Interest deductions on home loans - Section 24b

Introduction

Section 24b of the Income Tax Act allows for deducting home loan interest from taxable income. The loan must be taken out for the purchase or construction or repair or rebuilding of homeownership.

This deduction is allowed on an accrual basis, not for remuneration. In other words, the interest paid for the year is allowed as a deduction regardless of whether the interest was actually paid or not.

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

Deductions can be requested for two or more real estate loans. A deduction can also be requested for two or more homes.

To apply for a deduction under this section, a person must be the owner of the homeowner and the loan must also be in his name.

Inclusion/Exclusion in interest

Interest includes service fees, brokerage fees, commissions, prepayment fees, etc.

Interest/penalty on unpaid interest is not allowed as a deduction.

Types of Loans where deductions are allowed

Deductions are allowed regardless of the nature of the loan, be it a home loan or a personal loan from any person/institution. The loan must be used to build or buy or repair/rebuild the house.

If someone instead of getting a loan from a third party pays the selling price to the seller in instalments along with the interest, that interest is also allowed.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

Maximum reduction limit

This deduction limit applies to the appraiser and not to the asset. Therefore, if a person owns two or more properties, the total deduction for that person remains the same.

1) Property for rent/owned for rent - Rs. 2 lakh

2) Autonomous House (SOP) - Rs. 2 lakh

In the following cases, the limit of Rs 200,000 per SOP mentioned above will be reduced to Rs. 30,000

- Loans borrowed before 01-04-1999 for any purpose related to homeownership.

- Loans borrowed after 01-04-1999 for any purpose other than construction or acquisition.

- If the development/acquisition is not completed within 5 years from the end of the financial year in which the principal was borrowed. For example, if a construction/acquisition loan is obtained on 28 October 2019, the reduction limit should be reduced to Rs 30,000 if the construction/acquisition is completed after 31 March 2025.

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

Interest for pre-construction / acquisition

Interest for the pre-construction/acquisition period is paid in five equal installments starting from the year the homeownership is completed.

The pre-construction/acquisition period begins on the loan date and ends on the last day of the previous year in which construction was completed.

For example, if homeownership is completed on March 21, 2019, deductions are allowed from the 2019-2020 financial year to 2023-24.

Example

The loan was taken on 01-05-2006 for Rs. 5,000,000

Work ended on 07-09-2012.

Pre-construction / acquisition period = from 01-05-2006 to 03-31-2012

Pre-construction/acquisition interest = Rs 3,55,000 (Rs 5,000,000 * 71 months * 1%)

Deduction of pre-construction/acquisition interest for fiscal years 2012-13 to 2016-17 assuming the property is leased or considered leased = Rs 71,000 per year (3.55,000/5)

Interest deduction before construction/acquisition for financial years 2012-13 to 2016-17 assuming SOP = Rs 71,000 per annum (355000/5) (since construction is completed within 5 years from end of financial year in which capital is borrowed)

Interest from 01-04-2012 to 31-03-2013 is recognized as a deduction in 2012-13 as interest for the current year. Interest from 04-01-2012 to 09-07-2012 will not be considered a pre-acquisition/construction period.

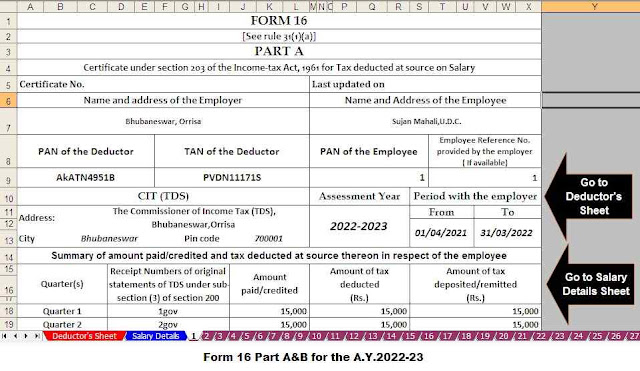

Download and Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2021-22

Notes: - If a property is partially SOP and partially leased, a limit of Rs 2,000,000/30,000 for the SOP portion will also be available and no deduction limit for the rented portion.

Deductions in the case of co-borrowers

If the home loan is taken in the collective name, a deduction is given to each co-borrower in proportion to his share in the mortgage. To take this deduction, this co-borrower must also be a co-owner of this property. If the appraiser is a co-owner but pays the entire loan himself, he can request a deduction of all interest paid by him.

The deduction limit in the case of Property for own use is applied individually for each co-borrower. In other words, each co-borrower can apply for a reduction of up to Rs. 2 lakhs / R 30,000. No restrictions apply to renting a property.

Difference between Section 24b and Section 80C

Home loan interest is allowed under section 24b while home loan principal is allowed under section 80C.

However, cut with HRA

The HRA under Section 10 (13A) and interest deductions can be applied at the same time even if the homeownership is located in the same city where you live in the rental property.

