See How Much Tax You Can Save in the Fiscal Year 2022-2023| Chapter VI A of the Income Tax Act

contains various subsections of section 80 that allow a taxpayer to claim deductions from total gross

income.

There are taxpayers who have not yet invested in the financial products needed to save on taxes. If you are one of those who are still undecided on which financial product you can invest in to cut taxes this year, here are some options for you.

Chapter VI A of the Income Tax Act contains various subsections of section 80 that allow the taxpayer to request deductions from the total gross income of various investments that save on taxes, eligible expenses, donations, etc. These deductions allow the taxpayer to significantly reduce the tax payable.

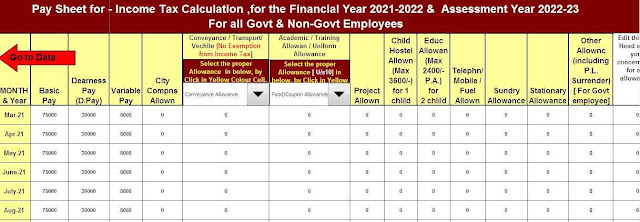

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

3) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4) Individual Salary Structure as per the Non-Govt Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10) Automatic Convert the amount into the in-words without any Excel Formula

Chapter VI A of the Income Tax Act contains the following sections:

80C: Deduction in connection with LIC premium, deferred annuities, contributions to a Provident Fund (PF), subscription of certain shares or bonds, etc. The deduction limit is Rs 1,5 lakh together with section 80CCC and section 80CCD (1).

80CCC: Deduction for contributions to some pension funds. The deduction limit is Rs 1,5 lakh together with section 80C and section 80CCD (1).

80CCD (1): Deduction of the contribution to the central government pension scheme - in the case of an employee, 10 per cent of the salary (base + DA), and in all other cases, 20 per cent of his total gross income. in the exercise will not be taxed. The general limit is Rs 1.5 lakh along with 80C and 80CCC.

80CCD (1B): Deductible of up to Rs 50,000 against contributions to the central government pension scheme (NTS).

80CCD (2): employer deduction of central government pension contributions. A tax credit is available on an employer contribution of 14% if the central government contributes and if any other employer contributes, a tax credit on a contribution of 10% is granted.

80D: Deduction for the health insurance premium. A maximum limit of Rs 25,000 is under the age of 60 years for deduction for people other than the elderly. For seniors, the limit is 50,000 rupees and the total limit of 80D U / s is 1 million rupees.

80DD: Food deduction, including the treatment of a dependent person with a disability. The maximum deduction in this section is Rs 75,000.

80DDB: Deduction on expenses up to Rs 40,000 for the treatment of a specific disease by a neurologist, oncologist, urologist, haematologist, immunologist or other specialists possibly appointed.

80E: Deduction of interest on a university loan without the maximum limit.

80EE: Interest deduction of up to Rs 50,000 on a loan taken out to purchase a residential home.

80EEA: deduction of interest up to 1.5 lakh on a loan taken out for the purchase of a specific house (affordable housing).

80EEB: Deduction on interest up to 1.5 lakh on a loan taken out for the purchase of an electric car.

80G: Donations to certain foundations, charities, etc. Depending on the nature of the donee, the limit varies from 100 % of the total donation to 50 % of the total donation, or 50 % of the donation with a 10 % cap. Gross Income.

80GG: Deductions for rent paid by self-employed people who do not receive HRA benefits. The deduction limit is Rs 5,000 per month or 25 per cent of gross income per year, whichever is lower.

80GGA: Full deductions for some donations to research or rural development.

80GGC: Full deductions for donations to a political party, provided such donations are in kind.

80TTA: Deductions for interest on savings accounts up to Rs 10,000 if the taxpayers are not senior residents.

80 TTB: Deposit interest deductions up to Rs 50,000 for senior residents.

80U: Disability deduction. Depending on the type and degree of disability, the maximum allowable deduction in this section is Rs 1.25 million.

