Tax on pension income: Calculation of discount amount| When an employee retires, the employer pays a certain amount to the regular employee considering his previous service. This periodic payment is paid by the employer to his employee and is referred to as his pension.

Once the National Pension Scheme is launched, employers will not only be able to pay pensions after retirement, the pension scheme can also pay pensions. Individual taxpayers can also invest in a pension plan that will pay their pension after retirement. Such investment in pension plans can be claimed as a rebate under Section 80CC and Section 80CCD.

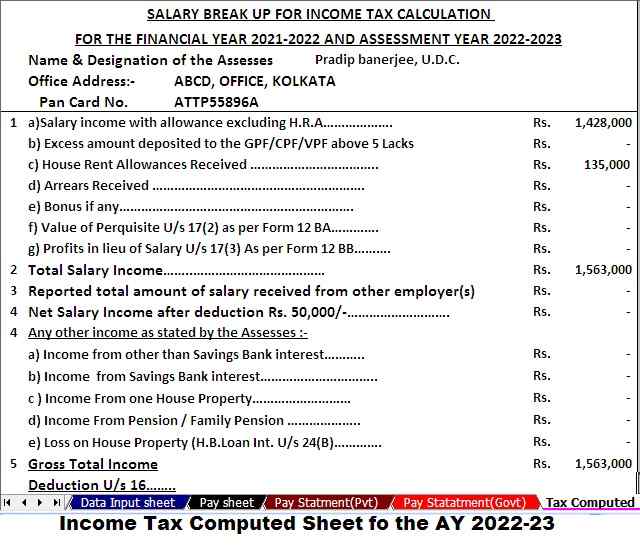

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Government and Non-Government (Private) Employees for the F.Y.2021-22 & A.Y.2022-23 as per New Budget 2021

The amount received as pension from the employer or pension fund or from any other source as pension will be liable to income tax. The article on calculating income tax on pension income is explained below.

Before focusing on the calculation of duties on pensions, it is important to understand that there are 2 types of pensions: -

1) Commuted pension: Commuted pension refers to the pension received in phases. The amount received as a commuted pension is fully taxable in the hands of both public and private employees.

2. Changed Pension: Changed money exchange. Many employers allow an employee to give up a portion of the pension by surrendering a portion of the pension and receiving a lump sum. This amount is known as Commuted Pension. The pension can be changed in whole or in part.

For example, suppose a person is entitled to a fifth pension. 2000 for life. He can travel 1/4 of this amount and get 25% in a single amount. After 30,000 journeys, his pension will now cost Rs5%. 2000 pm i.e. Rs. 1500 hours

Income tax on current pension

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Government Employees for the F.Y.2021-22 & A.Y.2022-23 as per New Budget 2021

The calculation of income tax on Commuted Pension at the time of filing income tax return under section 10 (10a) will be as follows: -

Commuted Pension Received 8,00,000 / -

- (Less) Amount Discount 2,00,000 / - = ,,,00,000 / -

Amount to be taxed as tax slab = 56,000 / -

Calculate the amount of pension

1. Received from Government Employer: Complete exemption from income tax. In other words, no income tax was levied on pensions from the government.

2. Received from private employer: The following amount will be exempted from tax collection on pension income

Tax on pension income

The pension received will be "taxable under the principal salary" in the manner described above

However, under section 5 ((ii) (a), if the family members receive the family pension without permission after the death of the employee, the pension received will be taxable under the head - in this case, the employer-employee relationship does not exist as "income from other sources". Where unregistered family pension is received by family members - 1 / 3 of the pension of Rs. 2,000 / - Rs. 15,000 whichever is less.

However, according to Circular No.573 dated 21/08/1990, if any modified pension is given to the family members, no tax will be levied on the enhanced pension.

Related points related to tax on pension

1. Judges of the Supreme Court and High Court will be allowed as a waiver of the Fifth Pension (Notification No.2322 dated 06-01-1993)

2. No tax will be levied on pension income on any amount received from UNO

Rs 50,000 can also be claimed from the standard discount pension income of Rs 3.50 as it also comes to mind - income from salary. This discount is applicable from the financial year 2019-20.

Download and Prepare at a time 50 Employees Revised Form 16 Part A&B for the Financial Year 2021-22 and Assessment Year 2022-23 as per new Budget 2021

Feature of this Excel Utility:-

1) This Excel utility prepares at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22 as per new Budget 2021

2) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

3) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

4) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

5) This Excel Utility has all the Income Tax Section as per Budget 2021

6) This Excel Utility can prevent your double-entry of Pan Number.

7) Who are not able to download the Form 16 Part B from the Income Tax TRACES PORTAL they can use this Excel Utility

8) This Master of Form 16 can use both Government & Non-Government Concerned.