Key Highlights of the 2021 Budget. The coronavirus epidemic caused financial problems for many.

Barriers encourage sector-after-sector, people lose jobs and uncertainty deepens. The health impact of

the COVID-19 epidemic introduces unexpected expenditures for the personal budget. The middle class

will expect unemployment in 2020-21 central budget to help overcome these problems. If anything,

middle-class taxpayers expected certain tax breaks so that they had more money in their hands than

their salaries.

The basic tax exemption limit was raised from Rs 2.5 lakh to Rs 5 lakh per annum to increase the amount of money in the hands of the people in the self-respecting

You may also, like- Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21 [This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

In the 2021 interim budget, the Center had proposed to increase the basic income tax exemption limit to Rs 5 lakh per annum. The discount limit has not been increased though. Last year, the government kept the exemption limit unchanged but allowed taxpayers to choose between a lower tax rate or an exemption between the existing tax and tax system.

There is a demand to increase the standard deduction from the current Rs 50,000. As a result, taxpayers' medical reimbursement and travel allowance discounts will be reduced from standard discounts to 2019-20. Was removed from the fiscal year. The standard waiver ensures that taxpayers have a portion of their salary that is not subject to income tax.

With the increase in the standard discounts, people will have more money to pay for medical bills and higher fuel costs. Some reports have suggested that the standard exemption limit could be increased from Rs 755,000 to Rs 100,000 depending on the Finance Ministry's assessment.

You may also, like- Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21[This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

There is a demand to increase the benefits for domestic workers in the real estate sector under Section 80C and Section 24B of the Income Tax Act. This will give taxpayers more disposable income, but it will also bring back demand in the residential real estate sector.

Paid classes will expect tax breaks against allowances paid by employers for setting up workplaces at home. As working from home became the norm, some companies paid their employees to buy the necessary furniture and equipment. However, this amount is taxable in the hands of employees.

You may also, like- Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

Considering the inconveniences caused by the coronavirus epidemic and the new wage code, any move to more disposable income this year would be welcome. Some estimates suggest that the share of household wages may decline from 1st April 2021 will take effect.

According to the new pay rules under the code mandate, the allowance components cannot exceed 50 per cent of the total salary, which means 50 per cent of the basic salary. This means companies will have to increase the private pay component, which will provide gratuity to provident funds and increase employee contributions. This will help increase their retirement corps, but it will also reduce their household wages.

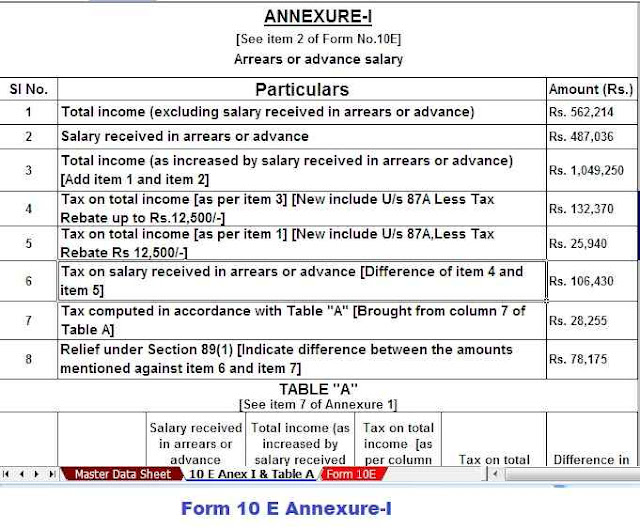

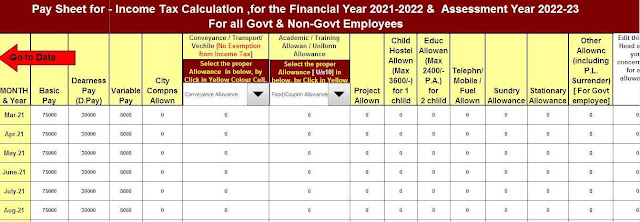

Download Automated Income Tax Arrears Relief Calculator U/s89(1) with Form 10 E from the F.Y.2000-01 to the F.Y.2021-22 (Updated Version)