Form 12BB must be submitted to the employer if you want the employer to consider deductions under this section and subsequently reduce the lower TDS

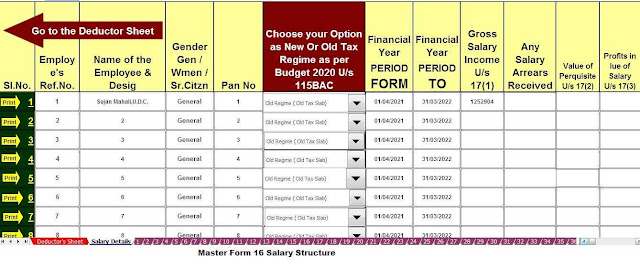

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

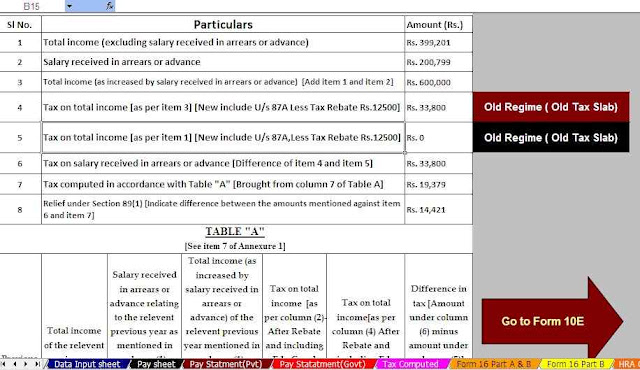

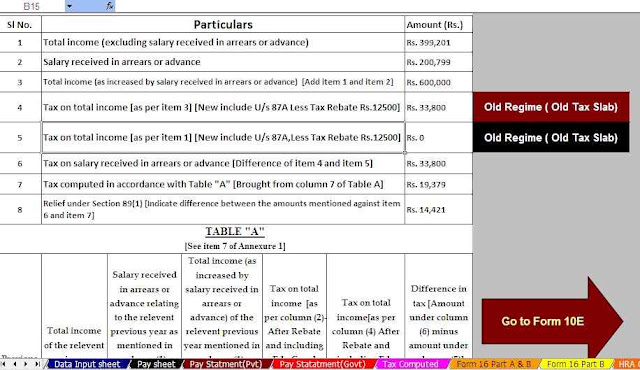

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

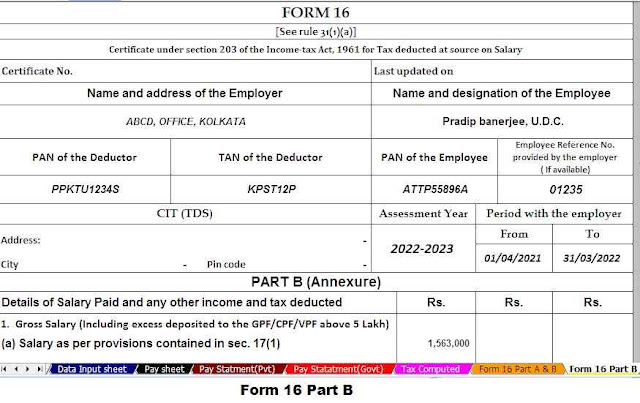

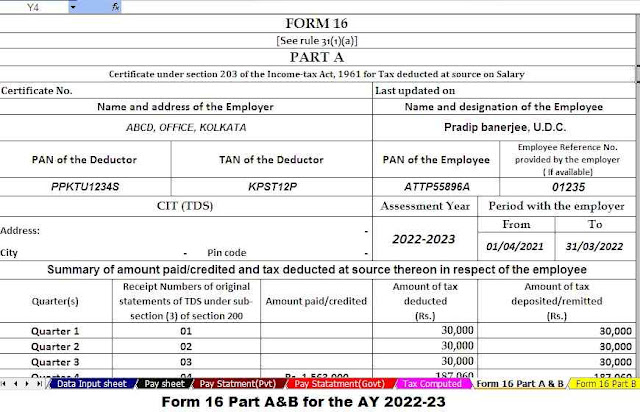

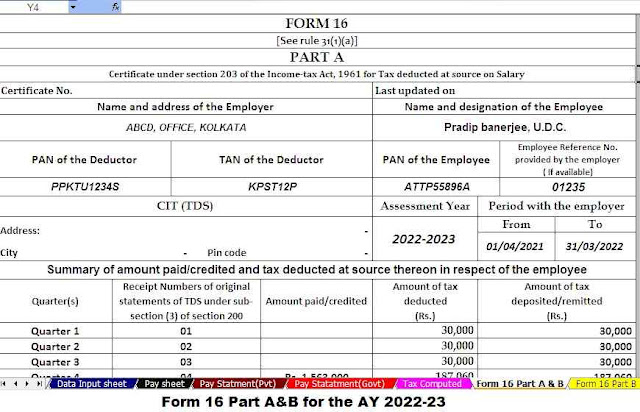

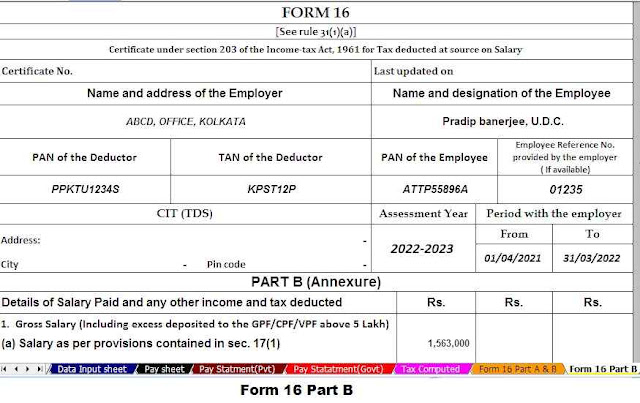

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23