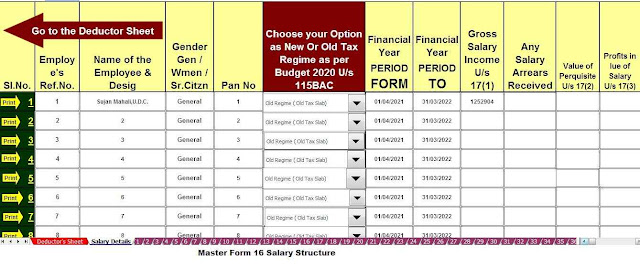

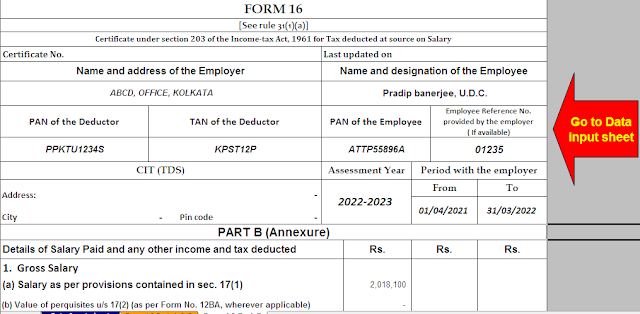

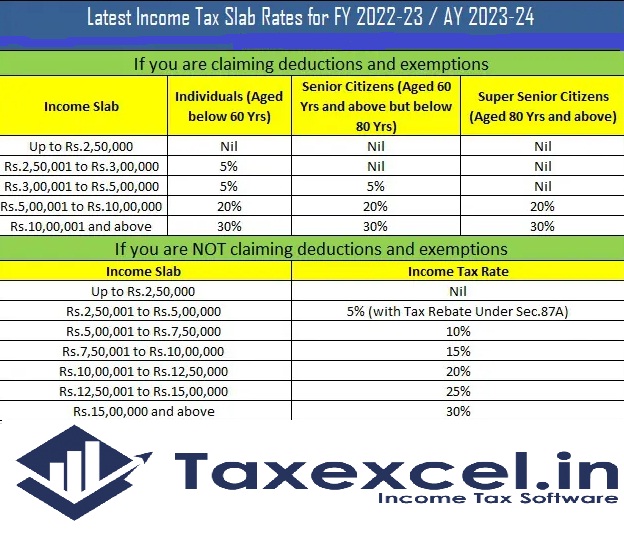

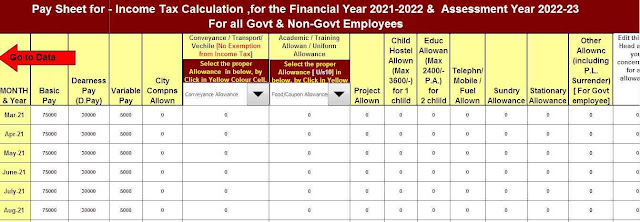

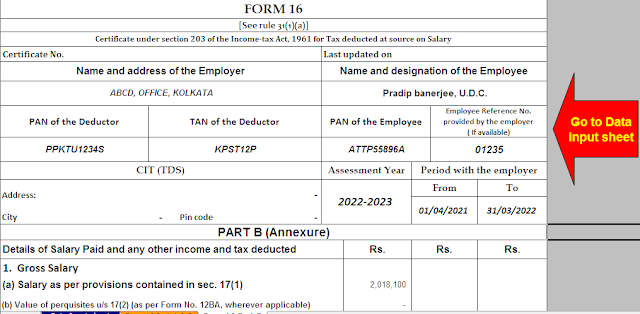

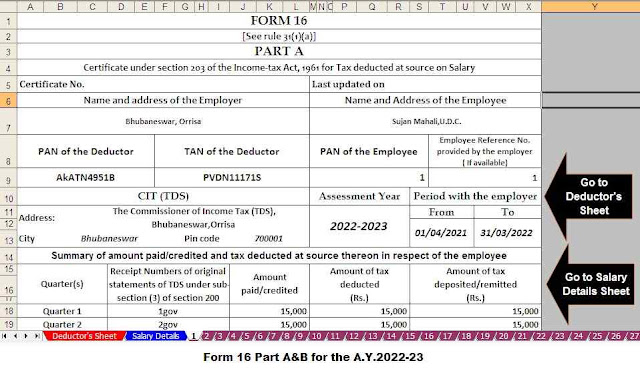

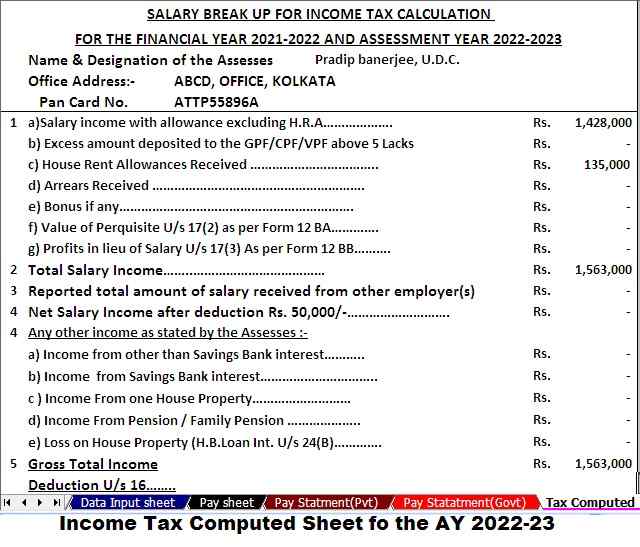

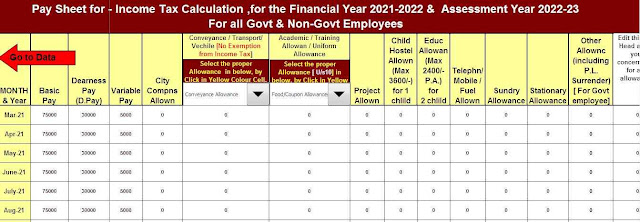

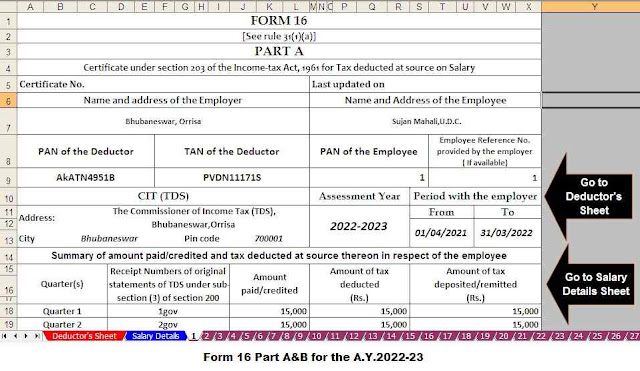

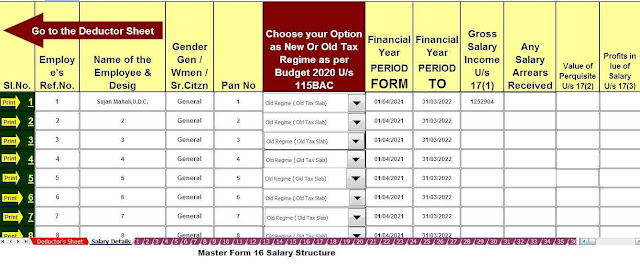

Download Automatic Income Tax Form 16 Preparation Software In Excel which can prepare at a time

50 and 100 Employees form 16 for F.Y.2021-22 |An income tax deduction is a reduction in taxable

income that reduces a person's tax liability. It is also important to note that a significant portion of a

person's income falls into the tax bracket. Section 80 deduction is divided into several categories

according to the type of investment.

What is Section 80C Deduction?

We all expect good returns when we invest, but did you know that some of your investments pay you more than that and help you save on taxes?

One such investment is Section 80C. It is considered as one of the most preferred categories of taxpayers as it reduces taxable income through tax-exempt investments.

