Section 80D - Health Insurance - Applicability, Discounts and Policies | Medical emergencies always

surprise us. It's always better to be safe than sorry, and it's no different from health insurance.

Most residents in

What is Part 80D?

Any individual or HUF may claim a deduction from their total income for health insurance premiums paid in a given year under Section 80D. This deduction is also available for supplementary health plans and critical illness plans.

Download and prepare At a time 50 employees' Form 16 Part B for the fiscal year 2021-22

Deduction benefits are available not only for the health insurance plan itself but also for purchasing a policy to cover a spouse, dependent children or parents.

The best part is that it is above the claimed cut under Section 80C.

Who is eligible for deductions under Section 80D?

Reduction of health insurance premiums and medical expenses for the elderly is only allowed for the Individual or HUF taxpayer category.

For individual taxpayers or HUF, insurance can be used to:

Self

Wife

dependent child

Parent

No other entity can claim this deduction. A company or business cannot be entitled to deduction under this section.

Payments Eligible as a Deduction Under Section 80D

Health insurance premiums are paid for yourself, your spouse, children or dependent parents by any means other than cash.

Costs incurred for preventive health checks

Download and prepare 50 employees at once Form 16 Part A&B for the fiscal year 2021-22 in Excel

Medical expenses are incurred for the health of the elderly (aged 60 years and over) who are not covered by any health insurance scheme.

Contributions are paid to the central government health scheme or any scheme notified by the government.

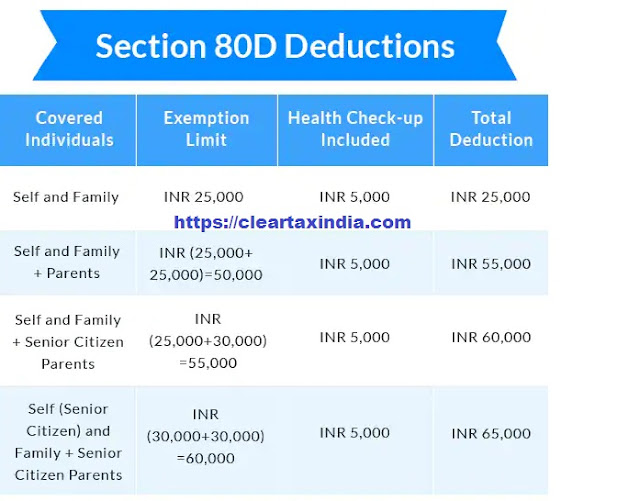

Reduction available under Part 80D

The deduction allowed under Section 80Dm is Rs 25,000 in one financial year. In the case of seniors, the deduction limit allowed is Rs 50,000.

The table below illustrates the number of deductions currently available for the fiscal year 2020-21 and fiscal year 2019-20 for a single taxpayer under various scenarios:

Individual:

An individual can apply for a deduction of up to Rs 25,000 for insurance of self, spouse and dependent children.

Additional/separate parental insurance deductions are available in the amount of Rs 25,000 if they are under 60 years old or Rs 50,000 if your parents are over 60 years old.

If the taxpayer and the parent are over 60 years old, and whose medical coverage has been taken, the maximum deduction that can be used under this section is Rs 1,00,000.

Download and prepare at a time 100 employees Form 16 Part B for the fiscal year 2021-22

The elderly are elderly and elderly over 60 years.

HUF

HUF may request a deduction under Section 80D for claims received from any of the HUF members.

This deduction will be Rs 25,000 if the policyholder is under 60 years old and will be Rs 50,000 if the policyholder is 60 years old or older.

Single premium health policy

The 2018 budget introduces new provisions for deductible requests on single premium health policies.

Under the new provisions, if a taxpayer has paid a flat-rate premium for a policy with a validity period of more than one year in just one year, he or she can request a deduction equal to an appropriate share of the amount specified in section 80D.

Download and prepare 100 employees at once Form 16 Part A&B for the fiscal year 2021-22 in Excel

The corresponding share is obtained by dividing the flat-rate premium paid by the number of policy years. However, this will again incur a limit of Rs 25,000 to Rs 50,000 depending on the case.

Things to keep in mind when buying health insurance to apply for an 80D deduction

Health insurance premiums paid to brothers, sisters, grandparents, aunts, uncles, or other relatives cannot be claimed as a deduction for tax benefits.

Premiums paid on behalf of working children cannot be used for tax benefits.

In the case of partial payments by you and your parents, both of you may request a reduction in the amount paid by each other.

The deduction must be withdrawn without showing the service charge and taxes from the premium amount.

Group health insurance premiums provided by the company cannot be deducted.

Premiums paid by any means other than cash are allowed to be deducted. Therefore, it is also possible to reduce the premium paid by credit card or other online methods.

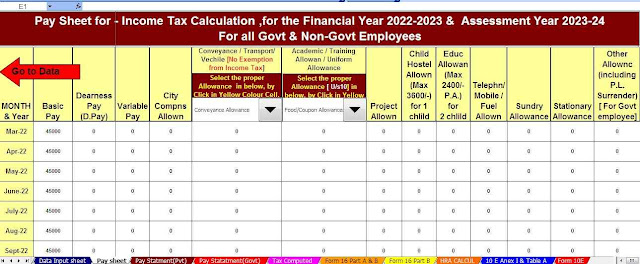

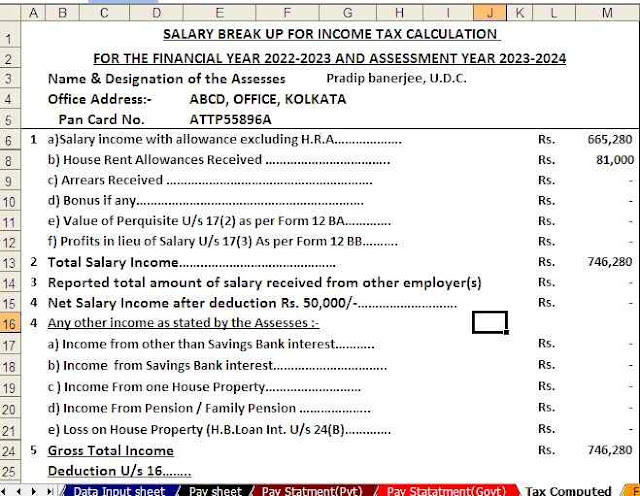

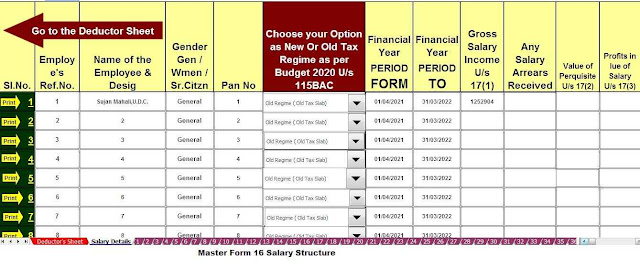

Features of this Excel utility:-

1) This Excel utility prepares and calculates income tax according to the new section 115 BAC (new and old tax regimes)

2) This Excel utility has options where you can select options like New or Old tax regime

3) This Excel utility has a unique salary structure for the salary structure of government and non-government employees.

4) Automatic calculator for the relief U/s 89 (1) with Form 10E from the tax year 2000-01 to the tax year 2022-23 (latest version)

5) Form 16 Revision of Automatic Income Tax Section A&B for the fiscal year 2022-23

6) Revised Form 16 Part B Automatic Income Tax for the Fiscal Year 2022-23