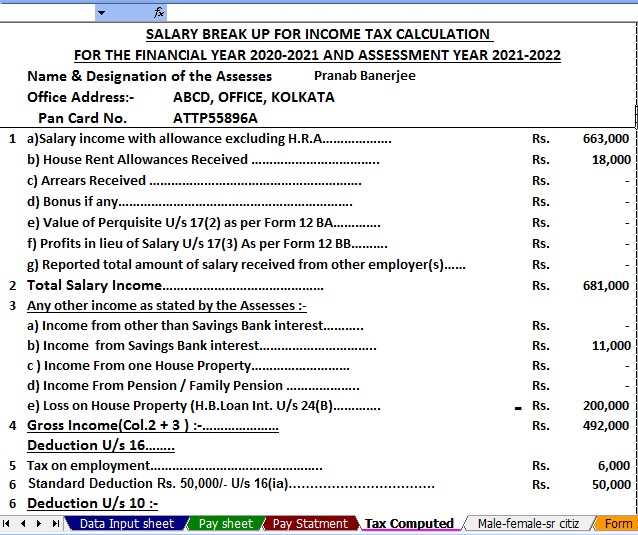

Interest income is treated as income from other sources. Taxpayers can claim a maximum deduction of Rs. 10,000 of your total gross income and receive taxable income. The applicable tax percentage will then be calculated based on the taxpayer's taxable income.

What interest is non-deductible under Section 80TTA?

Interests from the following sources are not allowed in this section -

Fixed deposit.

Duplicate account.

Term deposit.

Savings in non-bank financial companies.

Companies, LLPs and partner firms are not permitted to receive interest payments under section 80TTA.

Who is eligible to claim tax credits under Section 80TTA?

The most important factors for compliance with the requirements of Section 80TTA are:

Taxpayers residing in

Group of persons in HUF

NRI with NRO Savings Account

Age under 60 (Section 80TTA does not apply to older people, they can apply for section 80TTB)

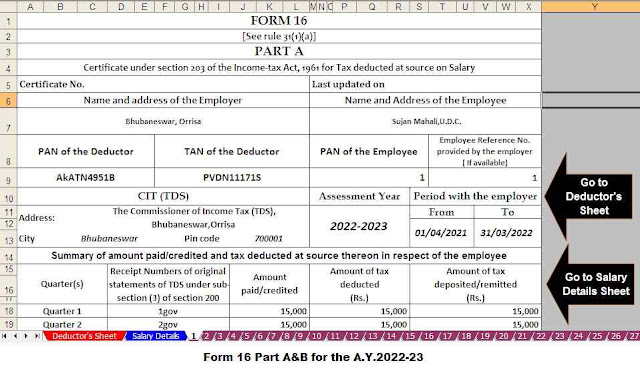

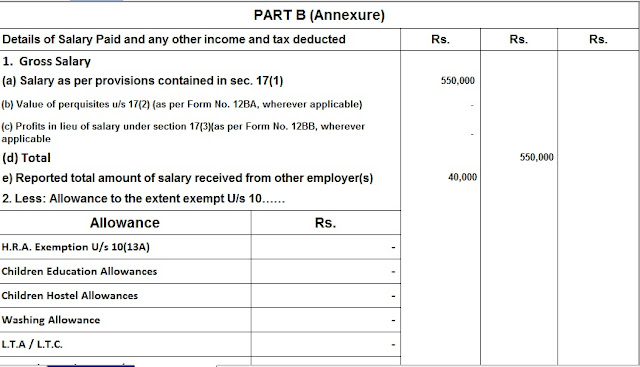

You may also like- Automated Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

The deduction under section 80TTA applies to persons whose total income exceeds the taxable base. For example, if your income is Rs. 2,00,000 and your specific interest income is Rs. 50,000 in the reporting year. In this case, you are not eligible to apply for section 80TTA because your total income is below the taxable level.

How much tax will you save?

This is a viable question on the internet, what is 80TTA in income tax and how much can you save on it? The maximum amount of tax that can be saved with 80TTA depends on the tax rate that the taxpayer is subject to.

If your total income falls under the 20 % tax rate, the maximum amount of tax you can save is Rs. 2000 thousand minus 20,000 thousand 10,000 below 80TTA. Likewise, if you qualify for the 30 % tax rate, the maximum amount you can save is Rs. 3000.

Section 80TTA of the Income Tax Act aims to improve financial management. Thus, it helps people avoid paying taxes on income earned by small savings and large investors, without bothering them to include small amounts of interest in the income tax return process.

You may also like- Automated Income TaxForm 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

General issues

✓ How do I get Section 80TTA deductions?

To claim a deduction under Section 80TTA, you must show savings interest income as income from other sources on your ITR file. You should mention this both in the chapters under other sources and in the chapters of deduction.

✓ How is 80TTA different from 80TTB?

Both acts are in accordance with section 80 of income tax. Section 80TTA is for a tax deduction on personal savings income and HUFS under the age of 60, whereas; 80TTB applies to the retiree tax deduction.

In addition, 80TTA excludes savings from fixed deposits, while 80TTB includes savings from all sources.

✓ Do I need to mention the interest accruing on a savings account balance to receive Section 80TTA benefits?

Yes, it is mandatory to indicate all sources of income from savings interest.

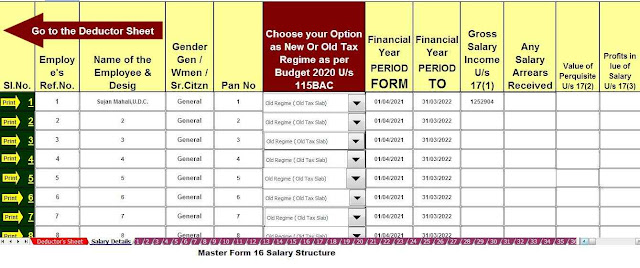

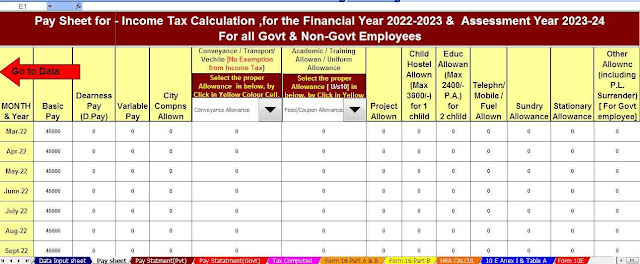

Feature of this Excel Utility:-

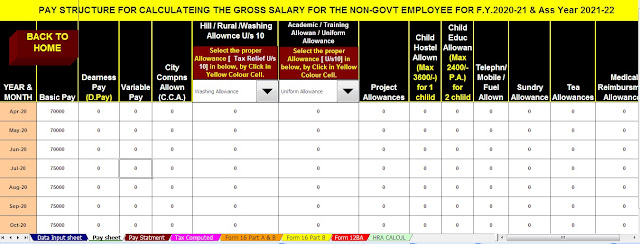

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10) Automatic Convert the amount into the in-words without any Excel Formula