What is Form 16 - Meaning of Part A and Part B | Form 16 is an indispensable certificate issued by

employers to their employees. Provides confirmation that the TDS has been deducted and filed with

government agencies on behalf of the employee. Provides a detailed report of the compensation paid to

the employee and the number of TDS deducted from the employee.

What is Form 16? -

Basics

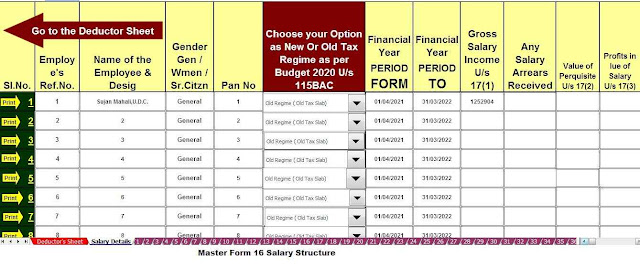

Form 16 contains the information you need to prepare and file your tax return. Shows a breakdown of payroll income and the number of TDS deducted by the employer. It is divided into two parts: Part A and Part B (discussed in detail below).

The employer must issue it annually no later than June 15 of the following year, immediately after the year in which the tax is withheld.

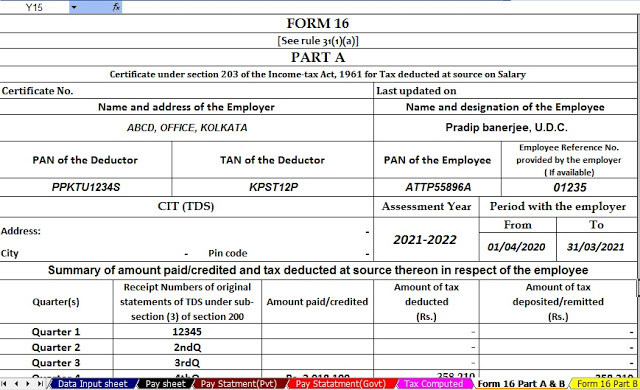

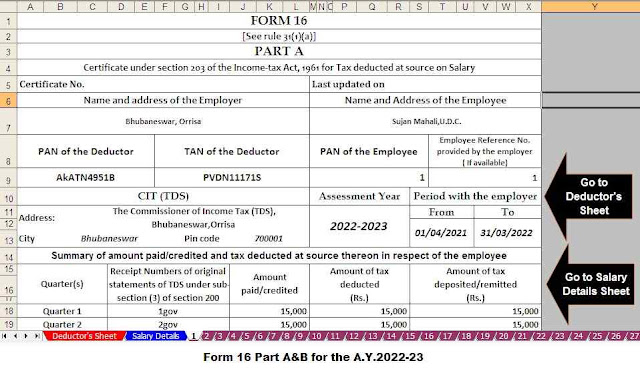

Part A of Form 16 contains details of deducted TDS and reported quarterly employer PANs and TANs, among other information.

The employer can create and upload this part of Form 16 through the TRACES Portal (https://www.tdscpc.gov.in/app/login.xhtml). Before issuing a certificate, the employer must certify its contents.

It is important to note that if you change jobs during the financial year, each employer will issue a separate Part A of Form 16 for the period of employment. Some of the components of Part A:

Name and address of the employer

TAN and TIN of the employer

PAN of the employee

A summary of taxes withheld and filed quarterly, certified by the employer.

Part B of module 16

Part B in Form 16 has an attachment to Part A. Part B is to be prepared by the employer for its employees and contains details of the wage breakdown and deductions approved under Chapter VI-A.

If you change jobs during the financial year, you must obtain a Form 16 from both employers. Here are some of the recently announced Part B components:

Detailed salary breakdown

A detailed breakdown of allowances exempted under Section 10

Deductions allowed under the IncomeTax Act (under chapter EIA):

The list of deductions mentioned is as follows:

Deduction for L.I.C. premium paid, PPF contribution, etc. pursuant to section 80C.

Deduction for contributions to pension funds in accordance with Section 80CC

Deduction of an employee's contribution to a pension scheme pursuant to section 80CCD(1)

Deduction for a taxpayer's own contribution to a claimed pension scheme under Section 80CCD (1B)

Deduction of an employer's contribution to a pension scheme pursuant to Section 80CCD(2)

Deduction of health insurance premiums paid pursuant to Section 80D

Section 80E Higher Education Loan Interest Deduction

Deduction on interest income on savings accounts in accordance with Section.80 TTA

Information required in Form 16 when submitting a declaration

With the link to the image below, here you can find some information for filing your Fiscal Year 2021-22 (The fiscal Year 2022-2223) tax return.

Reimbursement Exempted Under Section 10

Breach of deductions under section 16

Taxable salary

Housing income (or acceptable loss) reported by an employee and proposed for TDS

Enter the "Other Sources" section offered for TDS.

Violation of Section 80C Deductions

The aggregate of Section 80C Deductions (Total and Deductible)

Form 16 - Part B

Enter your name (taxpayer), address and TAN. You can also get additional information regarding your employer in Form 16 when filing your annual return, such as:

TDS is held by the employer

TAN of the employer

TAN of the employer

Name and address of the employer

Current assessment year

Your personal number

What are the eligibility criteria for Form 16?

In these rules made by the Ministry of Finance of the Government of India, any employee income over the tax bracket can apply for a Form 16.