All about Form 16 Part A and Part B | If you are a salaried employee, you should understand the

importance of the 16 forms when filing an income tax return (IRT). If you have completed Form

16, filing an ITR is a simple task. Although you don't have to know what's on your Form 16, it's a good

idea to familiarize yourself with these important tax filing forms.

What is Form 16?

Form 16 is like a payroll certificate, including details of income and taxes withheld from source (TDS) in the tax year. Form 16 also serves as legal evidence of your payroll tax deductions made against your Permanent Account Number (PAN).

Why is Form 16 issued?

The Income Tax Act 1961 states that each employer must deduct a specified amount from the employee's salary if it exceeds the basic exemption limit of Rs. 2.5 Lack. The deductible will be paid to the government for your PAN. However, if your income is below the taxable limit, the withholding tax reduction will not be made and you may not receive a Form 16.

Who issues Form 16?

Under Section 203 of the Income Tax Act, the employer submits Form 16 when deducting wage tax. If you change your job in a particular year, you will receive two Form 16s. Currently, the deadline to issue Form 16 for the IRPF is June 15 each year. In case the employer delays or fails to file Form 16 by the due date, a fine of Rs 100 per day will be imposed for the duration of the non-compliance. But the penalty cannot be exceeded. Total taxes deducted.

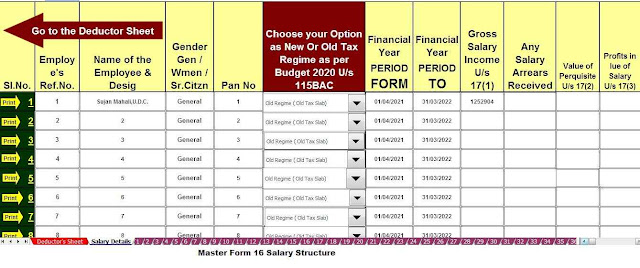

Download Automated Income Tax One by One Preparation Excel Based Form 16 Part B for the F.Y.2021-22

What does Form 16 include?

Form 16 online consists of two parts: Part A and Part B. Part A covers deductions made to your paycheck from your total withholding tax (TDS), while Part B contains details about calculating taxable income and the total taxes owed. or refundable. In addition, Part B also contains complete details of the salary you pay in the tax year.

The particulars of Part A of the online form 16 are:

• The full Address and Name of the Employee

• The employee's full name and address

• Employer account number, tax collection and deduction account number (TAN)

• Employee PAN

• A total summary of the tax withheld and deposited every three months by the employer

• Evaluation year

• The period of working with the present employer

• Unique TDS Certificate Number

Download Automated Income Tax 50 Employees Excel Based Form 16 Part A&B for the F.Y.2021-22

Part A can be created through the TRACES portal.

The particulars of Part B of Form 16 are:

• Comprehensive salary distribution

• Assignments under Section 10

• DISCOUNTS UNDER SECTION 16

Other income from home ownership

• Tax deductions permitted by Chapter VI - A of the Income Tax Law

• Any compensation under Section 87A, if any

• Surcharges, the endowment of health and education, if any

• Any exemption provided under Section 89

• net tax payable

Download Automated Income Tax 50 Employees Excel Based Form 16 Part B for the F.Y.2021-22

Part B is prepared by the employer.

What do you do if you have worked with more than one employer?

If you have worked with more than one employer in a given year, they will each file Form 16 to continue your business. However, Part B can be granted by both employers and another employer, depending on your choice.

Tax filing in multiple 16 forms can be a bit tricky. However, to avoid this, you can tell your current employer about your previous service. Also, submit Form 12B to your new employer, with details such as base salary, HRA, LTA, benefits, and other tax deductions granted.

If you file Form 12B in your new job, you will get a Standard 16 Income Tax Form. This, in turn, will reduce difficulties during tax filing.

Download Automated Income Tax 100 Employees Excel Based Form 16 Part A&B for the F.Y.2021-22