Tax filing season is almost here. This is the time of year when you need to collect various proofs of

income and expenses so that you can file your taxes. For employees, one of the most important

documents required to file a tax return is Form 16. Here is a summary of Form 16.

1. What is FORM 16?

Form 16 is an annual tax document issued by employers to employees. This document contains details of income received by the employee, tax-saving investments and deductions that have been used, and any tax deducted at source (TDS) for the relevant fiscal year. These are the basic data an employee needs to file an income tax return.

Under the Income Tax Act 1961, employers are required to provide the form to 16 employees who earn an annual income of more than Rs. 2.5 lakh. Form 16 is usually issued to employees no later than June 15 of each year.

Download and Prepare at a time 50 Employees Automated Income Tax Form 16 Part B for the F.Y.2021-22

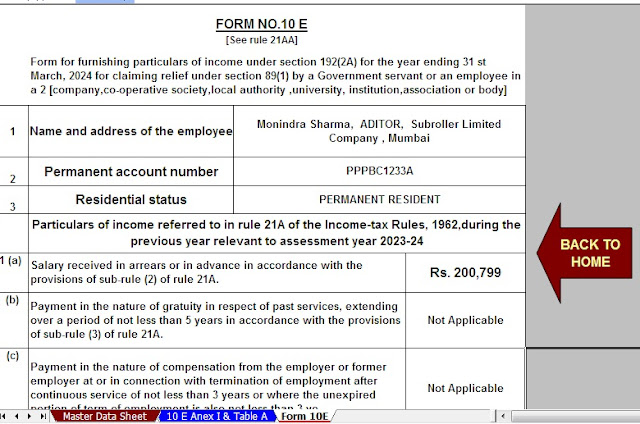

If you changed jobs during a fiscal year, you will receive a Form 16 from all of your employers during that year. You will then need to match income, TDS and tax savings or deductions from 16 multiple forms so you can calculate your income tax online and file your ITR correctly.

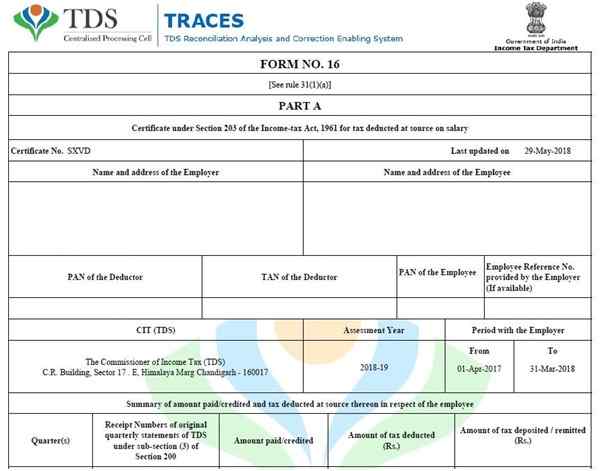

2. FORM 16 Format

Because Form 16 is an income tax document, it has the format. The Income Tax Department of India has a predefined Form 16 format.

Form No. New Revised 16 have two parts - Part A and Part B.

Part A of Form 16 contains information about TDS, which is deducted directly from your paycheck and paid to the government. Part A usually includes details such as:

• Employee, ie your personal details such as name, residential address and Permanent Account Number (PAN).

• Employer information such as company name, tax credit account number (TAN), and PAN number.

• The amount of TDS that is deducted every quarter, along with details such as deposit dates, bank details through which TDS was made, challan serial number for each transaction, etc.

• Year of tax calculation

• Date of Employment to your concern

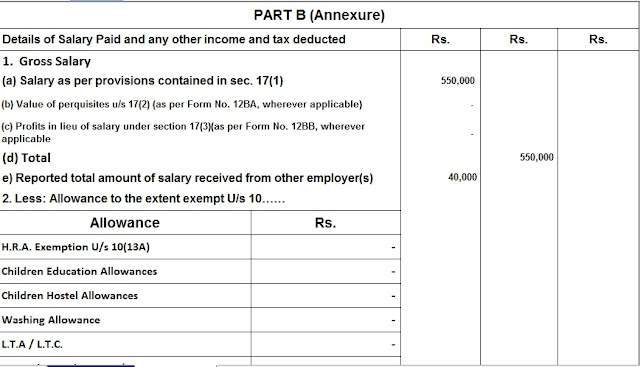

Part B of Form 16 describes the calculation of tax paid. This is a detailed statement of your salaried income, various components, deductions and benefits, and the final tax paid. It should include:

• Gross salary with details of base salary, high-cost allowance, house rent allowance, reserve fund contributions, any other allowances, TDS, occupational tax, etc.

• Exceptions such as HRA, transportation allowance, medical allowance, etc.

• Any deductions under Chapter VI A of the Income Tax Act 1961.

• Any concessions

• Amount of tax paid

• Any tax that may be payable

• Tax refund, if applicable

Part A and Part B of Form 16 should not be confused with Form 16A and Form 16B.

Download and Prepare at a time 100 Employees Automated IncomeTax Form 16 Part B for the F.Y.2021-22

When considering how to get a Form 16, the only thing to know is that it must be provided by your employer. You cannot download Form 16 from anywhere. If you have moved from a previous position, you can contact the human resources or finance department of your former organization and ask them to provide you with an income tax form 16.

The information provided on Form 16 is required to file a tax return. Whether you file your own taxes or use the help of a registered account, Income Tax Form 16 is required for employees to file taxes.

You can also use online portals where you download Form 16 issued by your employer and it will collect the relevant data for you to file your tax returns.

4. Eligibility for Form 16

Under the rules of the Income Tax Act of 1961, all employees who fall within the taxable range must obtain a Form 16 from their employers. This means that any person hired by someone else earns more than Rs. 2,50,000 a year must receive a Form 16. You can request this from your current and previous employers when filing your tax return.

5. Importance of FORM 16

Form 16 is the key document for employees filing a tax return.

• Form 16 contains a detailed statement of your salary and taxes paid. This is proof that the tax was paid to the government on your behalf. When filing taxes, this is necessary to provide an accurate report of your income.

• In addition to a tax return, Form 16 can also be used as proof of income for a loan.

• Electronic Form 16 is also useful for verifying the correctness of taxes paid. You can compare the same with your 26AS form.

• It is also a good supporting document for visa applications.