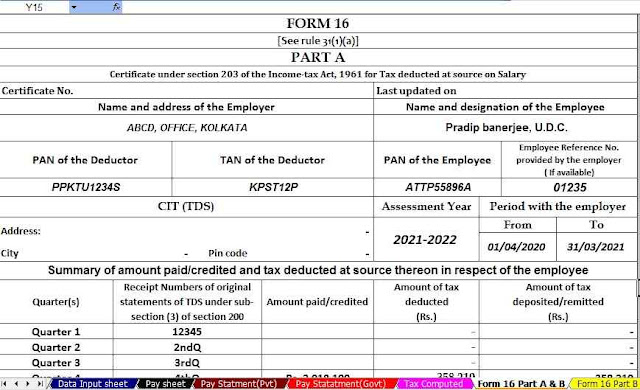

Introduced a New Revised Format of Salary Certificate Form 16 by the CBDT Vide Notification

No.36/2019/F Dated dated 12th April 2019| The Central Board of Direct Taxes (CBDT) has issued an

amendment to the Source of Annual Salary Tax Exemption Source

(TDS) certificate issued to employees in Form No. 16. Part B of Form 16, which provides details of

salary paid and other income details seek further details on allowances and exemptions under Section

10 approved under Chapter VI-A of the Income-tax Act

Exemption under section 10:

Form 16 In the current format of a piece of marriage, an employer has the option to specify the nature of the allowance under section 10 with the corresponding amount. In the absence of mandatory disclosure requirements, different employers issued 16 forms in different formats. Some employers disclosed in full, others consolidated allowances and disclosed continued net amount under section 10.

You may also, like- Automated Revised Form16 Part B for the Financial Year 2020-21 which can prepare at a time 50 Employees Form 16 Part B

New Form 16 Now in the notification, employers will have to pay the amount of allowance as compared to the ear-marked areas. Specific fields for the following allowances have been informed:

Travel concessions under section 10(5)

Death cum Retirement Gratuity Exemption under Section 10 (10)

Leave encashment under Section 10(10AA)

House rent allowance under section 10 (13A)

The amount of any other exemption under section 10 shall be specified with reference to the notable article. A snapshot of the discount details is provided below:

Exemption under Chapter VI-A

Similar to the disclosure for the above exemption allowance, employers had the option to submit details of the exemption under Section 80C of the Income Tax Act.

You may also, like- Automated Revised Form16 Part B for the Financial Year 2020-21 which can prepare at a time 100 Employees Form 16 Part B

As notified in Form 16, employers are required to present a discounted amount compared to the earmarked areas. Such deductions are given below are notified:

Contribution to PPF for life insurance premium paid under section 80C.

Deduction for contribution to pension fund under 80 CC

Exemption for Pension Scheme under Section 80CCD (1)

Exemption for taxpayer self-contribution in a notified pension scheme under section 80CCD (1B)

Exemption for Employer's Contribution to Pension Scheme under Section 80CCD (2)

Exemption for health insurance premiums paid under Section 80D

Discounts for donations under Section 80G

Discount for interest income on savings account under section 80TTA

The amount due for exemption under any section of this section should be quoted in the relevant section.

Other changes:

With reference to any other earnings reported by an employee, specific fields are introduced as follows:

You may also, like- Automated Revised Form 16 Part A&B for the Financial Year 2020-21 which can prepare at a time 50 Employees Form 16 Part A&B [Who are not able to download Form 16 Part A, they can use this Excel Utility]

A field has been introduced for the report of total salary received from other employers

A field has been introduced for exemption of standard approved in Section 16 of the Income Tax Act.

The new Form 16 has been implemented from 12th May 2019. Thus, most of the employers providing Form 16 from the financial year, 2018-19 and onwards will have to issue it in the new format. The changes outlined in Form 16 will ensure that employers follow the same format for reporting tax deductions and deductions.

Also, the amendment is in line with the changes introduced in the income tax returns advertised for AIY 2019-20. This will help employees file their tax returns for AY 2019-20.

In addition to the above, this step will help the Income Tax Department to cross-verify the income received by an employee with the TDS certificate issued by the employer.