Income tax deduction under Sec 80 CCD (1B). According to the rules and regulations of the Income

Tax Act 1961, payment of income tax is mandatory for every citizen of India. But that doesn't mean

you have to pay tax on the income you make. In a given financial year. There are several provisions

under the Income Tax Act that allow you to claim exemptions against certain investments and

expenses.

Plan your taxes to save your income

By planning your taxes carefully, you can save a significant amount for your taxation obligations and create an additional source of income for yourself. With the dual benefits of tax savings and income growth, these discounts offer you significant benefits.

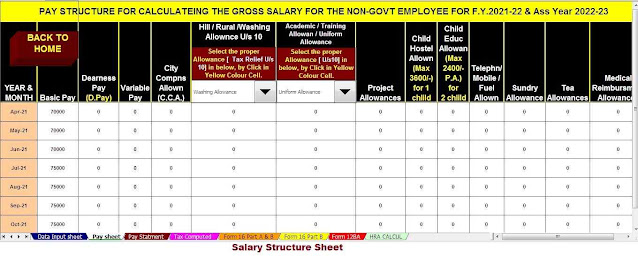

You may also, like- Automated Income Tax Preparation Software in Excel for the Non-Government Employees for the F.Y.2021-22

The government introduces new exemptions or amendments from time to time which you must observe closely. One deduction available to you is Sec 80 CCD (1B) which deals with contributions to NPS.

The NPS or National Pension System is a pension scheme available to both government employees as well as private citizens. NPS is one of the most popular options for people looking to build a corpus for their retirement with a regular monthly income.

The investment in NPS is a variety of securities and deposition of avenues, including the share market. It is widely regarded as one of the cheapest investment options, including exposure to equity. Since returns are directly related to market performance, there is no guarantee of a fixed amount, but within a specified period, the return from NPS is one of the highest in the market.

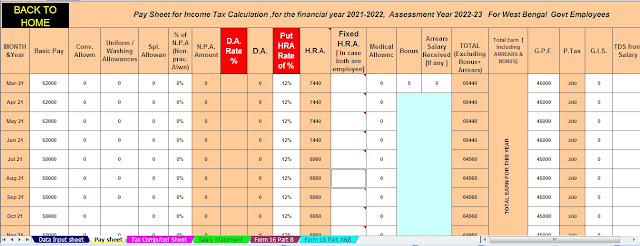

You may also, like- Automated Income Tax Preparation Software in Excel for the West Bengal State Government Employees for the F.Y.2021-22

NPS has two types of accounts, NPS Tier 1 and NPS Tier 2.

Tier 1 account: It has a fixed lock-in period until the customer reaches 60 years of age. Partial withdrawal can be made only in certain conditions. Contributions made for Tier 1 are tax-exempt and deductible under section 80CCD (1) and section 80CCD (1B). This means you can invest up to money. Claim a deduction for 2 lakhs and the full amount in an NPS Tier 1 account, i.e. Rs. 1.50 lakh under section 80CCD (1) and Rs. 50,000 under Section 80CCD (1B)

Tier 2 Account: This is essentially a voluntary savings account that allows customers to withdraw money of their choice. But contributions made to a Tier 2 account are not eligible for a tax deduction. To open a Tier 2 account, you must first open a Tier 1 account. Contributions to the NPS now qualify under the Tax-Free-Free (EEE) mode where the amount of contributions to the NPS, the income generated and the amount of maturity are all tax-free. According to the latest guidelines, you can withdraw up to 60% at maturity and reinvest the remaining 40% to make an annual purchase that gives you a regular monthly income.

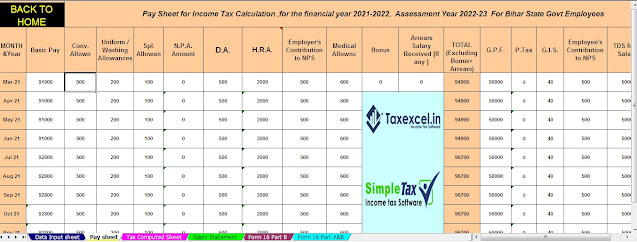

You may also, like- Automated Income Tax Preparation Software in Excel for the Bihar State Government Employees for the F.Y.2021-22

What is Sec 80CCD (1B)?

Section 80CCD of the Income-tax Act deals with deductions made by persons contributing to NPS. As per Section 80CCD, till 2015, a person has to pay Rs. Till was eligible to claim income tax exemption. 1 lakh against the contribution to NPS. In the 2015 budget, the government increased the maximum amount payable for NPS to Rs. 1.50 lakh annually.

In addition, a new sub-section 1B has also been introduced, which offers discounts up to extra money. 50,000 / - for contribution to NPS by individual taxpayers. Extra money has been deducted. Benefits of Rs. 50,000 / - and above are available for assessment under Section 80CCD (1B). 1.50 lakh is available as an exemption under section 80CCD (1). Thus, by increasing the maximum limit of discount to Rs. 2.00 lakhs including Section 80CCD (1) + Section 80CCD (1B).

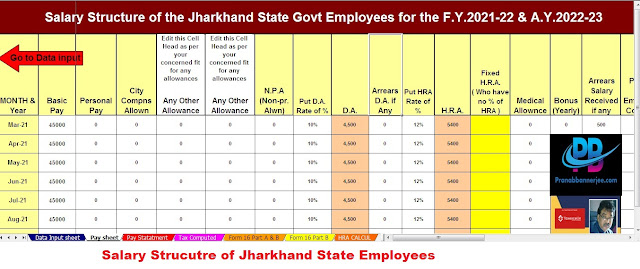

You may also, like- Automated Income Tax Preparation Software in Excel for the Jharkhand State Government Employees for the F.Y.2021-22

Here are some important points about Section 80CCD (1B) that you should be aware of.