We all as Indian taxpayers look for different ways to save money and reduce our tax deductions. A taxpayer who uses a tax-saving investment and claims a deduction under section 80C is entitled to a rebate of up to Rs. 1,50,000 on their taxable income. The following different investment possibilities are available:

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This Excel Utility can prepare At a time 50 Employees Form 16 Part A&B as per Budget 2021

1. Employee provident fund: Under this investment, both the employer and the employee can contribute equally (12% of the basic salary).

2. Premium for health insurance: If you pay a premium for health insurance, you may be eligible for tax benefits.

3. Public Provident Fund (PPF): The government of India offers long-term investment in PPF. Any amount deposited in a PPF account in one year is eligible for a rebate starting from Rs.500 to a maximum of Rs.1.5 lakhs. 15 years later.

4. Premium for life insurance: If you pay the life insurance premium, you are eligible for tax benefits.

5. Sukanya Samrudhi Account Investment: For a girl child in India, you can open a Sukanya Samrudhi account with a minimum of Rs.1000 and a maximum of Rs.1.5 lakhs. The scheme currently has an interest rate of 8.1% and is tax-deductible.

6. National Savings Certificate: It is a safe way to save. Also, even if the NSC has a 5-year term, you can claim a discount for interest in the year you bought them. Because it is a government-sponsored program, it protects the security of your money.

7. Children's tuition fees: It covers the cost of tuition at a university in India. This is a good option for kids up to two.

8. Housing Loan: The principal repayment of a home loan, as well as the cost of registration, may be eligible for tax relief under section 80C.

9. Post Office Fixed Deposit: Fixed deposit at the post office is like a bank fixed deposit, however, only a 5-year deposit is eligible for a tax deduction.

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This Excel Utility can prepare One by One Form 16 Part A&B and Part B as per Budget 2021

What is Section 80CCC?

Single contributions to pension plans are eligible for an income tax credit under section 80CCC. Payment in annual pension schemes may be deducted under section 80CCC. Tax benefits on expenses for purchasing or continuing a retirement plan are defined under section 80CCC.

What is Section 80CCD?

It relates to the individual's contribution to the following schemes:

National Pension System (NPS)

Section 80CCD (1): It deals with tax deduction for self-employed / central government / other employers. Salary employees are entitled to a maximum deduction of 10% of their salary, whereas self-employed taxpayers can deduct 10% of their total income.

Section 80CCD (2): This section discusses the NPS contribution of the employer. Individuals who deposit in their pension account are eligible for deductions under section 80CCD. If an employer contributes to an employee's NPS account, the employee can claim a tax deduction. The threshold is 10% of an employee's salary.

Section 80CCD (1B): For the capital invested in NPS, the total tax savings can be up to Rs. 2,00,000, an additional tax benefit of Rs.50,000/-

What is 80D?

A tax deduction under section 80D is available for premiums paid for health insurance coverage. A taxpayer can deduct up to Rs 25,000 for insurance for themselves, their spouses, and their dependent children under section 80D. If your parents are under 60, you can get an additional discount of up to Rs 25,000 for their insurance. However, if they are over 60 years of age, they can deduct Rs 50,000 under this section.

What is Section 80DD?

Rehabilitation of disabled dependent relatives is included in section 80DD. An individual or a HUF department can take advantage of the 80DD discount:

খরচ Cost of medical services, training, and rehabilitation of a disabled dependent relative.

Payment or contribution to a designated scheme to assist disabled dependent relatives. If the disability is 40% or more but less than 80% then there is a set deduction of Rs. 75,000. There is a set deduction of Rs. 1,25,000 for 80% or more severe disability.

Conclusion

As an investor, having the right information can help you save a lot of tax money. Now that you are aware of all the tax-saving options like 80C, 80D, 80CCD, and others, you need to make sure that you use them properly to save money.

Download Automatic Income Tax Form 16 Preparation Excel Based Software for the Financial Year 2021-22 [This Excel Utility can prepare At a time 100 Employees Form 16 Part A&B as per Budget 2021