List of different exceptions under section 80C. The exception under Section 80C Leaves U/S 80C for

Life Insurance Premium, Commitment to PF, and so forth (Individual/HUF as it were). Discover the

list of personal expense exclusions under section 80C. Section 80C to an individual

(A) Makes concessions;

(B) A Hindu unified family is dependent upon a limit of one lakh and 50,000 rupees for interest in explicit resources. In this article, you can get a list of discounts accessible just to Individuals, a list of discounts accessible to Individuals and HFF, other uncommon focuses for quite a long time. 80C. presently you can look down and check the total list of various deductions under section 80C

You may also like- Automated Income Tax Preparation Excel Based Software All in One for the State of Andhra Pradesh for the F.Y.2021-22 [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per the Andhra Pradesh State Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]

Should Peruse - Discount for Clinical Insurance Premium U/Sec 80D

Individual discounts are accessible as it was:

Any instalment made by the individual to keep in actuality a non-movable conceded annuity understanding about the life of the individual, the spouse, any offspring of the individual

Any sum deducted from the compensation payable by the public authority to pay the commemoration payable to him. In any case, the discount ought not to surpass 1/5 of the compensation.

You may also like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Govt Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per the Bihar State Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]

SPF/RPF commitments.

Commitments to the Endorsed Endorsement Asset.

Public Reserve funds Plan Membership.

NSC membership, even interest in it is qualified for a discount

Shared Asset/UTI Membership Unit

Commitment to Shared Asset/UTI/Benefits Asset set up by Public Lodging Bank

Submitted to Public Lodging Bank, HIDCO

Stores with a PSU giving long haul financing to the development or acquisition of private homes in India.

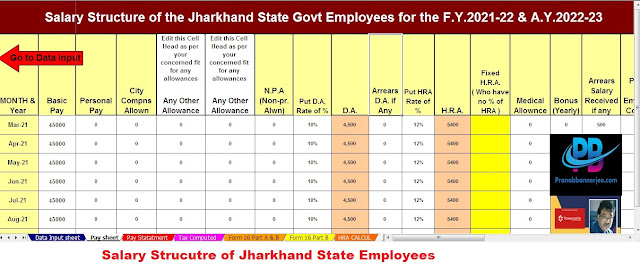

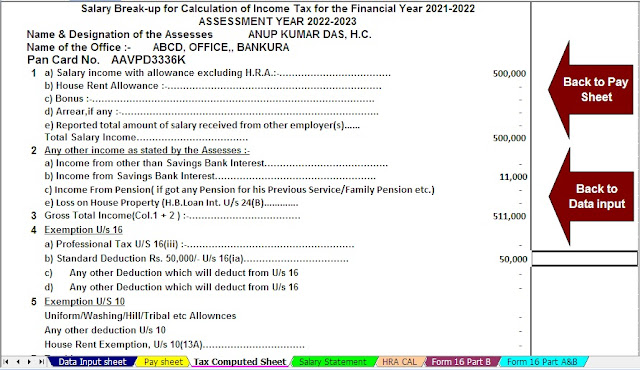

You may also like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per the Andhra Pradesh State Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]

Stores with informed lodging board according to law for arranging, advancement and enlistment of towns/urban areas/towns.

Educational expenses paid for full-time instruction of kids in colleges, universities, schools or other instructive establishments situated in India, for other advancement awards. (Most extreme 2 kids)

Lodging/Consumption

Memberships of approved value offer or elements of any open company or an administration monetary establishment and the whole continuation of the issue are utilized for the full and selective utilization of force age or foundation offices. (Holding period least 3 years)

You may also like- Automated Income Tax Preparation Excel Based Software All in One for the West Bengal State Govt Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per the West Bengal State Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]

Term store with a booked bank for somewhere around 5 years.

Educated NABARD Bond Membership.

Stores under the Senior Residents Investment fund Plan.

5-year time store in any record under Mailing station Store Rules.

Should peruse - Genuine installments dependent on Section 43B discounts

Individual and HFF discounts accessible:

Any sum paid by an individual to apply insurance or power in the life of an individual, his/her companion, any kid (wedded/unmarried or subordinate/not reliant). On account of HUF, a premium must be paid for the life of any relative.

Note: A premium of over 20% in an insurance strategy isn't qualified for a premium discount on the life insurance strategy (pertinent for an approach gave before 01/04/2012) Greatest premium dis countable = 10% of the insured sum. (15% for people covered by U/s 80U/80DDB)

A PPF commitment. At least 2,000 rupees. 500 and greatest Rs. 1 lakh rupees

LIC/UTI's ULIP commitment and proceeded for at least 5 years.

Add to the insurance organizations' yearly plans.

Should peruse - Discount for awards under section 80G

Different focuses for quite a long time is 80C

You may also like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Government(Private) Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per the Non-Government (Private) Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]

As far as possible under this section is 2014-1. Financial year/appraisal year 2011-16-1 from 1.50 lakh. 2014-1. The cutoff before the monetary year was Rs1 lakh. Many little reserves funds plans like NSC, PPF and other annuity plans under this heading are likewise qualified for an exception under section 80C for the instalment of life insurance premiums and interests in certain administration framework securities.

On the off chance that the appraiser moves HP, no waiver is guaranteed, before the termination of the five-year term toward the finish of the monetary year, where the public property was procured. No concession will be permitted in the house to which the place of PIO is moved. The measure of discount permitted in earlier years will be treated as the payment of the appraiser of PY, where the house is moved.

In the event that a part taking an interest in ULIP ends before 5 years of commitment, similar treatment as given in point 2 will be given.

The discount is accessible just if the earlier year for example 31st Walk or prior is paid/contributed/contributed.

Download Automated Income Tax Preparation Excel Based Software All in One for the Assam State Government Employees for the F.Y.2021-22

#This Excel Utility can prepare at a time your Tax Computed Sheet

# Individual Salary Sheet

# Individual Salary Structure as per the Assam State Government Employees Salary Pattern

# Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A)

# Automated Income Tax Revised Form 16 Part A&B and Part B for F.Y.2021-22 as per Budget 2021]