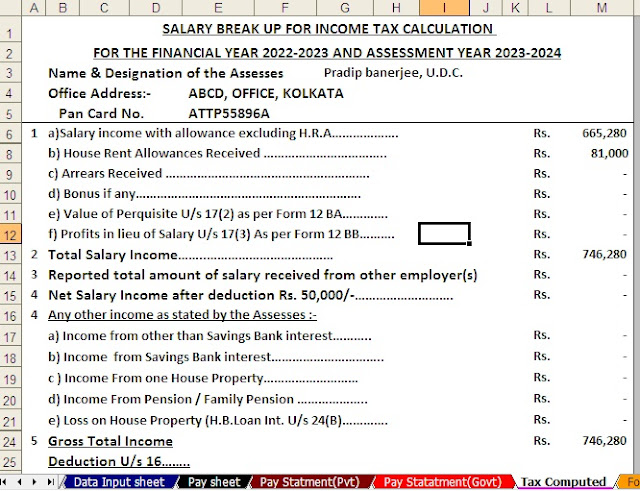

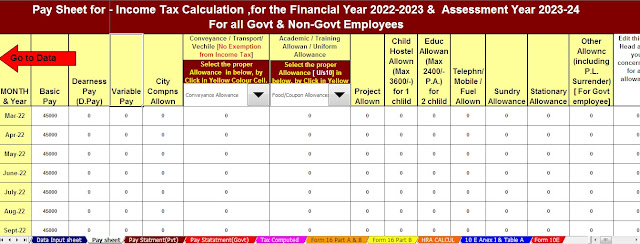

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

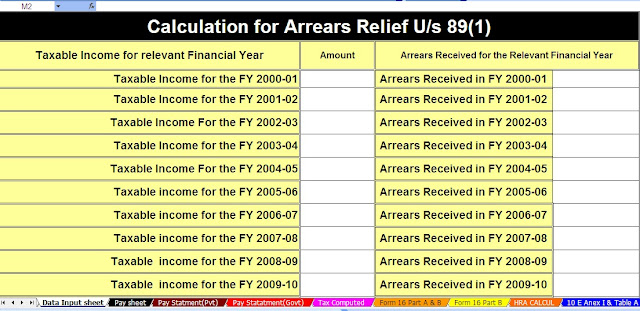

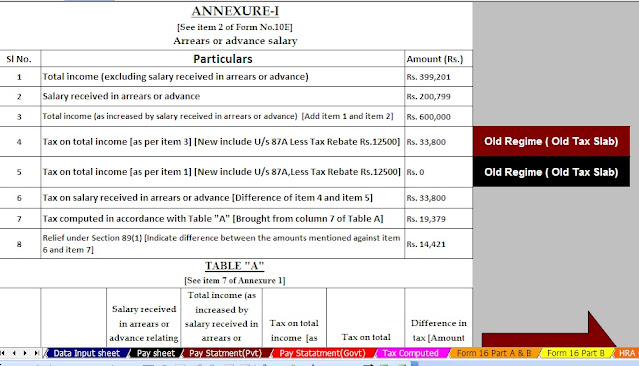

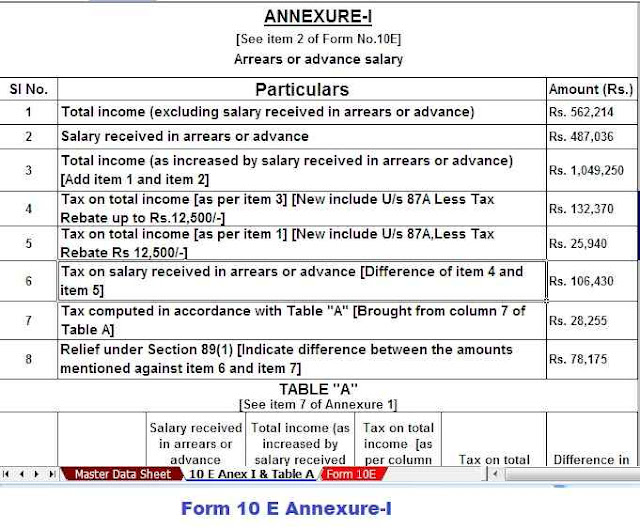

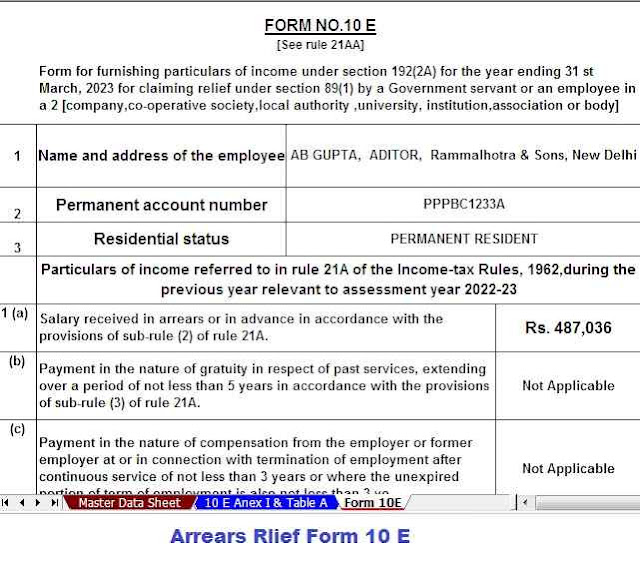

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

10) Automatic Convert the amount into the in-words without any Excel Formula