Relief U/s 89 (1) regarding received salary arrears | Have you received a salary advance or arrears? If

so, you may be concerned about the tax implications of the same. What about the tax calculations for

the previous year and so on? For taxpayers who have these questions, here's everything you need to

know.

By now, you should have understood that income tax is calculated on the basis of a taxpayer's total income for a given year. The income can be in the form of family wages or pensions or other sources of income.

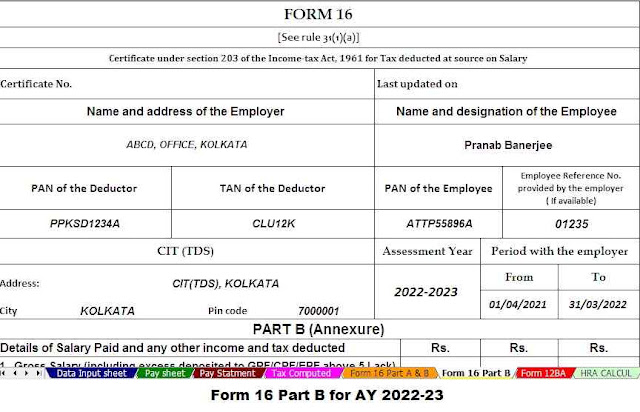

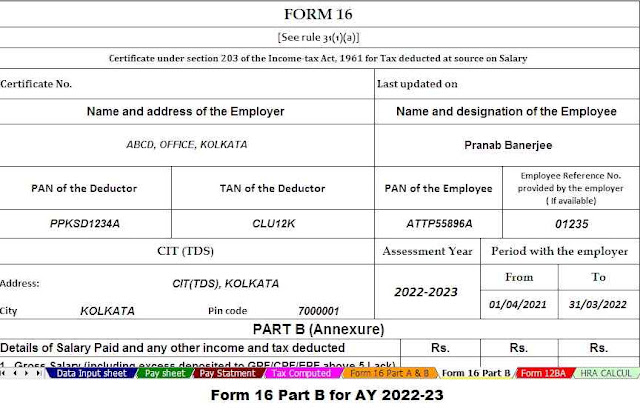

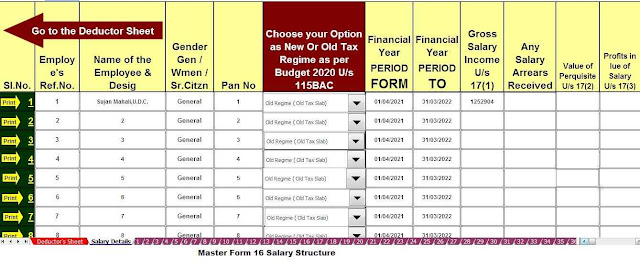

You may also like- Automated Income Tax Form 16 Part B Preparation Excel Based Software for the Financial Year 2021-22[This Excel Utility can prepare at a time 50 Employees form 16 Part B for the F.Y.2021-22]

However, there may be scenarios where you are overdue with your family pension or expected salary during the current financial year. It may be that a taxpayer receives a portion of his earnings or wages upfront or as debt in any financial year, which increases his total income, thereby increasing the taxes he owes. If so, an application can be made and the assessment officer can grant an exemption to the taxpayer. In summary, the Income Tax Law ensures that the rates of income tax are equal, and therefore, when a part of the income received is not in the current year, relief is provided so that the taxable income does not increase.

To ensure that you are not burdened with additional taxes, the Department of Income Tax provides U / s 89 (1) relief. If you are receiving pensions or benefits from the previous year, you will not be taxed on the current year's total. It essentially prevents you from paying additional fees because there has been a delay in paying.

To receive benefits under section 89 (1), you must submit Form 10E. What is Form 10E will be the most obvious question. Detailed information on Form 10E and how and why to submit it is detailed below.

What is assistance under section 89 (1)?

When the taxpayer receives:

1. Wage arrears o

2. Advance or

3. The arrears of the family pension

Then this amount is taxable in the year in which it is received.

You may also like- Automated Income Tax Form 16 Part A&B Preparation Excel Based Software for the Financial Year 2021-22[This Excel Utility can prepare at a time 50 Employees form 16 Part B for the F.Y.2021-22]

Moreover, relief under section 89 (1) is provided to reduce the additional tax burden due to delays in receiving such arrears' income.