Extra money has been deducted. 50,000 / - is available for contributions to NPS Tier 1 account only

Tier 2 accounts are not eligible to claim deductions under section 80CCD (1B)

Deductions under section 80CCD (1B) are available to salaried persons as well as self-employed persons.

You will need to present documentary evidence of the transaction related to your contribution to the NPS

Partial withdrawal is allowed under NPS but subjects to certain conditions

The Maximum limit under section 80CCD (1B) is Rs. 50,000 / - and exempt from exemption under section 80C. As a result, you can claim the maximum money discount. 2,00,000 / -

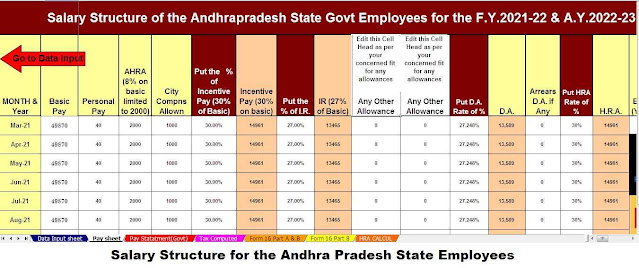

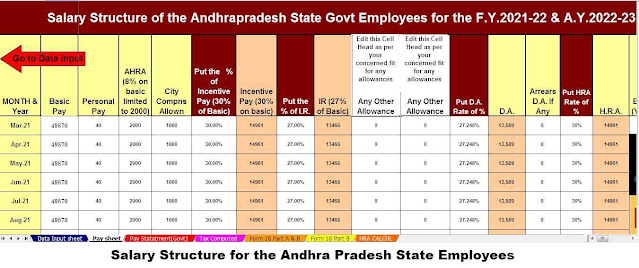

You may also, like- Automated Income Tax Preparation Software in Excel for the Andhra Pradesh State Government Employees for the F.Y.2021-22

If the assessee dies, and the nominee decides to close the NPS account, the nominee is exempt from tax.

If the account is partially deducted, only 25% of the contribution is exempt from tax

If the appraiser is an employee and decides to close the NPS account or opt out of the NPS, only 40% of the total amount is tax-free.

After reaching the age of 60 as tax-free income, the assessor will be able to withdraw 60% of the total amount. The remaining 40% is tax-free if it is used to purchase an annual plan. Section 80CCD (1B) gives you an excellent opportunity to save a substantial amount on your taxation obligations.

You may also, like- Automated Income Tax Preparation Software in Excel for the Assam State Government Employees for the F.Y.2021-22

This way you can not only reduce your current tax liability but also work towards creating a significant corpus for your retirement. Please note the above points before taking any action regarding your NPS account regarding Section 80CCD (1B).

Convenience for existing NPS customers

Presently NPS members can also avail of deduction under Section 80CCD (1B) in addition to deducting Rs 1.5 lakh under Section 80C. They can claim an additional Rs 50,000 rebate on their contribution under section 80CCD (IB). They can split their NPS contributions and claim partially at 80C and the remaining 80CCD (1B), with a maximum tax deduction of Rs 2 lakh. See NPS tax benefits here:

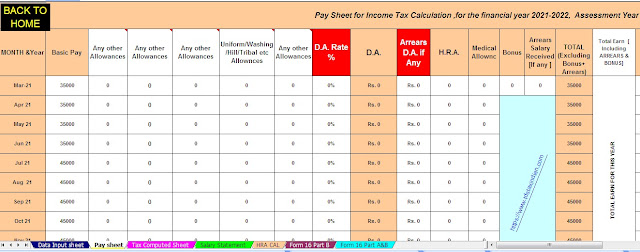

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

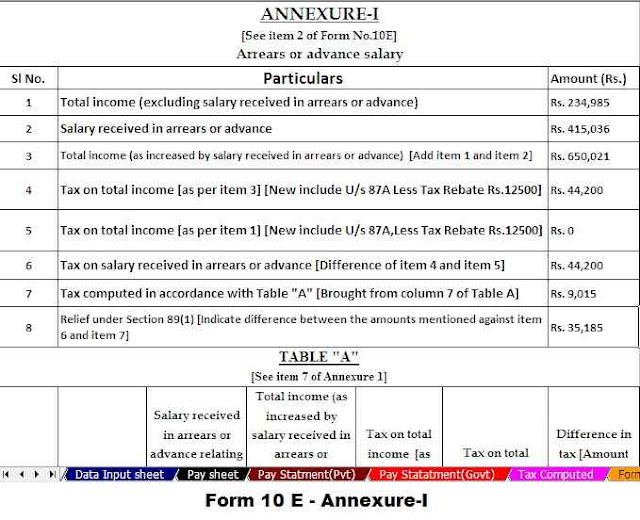

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

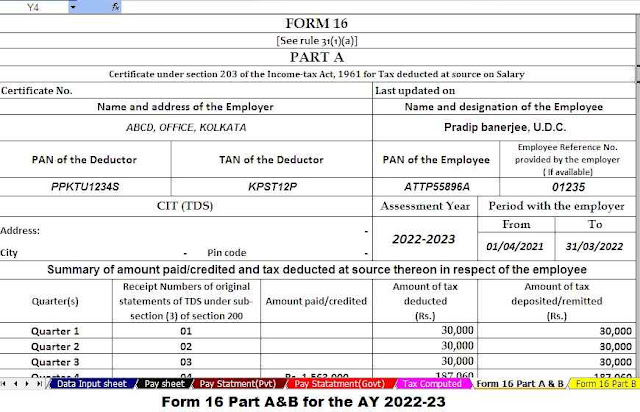

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula