1. Tax Exemption from Salary Arrears | How to file Form 10E in the new tax portal Let's try to

understand the calculation of arrears, relief dated 21.06.2021 on Sec 89 and how to file Form 10E to

2. Illustration: Mr Pabir Mahato received arrears of salary in the financial year 2011-2012. The arrears are related to the salaries of FY 2017-18, FY 2018-19, FY 2019-20. The details are as follows:

Sl | Particulars | Financial Year | Assessment Year | Amount (Rs.) | Amount( Rs.) |

a | Taxable Salary | 2020-21 | 2021-22 |

| 8,00,000 |

b | Arrears for the year | 2017-18 | 2018-19 | 75,000 |

|

c | Arrears for the year | 2018-19 | 2019-20 | 1,00,000 |

|

d | Arrears for the year | 2019-20 | 2020-21 | 1,25,000 |

|

e | Total Arrears (b+c+d) |

|

|

| 3,00,000 |

f | Total Salary (including Arrears (a+e) |

| 2021-22 |

| 11,00,000 |

g. | Tax (including H&E Cess) on total salary including arrear ( Tax on income (f)) |

| 2021-22 |

| 1,48,200 |

h. | Tax (including H&E Cess) on total salary without considering arrear ( Tax on (a)) |

| 2021-22 |

| 75,400 |

i | Additional Tax due to Arrears (g-h) |

| 2021-22 |

| 72,800 |

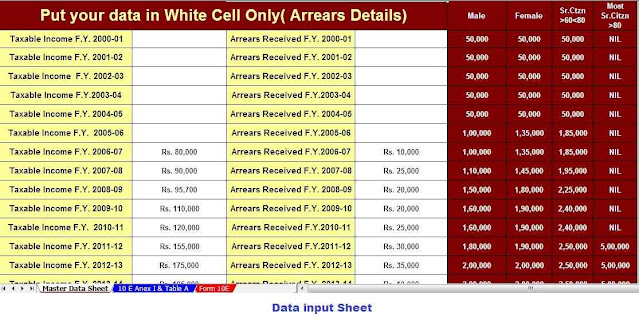

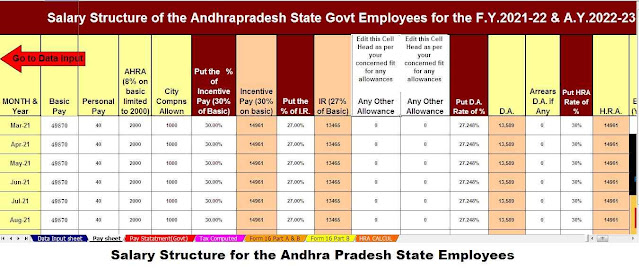

3. Reliable calculations under section 89 (1) It is advisable to make the following calculations and keep the statistics ready before filing Form 10E in the new income tax portal. The new income tax portal is giving wrong tax calculations which can be edited and corrected according to the pre-calculated amount.

Sl | PARTICULARS | FY 2017-18 (AY 2018-19) | FY 2018-19 (AY 2019-20) | FY 2019-20 (AY 2020-21) | |||

Before Arrears | After Arrears | Before Arrears | After Arrears | Before Arrears | After Arrears | ||

a | Total Income (Rs.) | 575000 | 575000 | 600000 | 600000 | 675000 | 675000 |

b | Arrears |

| 75000 |

| 100000 |

| 125000 |

c | Total Income (a+b) | 575000 | 650000 | 600000 | 700000 | 675000 | 800000 |

d | Deductions | 150000 | 150000 | 150000 | 150000 | 150000 | 150000 |

e | Net Taxable Income(c-d) | 425000 | 500000 | 450000 | 550000 | 525000 | 650000 |

f | Tax Liability * | 9013 | 12875 | 10400 | 23400 | 18200 | 44200 |

g | Taxon Arrear (tax after arrears- before arrears) | 3862 | 13000 | 26000 | |||

h | Total Tax on Arrears in respective years | If the amount is received in respective years, the tax liability would be Rs 3862+13000+26000 = Rs 42,862 | |||||

i | Additional Tax Liability due to late receipts of amount Rs. 72,800-42,862 = Rs. 29938/- | ||||||