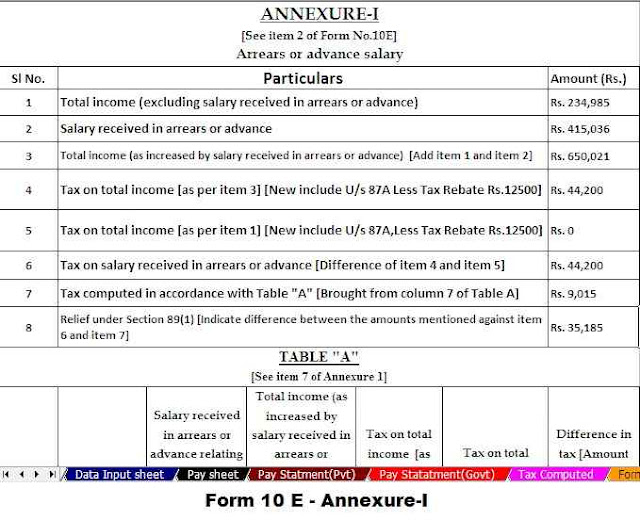

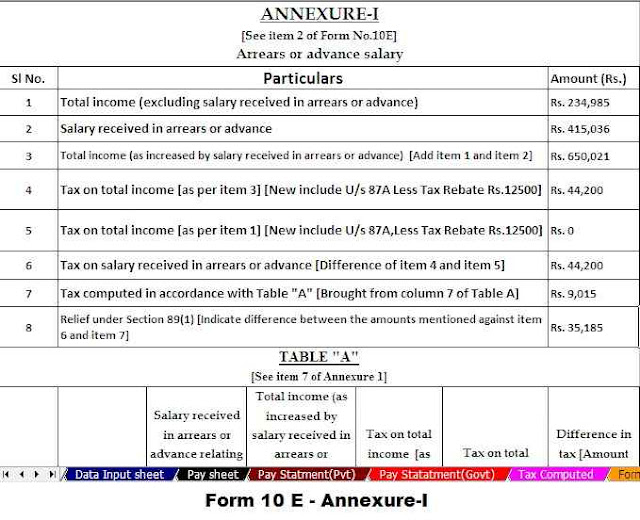

How to calculate the compensation under section 89 (1)?

Here are the steps to calculate the exemption under section 89 (1) of the Income Tax Act of 1961:

1. Calculate the tax payable on total income, including debt, in the year in which it accrued.

2. Calculate the tax due on the total income, excluding the debt in the year in which it is received.

3. Difference between (1) and (2).

4. Calculate the total income tax payable for the year to which the debt relates, including the debt.

5. Calculate the total income tax payable for the year to which the debt relates, excluding the debt.

6. The difference between (4) and (5).

7. The release amount will exceed the amount (3) on (6). No assistance is allowed if the amount (6) exceeds the amount specified in (3).

You may also like- AutomatedIncome Tax Form 16 Part B Preparation Excel Based Software for the Financial Year 2021-22[This Excel Utility can prepare at a time 100 Employees form 16 Part B for the F.Y.2021-22]

What is the 10E module?

To receive Section 89 (1) assistance for past due wages received, Form 10E must be filed with the Income Tax Office. If a 10E form is not submitted and an exemption is requested, the taxpayer will most likely receive a notice from the Income Tax Department that they have not submitted a 10E form.

When do I have to submit Form 10E?

Form 10E must be submitted before filing a tax return.

How can I submit form 10E?

Assistance under section 89 (1) for wage arrears is available in the following cases:

• Wages received in advance or in arrears

• Family pension received late

• Salary for more than 12 months received during a financial year

• Compensated pension

• Allowance received by the employer by way of severance pay

• Advice

Tax incentives are an effective measure to ensure that taxpayers do not face additional tax problems due to arrears. You must complete Form 10E to avoid paying additional fees that you would otherwise have to pay. It should also be noted that the exemption is only allowed in the event of an increase in the tax burden of the taxpayer. If there is no increase in liability, no relief is expected.

Also, please note that if the worker has received VRS compensation, there is no exemption under section 89 if the exemption was requested by the taxpayer under section 10 (10C) for VRS. Only one of these exceptions can be requested and they cannot be combined.