Income Tax Planning Salaried Persons for F.Y.2021-22.No change in income tax slab or rate has been

proposed. Also, no additional tax exemptions or exemptions were introduced. The standard deduction

for U/s 16(ia) salaried and pensioners remains the same.

Without any change in income tax slab and rate and basic exemption limit. An individual taxpayer will continue to pay taxes at the same rate as in the fiscal year 2020-21. Read more at:

In addition, to 80C, there are many ways to save tax, which gives exemptions and tax benefits-

1. Section 80D: Medical Insurance Premium Section 80D of the Income Tax Act Helps to claim a tax deduction from total taxable income Payment of medical insurance premium.

You can get a maximum discount of Rs. 25,000 per year you pay for medical purposes for yourself, your wife or your children. The max limit for senior citizens is Rs. 50,000. Also, if you spend money on behalf of your parents, you will get a maximum tax deduction of up to Rs 10,000. 25,000

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22

2. Section 80G: Charitable Donations You can claim 50% or 100% of the amount, which is donated to a charitable trust. To claim a deduction you need to save the receipt of the organization after the financial year.

Income Tax Planning Salaried Persons for F.Y.2021-22.Make sure that whenever you donate, charities and trusts will be registered under the Section 12A post that they are eligible for the 80G Certificate.

3. Section 80GG: Rent towards housing Individuals living in a rented house can claim a tax exemption under section 80GG. However, this deduction is eligible for those who are not salaried and employees who do not receive House Rent Allowance (HRA) from their employers.

4. Section 80D: Health Insurance Nowadays, medical services are skyrocketing and buying health insurance has become a necessity for everyone. Because it helps you with your medical expenses in case of emergency. For example, if you pay a premium for your health insurance, you can save up to Rs 15,000 - Rs 20,000 under Section 80D.

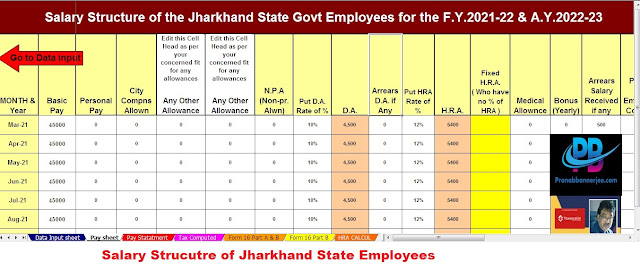

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2021-22

5. Section 80EEE: Education Under section E0E, interest on loans for higher education is tax-free for oneself, wife and children. An individual can claim the amount of interest discount not paid but the amount paid.

Section: 80EE: Home loan is one of the best ways to save tax in

7. Section 80TTA: Interest can be claimed as a deduction under 80TTA of Rs. 10,000/-.

Save income tax under section 80C. Read more at:

Under Section 80C you can find various options and ways to save income tax-

1. Life insurance not only provides full life coverage, but it is also the best way to save tax. In a life insurance policy, one has to pay a certain amount of money every year, which is instead refunded in a healthy single amount.

Endowment, ULIP, Term Life Life Insurance, an annual approved for tax savings. The maximum exemption eligible under section 80C is up to Rs.1,50,000.

2. ULIP's Unit Link Insurance Plan aka ULIP is a market-linked insurance plan. The advantages of this plan are that it provides flexibility, long-term goals, financial security after retirement and income tax benefits. Investments made in this scheme are tax-deductible under Income Tax Act 80C. In addition, it gives you the opportunity to grow your money.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the West Bengal State Employees for the F.Y.2021-22

3. Mutual Funds, you can go for ELSS (Equity Linked Savings Scheme) where you can get a discount of up to Rs 1,50,000 under Section 80C. Being a combination of equity and tax savings, ELSS is an optimal gateway to equity. This means that with tax savings, your money grows as the stock market grows. Thus, the profit in ELSS is higher. This facility can be a minimum lock-in period of 3 years.

4. Tax Savings Fixed Deposit Provides tax exemption on investments up to Rs. 1,50,000 under section 80C.

5. SCSS or Senior Citizen Savings Scheme This scheme is formulated only for senior citizens who have retired at the age of 60 years or above 55 years. Under Section 80C, the maximum SCSS investment is liable for tax exemption. 1,50,000

6. Future funds (PF) are helping to create a goal with long-term returns. Deposits made in PF are Rs. Till the claimant of tax deduction. 1,50,000 under section 80C.

7. National Savings Certificate (NSC) starts with a minimum deposit of Rs.1000. 100. The term of investment of NSC is 5 years. Upon maturity, you can claim a full refund to their account. However, if not claimed, the entire amount will be reinvested in the scheme. You may get a tax exemption of Rs.. 1,50,000 under Section 80C of the Income Tax Act

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

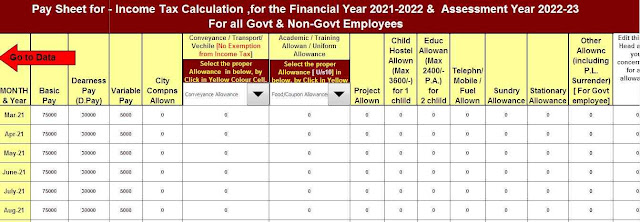

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Exemption from House Rent U/s 10(13A)

5) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

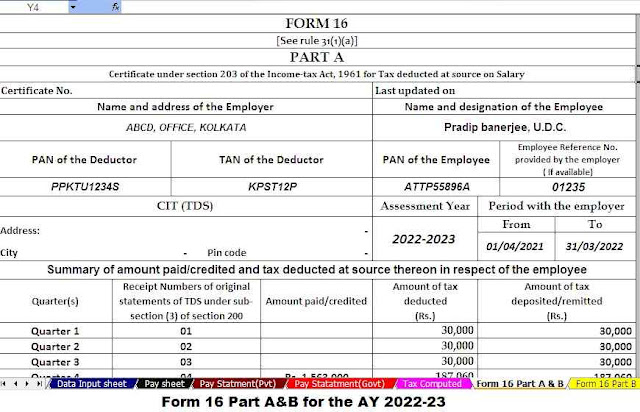

6) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

7) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22