Deduction under Chapter VI A of the Income Tax Act| Income Tax Chapter VI A of the Income Tax Act

available different subsections of section 80 which allows a taxpayer to claim a deduction from total

gross income.

Income Tax Chapter VI A of the Income Tax Act bear carry subsections of section 80 which allows a valuer to claim a deduction from total gross income due to various tax savings investments, permitted expenses, donations etc. This deduction allows the assessor for the allowance to substantially reduce the tax due.

Chapter VI A of the Income Tax Act bears the following sections:

80C: Deduction relating to the life insurance premium, deferred annuity, contribution to the retirement fund (PF), subscription of certain shares or bonds, etc. The deduction limit is Rs 1,5 lakh with the 80CCC section and the 80CCD section (1).

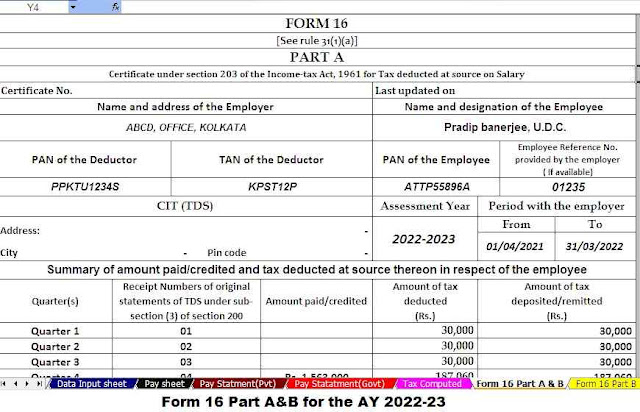

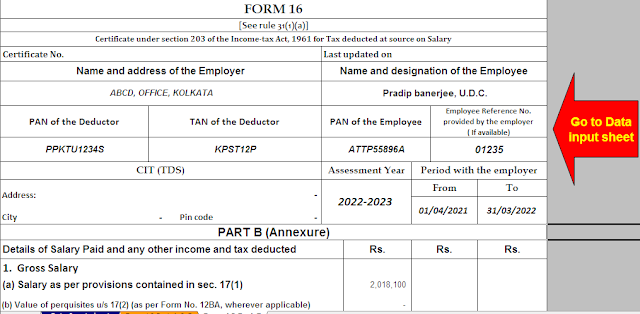

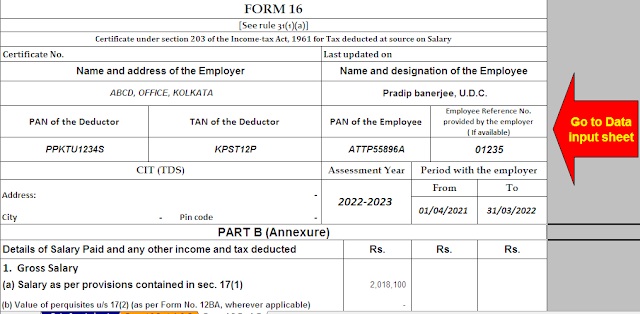

Download and prepare at a time 50 Employees form 16 Part A&B for the F.Y.2021-22

80CCC: Exemption for contribution to some pension funds.

With section 80C and section 80CCD (1) the deduction limit is Rs 1,5 lakh.

80CCD (1): Deduction related to the contribution to the central government pension scheme - In the case of an employee, 10 % of the salary (Base + DA) and in any other case 20 % of the total gross income of a financial year will be tax-free. The total limit is Rs 1.5 lakh including 80C and 80CCC.

80CCD (1B): Deduction of up to Rs. 50,000 in relation to the contribution to the central government pension scheme (NPS).

80CCD (2): Deduction related to the contribution paid by the employer to the pension scheme of the central government. The tax relief is granted on the employer's contribution to the extent of 14 per cent where this contribution is made by the central government and where the contribution is paid by any other employer, the tax reduction is granted in the amount of 10 per one hundred.

Download and prepare at a time 50 Employees form 16 Part B for the F.Y.2021-22

80D: Deduction on the health insurance premium. The premium paid up to Rs 25,000 is eligible for deduction for people other than the elderly. For seniors, the limit is Rs 50,000 and the total limit under section 80D is Rs 1 lakh.

80DD: Deduction for alimony including medical treatment of a dependent person who is a disabled person. The maximum deduction limit in this section is Rs 75,000.

80DDB: Deduction in relation to the expense of up to Rs. 40,000 for the medical treatment of a specific disease by a neurologist, oncologist, urologist, haematologist, immunologist or any other specialist, as may be prescribed.

80E: Deduction for interest on the loan granted for higher education without any upper limit.

Download and prepare at a time 100 Employees form 16 Part B for the F.Y.2021-22

80EE: Interest deduction of up to Rs. 50,000 on the loan taken for residential homeownership.

80EEA: Interest deduction of up to Rs.1.5 lakh on loan taken for certain homeownership (on affordable housing).

80EEB: Deduction for interest up to Rs.1.5 lakh on the loan taken for the purchase of an electric vehicle.

80G: Donations to certain funds, charities, etc. Depending on the nature of the donee, the limit ranges from 50 % of the donation to a limit of 100 % of the total donation, 50 % of the total donation, or 10 % of gross income.

Download and prepare at a time 100 Employees form 16 Part A&B for the F.Y.2021-22

80GG: Deduction relating to the rent paid by non-salaried people who do not receive the HRA benefit. The deduction limit is Rs 5,000 per month or 25% of total income in a year, whichever is lower.

80TTA: Deduction for interest on savings current accounts up to Rs 10,000 in the case of experts other than elderly residents.

80TTB: Deduction for interest on deposits up to Rs. 50,000 in the case of elderly residents.

80U: Deduction in case of a disabled person. The maximum allowance allowed in this section is Rs 1.25 lakh, depending on the type and extent of the disability.

87A: The exemption under section 87A helps taxpayers reduce their income tax. You can apply for the above exemption if your total income, i.e. after deduction of the VIA chapter, does not exceed Rs 5 lakh in a financial year. Income tax liability becomes void after applying for an exemption under section 87A.

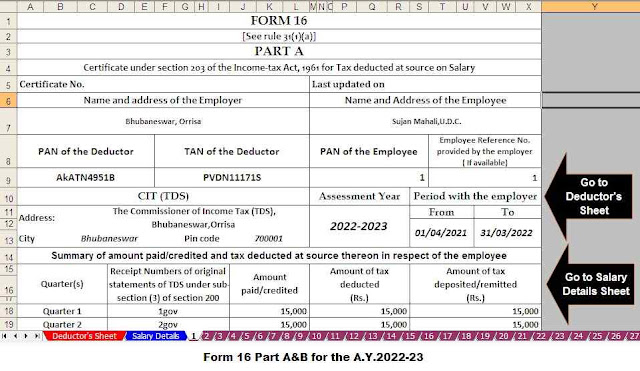

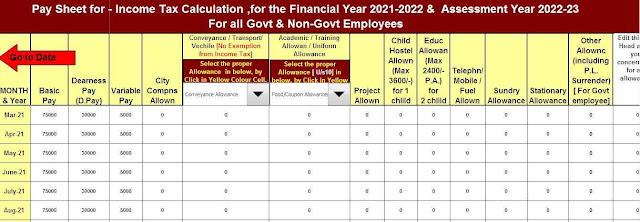

Download Automated IncomeTax Preparation Excel Based Software All in One for the Government andNon-Government (Private) Employees for the Financial Year 2021-22 and Assessment Year 2022-23 U/s 115BAC

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula