Download Auto-Fill Income Tax Preparation Software All in One in Excel for all State Govt and all Non-Govt Employees for the F.Y 2021-22 (A.Y 2022-23)

Every year taxpayers, especially salaried individuals, wait for the budget in the hope that some tax relief, additional tax deductions or income tax slabs will increase to reduce their total tax expense.

You must know which tax system is more beneficial for you. The Budget 2021 has no major income tax, it is more or less the same as in F.Y 2020-21.

You may also, like- All in One Income Tax Preparation Software in Excel for the Andhra Pradesh State Employees for the F.Y.2021-22

However, it is necessary to know your tax burden for the F.Y.2021-22 as per Budget 2021. and also know the what is the differences between the old vs. the new tax system.

Old Tax Regime | New Tax Regime |

It encourages investment in tax saving instruments. | It discourages investments in tax saving instruments. |

Existing income tax deductions are allowable. | Major existing deductions are disallowed. |

Standard deductions and Professional Tax are deducted from income (Max Rs.52,400). | No deduction is permissible for Standard Deduction & Professional Tax. |

The benefit of Housing Loan interest payment is allowed. | Housing loan interest payment is disallowed. |

Only 3 tax slabs such as 5%, 20% and 30% are applicable. | 6 tax slabs applicable such as 5%, 10%, 15%, 20%, 25% and 30%. |

5% Tax rate is basically non-functional. | For every ₹2.5 Lakh, the tax slab changes by 5%. |

A tax rebate of Rs 12500 is allowed for income up to Rs 5 Lakh. | A tax rebate of Rs12500 is allowed for income up to Rs. 5 Lakh. |

Deductions under Chapter VI-A is allowed. | Deductions under Chapter VI-A are not entitled to be claimed. |

This tax regime is more beneficial for income up to Rs 15 Lakh. | This tax regime is more beneficial for income above Rs.15 Lakh. |

What are The main differences between the two existing tax systems are as follows:

Limitations of the new tax system F.Y 2021-22:

Pursuant to Section 115BAC, a taxpayer opting for a new income tax system is not eligible to claim the following income tax deductions:

You may also, like- All in One Income Tax Preparation Software in Excel for the Assam State Employees for the F.Y.2021-22

Exemption from Travel U / S Section 10 (5);

H.R.Allowance U / S Section 10 (13A);

Allowances for the income of minors included in section 10 (32);

The standard deduction, entertainment allowance and occupational tax at U / S 16;

U / S 24(B) reduction due to interest on the self-occupied or abandoned home property;

Carrying forward losses and depreciation is no longer allowed to stop;

Deduction under chapter VI-A such as 80C, to 80 CCD(1B).

Calculating income tax sometimes becomes a difficult task. Hence, this Income Tax software in excel for the F.Y 2021-22 is designed keeping all these aspects in mind.

You may also, like- All in One Income Tax Preparation Software in Excel for the Jharkhand State Employees for the F.Y.2021-22

This excel-based calculator can calculate both old and new tax systems. You don't have to do anything extra. After giving details of all your income and deductions and this calculator will automatically calculate your final tax liability under both regimes.

Key Features of Excel Old and New Income Tax Calculator A.Y 2022-23:

It helps you determine which tax system is best for you;

This calculator shows your total tax liability as a percentage of GTI;

You may also, like- All in One Income Tax Preparation Software in Excel for the Bihar State Employees for the F.Y.2021-22

This Excel Based Software is most suitable for salaried people;

This Software can not calculate the long term capital gains tax;

This Excel-based software is password protected to give you the best results;

• Only keep your details in white cells and do not attempt to remove other unused cells to maintain the integrity of the calculator

The 2021 budget is by far the most frustrating for salaried employees. Not changed the tax slabs, or no other tax benefits. The benefits of U / S 80EEA for new home buyers only have been extended for one more year.

The new tax system will be beneficial only when your total income is more than Rs 15 lakh and you will not pay any interest on housing loan U / S 24.

You may also, like- All in One Income Tax Preparation Software in Excel for the West Bengal State Employees for the F.Y.2021-22

What is the better tax regime old or new for you?

As can be seen from the comparison table above, the old tax system for annual income up to Rs 15 lakh is more beneficial considering full 80C deduction and Rs 25,000/- 80D deduction.

But the situation changed when the interest on housing was paid at Rs 1 lakh. If no HBL interest is paid, the old tax system will be the absolute winner for each income level, as shown above.

Therefore, if you pay any interest on your housing, you are advised to opt for the old tax system, as it will ensure that your total tax expense will be reduced by at least a little.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

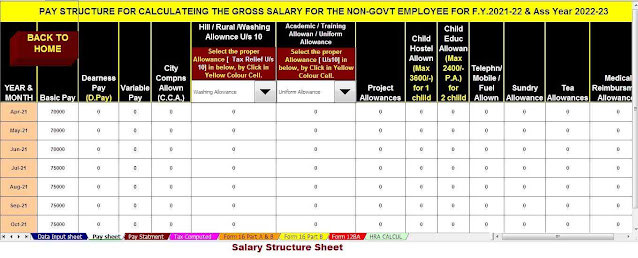

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Calculate your House Rent Exemption Calculation U/s 10(13A)

5) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

6) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

7) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22