Download Automated Income Tax Software in Excel for the Govt & Non-Govt Employees F.Y.2021-22 as per Budget 2021 with how to save income tax

Are you someone who likes Bollywood a lot? Do you think Bollywood life is glamorous? The lives of celebrities always seem exciting and full of glamour. They are always ahead when it comes to clothing, travel, or lifestyle. You must know that these actors are always given a jaw drop, they are paid a lot of money for everything they do, be it movies, music albums, commercials, or performances.

However, people are usually so blinded by these glamorous shows that they often forget that the higher the income, the higher the income tax.

You may also, like- Prepare at a time 50 Employees Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Now, are you wondering how much land you will have to pay income tax this year? The following list shows the different tax rates for different categories of taxable income for the fiscal year 2020-2021.

Section 80C- Investments in PPF, PF, insurance, NPS, ELSS, etc. Max Rs.150,000

Section 80CCD-NPS investments 50,000

Section 80D- Investment in medical insurance for self or parents 25,000/50,000

Section 80EE- Interest on Home loan Rs. 50,000

Section 80EEA-Interest on Home loan Rs.1,50,000

Section 80EEB-Interest on electric vehicle loan 1,50,000

Section 80E-Interest on education loan Full amount

Section 24-Interest paid on the home loan 200,000

Section 10(13A)-House Rent Allowance (HRA) as per salary structures

Income tax-saving tips

The Government of India also provides certain ways to reduce the income tax of taxpayers. The Income Tax Act, 1961 covers some tax savers including mutual funds, insurance premiums, NPS, medical insurance, home loans, and many more.

There are some departments that act as relief for taxpayers, as under these main departments, they can save taxes. These categories are 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80CCG, 80G G

They can certainly be helpful for income tax by many taxpayers, especially salaried employees. Exemptions and allowances for income tax are of utmost importance in the financial planning of any person or entity.

Therefore, the following table shows the categories and discount limits for each.

You may also, like- Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

How to save income tax under section 80C?

Under Section 80C, there are a various investment and expense options through which you can claim a discount within the rupee limit. One and a half lakh rupees in the financial year. These options are as follows:

Equity Linked Savings Scheme (ELSS)

The Equity Linked Savings Scheme is the only mutual fund division that provides tax exemption under the Income Tax Act.

ELSS returns are higher than other income tax saving schemes in the long run because investments are made in the equity market but two things to keep in mind with ELSS are that it cannot be withdrawn for 3 years before the lock-in period and there is high risk because the investment Is in the equity market.

You may also, like- Prepare at a time 100 Employees Form 16 Part B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Certificate of National Conservation (NSC)

The NSC is another income tax protection strategy that comes with a 5-year term with the National Conservation Certificate providing a fixed rate of interest, which is currently 6.8% per annum.

The interest earned from this income tax protection strategy is a duty-saving option and under Section 80C, Rs. 1.5 lakh can be taken as a discount.

Public Provident Fund (PPF)

PPF One of the strategies to save income tax in India sought In PPF, long-term investment can be made with a term of 15 years. One can open a PPF account with minimum cash at banks and post offices.

PPF rates change quarterly, which is currently .1.1%. The funny thing about PPF is that PPF is interest-free.

Employees Provident Fund (EPF)

12% of the salaries of employees covered by the Employees Provident Fund are tax-free. So it is a beneficial income tax saving scheme for people in the service line.

Senior Citizens Protection Project (SCSS)

The current rate of interest is 7.4% (taxable). However, the discount limit is Rs 2,000. One and a half lakh rupees. This means that this limit can be taken under this scheme of tax exemption.

You may also, like- Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2020-21 as per new and old tax regime U/s 115 BAC

Tax exemptions do not depend on the child's class or level of education. This income tax saving scheme is for all types of parents including divorced, single parents, or those who have adopted children.

Home payment

In order not to hinder income tax in the process of buying their own house, Section 60 comes up with a scheme where these people, who are already paying EMI for their home loan, are exempted from paying income tax on interest.

They can claim tax exemption under section 80C.

What are the other income tax saving options?

Apart from Section 80C, there are other sections (mentioned earlier) that provide for income tax exemption. Here is some of the income tax saving options:

There are tax exemptions for contributions to the National Pension System (NPS). The discount limit is 1.5 lakh.

Exemption for medical insurance premiums U/s 80D. It's up to the rupee. 25,000, and Rs. 50,000 for senior citizens.

There is also a tax deduction on home loan interest; You have Rs. 60,000 under Section 80EE.

Feature of this Excel Utility are-

1) Auto Calculate your Income Tax liability as per the new system (New and Old Tax Regime) U/s 115 BAC

2) Auto calculate House Rent Exemption Calculation U/s 10(13A)

3) Automated Income Tax Computed Sheet

4) Salary Structure as per the Jharkhand State Employees Salary Pattern.

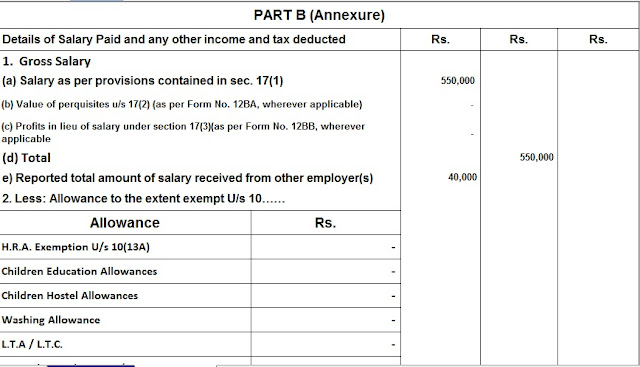

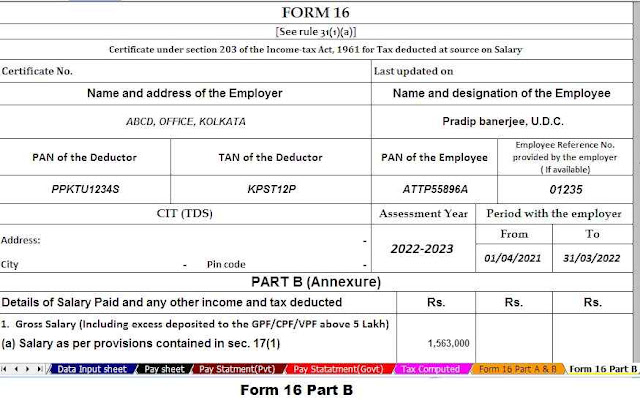

5) Automated Income Tax Revised Form 16 Part A&B

6) Automated Income Tax Revised Form 16 Part B