Tax benefits on home loans: Sections 24, 80EEA and 80C, Home loan repayment consists of 2

components i.e. principal repayment and interest repayment.

Home loan tax benefits

The following are the benefits of a home loan that can be claimed: -

|

Section |

Deduction allowed |

Allowed for |

|

Section 24 |

Rs. 2,00,000 |

Interest repayment |

|

Section 80C |

Rs. 1,50,000 |

Principal repayment |

|

Section 80EEA |

Rs. 1,50,000 |

Interest repayment |

These sections under which tax benefit can be claimed on home loans are explained below: -

Section 80C: Home Loan Tax Benefit (Basic Amount)

The amount paid by an individual /HUF as principal repayment of a home loan is approved as tax exemption under Section 80C of the Income Tax Act. The maximum is Rs. 1.5 Lakh as the principal amount U/s 80C.

This tax deduction includes the total exemption allowed under section 80C and includes the amount invested in the PPF account, tax-saving fixed deposit, equity-oriented mutual fund, national savings certificate, senior citizen savings scheme etc.

However, the repayment of the principal portion of the home loan is allowed under this section only after the completion of the construction of the home loan and the issuance of the certificate of completion.

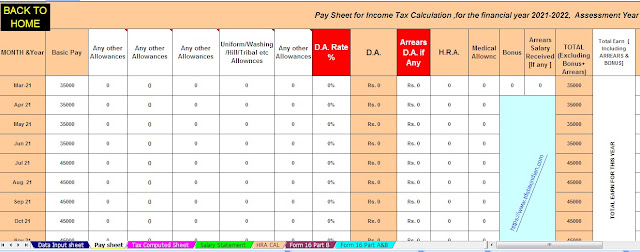

Download Automated Income Tax Preparation Excel Based Software for the Non-Govt (Private) Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time Tax Computed

Sheet + Individual Salary Structure as per the Govt & Private Employees

Salary Pattern + Automated House Rent Exemption Calculation U/s 10(13A) +

Automated Form 12 BA + Automated Income Tax Form 16 Part A&B and Part B for

the F.Y.2021-22]

Moreover, if you are planning to buy a property under construction because it is priced lower than the completed property, you are also requested to note here that GST is also levied on the property under construction. However, no service tax is levied on properties on which construction has been completed.

Home Loan Tax Benefit (Amount of Interest)

Tax rebates on home loan interest can be claimed as deduction U/s 24 and under the newly inserted section 80EEA (as amended by Budget 2020).

Section 24: Income tax benefit on interest for purchase/construction of the real estate

Tax benefits on home loans for interest payments are approved as a rebate under Section 24 of the Income Tax Act. It has been taken for the purpose of construction/repair/renewal/restructuring of the property.

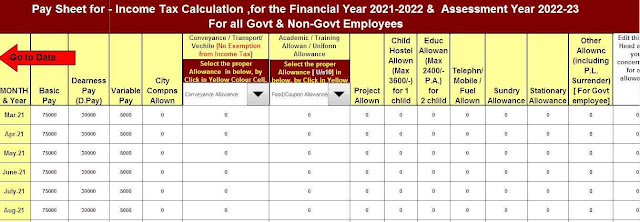

Download Automated Income Tax Preparation Excel Based Software for the Bihar State Employees for the F.Y.2021-22 asper Budget 2021[This Excel Utility can prepare at a

time Tax Computed Sheet + Individual Salary Structure as per the Bihar State Govt

Employees Salary Pattern + Automated House Rent Exemption Calculation U/s

10(13A) + Automated Income Tax Form 16 Part A&B and Part B for the

F.Y.2021-22]

The maximum tax deduction allowed under section 24(b) to a maximum limit of Rs. 2 lakhs

In addition, if the acquisition/construction of the property is not completed within 5 years from the end of the financial year taken, then the interest benefit, in this case, will be reduced from Rs. 2 lakhs to only Rs.50000 (The limit has been increased from 5 years to 5 years from F.Y2019-20).

The Finance Act 201, promulgated on February 1, 2001, has the maximum loss limit under head house property that can be set off from other income heads. From the financial year 201-1 financial year, the maximum loss is allowed to set off Rs 2 lakh with income from other heads. The amount that is not set off will be carried over to future years.

These new provisions inserted in the Income Tax Act is explained very nicely in this link - the cure of rate property from income tax property.

Section 80EEA: Income tax benefits on home loan (first-time buyers) interest

An interest rebate may be claimed under Section 80 EEA which is higher than the sanctioned rebate claimed under Section 2 under Section0 Taka. On discounts of Rs 2 lakh and above. 1.5 lakh sanctioned under section 80C

This reduction of section 80EEA will be applicable only in the following cases: -

1. This deduction will be allowed only if the stamp duty value of the purchased property is less than Rs. 45 lakh

Download Automated Income Tax Preparation Excel Based Software for the AssamState Govt Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time Tax Computed

Sheet + Individual Salary Structure as per the Assam State Employees Salary Pattern + Automated House

Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part

A&B and Part B for the F.Y.2021-22]

2. Loans should be approved between 1 April 2019 and 31 March 2021.

The above 3 sections relating to tax benefits on home loans have been summarized as follows: -

|

Particulars |

Quantum of Deduction (Rs.) |

|

|

Self Occupied Property |

Non-Self Occupied Property |

|

|

2,00,000 |

No Limit |

|

|

Section 80C |

1,50,000 |

1,50,000 |

|

Section 80EE |

1,50,000 |

1,50,000 |

Feature of this Excel Utility -

$This

Excel Utility can prepare at a time Tax Computed Sheet

$

Individual Salary Structure as per the Govt & Private Employees Salary

Pattern

$

Automated House Rent Exemption Calculation U/s 10(13A)

$

Automated Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E

from the F.Y.2021-22

$

Automated Income Tax Form 16 Part A&B and Part B for the F.Y.2021-22]