Tax savings tips to reduce your tax amount for F.Y.2021-22. Tax planning is a part of financial planning although taxes are difficult to avoid, you can efficiently devise strategies to reduce them under two important steps.

1) In order to choose between the old tax (with discount) and the new system (without discount) one has to carefully analyze the comparison between tax outgo and other factors.

2) Inform your employer (so they have to deduct TDS based on your selection)

Tax Saving Tips 1.

Additional tax savings with NPS under Section 80CCD In addition to the exemption under Section 80C of Rs 1.5 lakh per annum, you can claim additional tax exemption under Section 80CCD (1B) by contributing an additional Rs 60,000. 50,000 in your NPS account.

2. House Rent Allowance U/s 10(13A) for those who live in a rented home, then you can help save tax through HRA. The maximum amount of HRA discount: below

Got the original HRA

(Basic Salary + DA) 40% (Non-Metro) / 50% (Metro)

The actual rent was less than 10% (basic salary + DA)

Note: If you rent a house and pay more than Rs 1 lakh per annum - don't forget to provide the landlord's PAN to claim an HRA discount

Download Automated Income Tax House Rent Exemption Calculator U/s 10(13A) in Excel.

The simple text of Notification No. 01/2019 dated 1st January 2018 and Form 12BB indicates that there is a limit of Rs.

If a residential home is rented + you will not receive an HRA from your employer + you or your spouse or your minor child does not have a residential home where you currently live

You can then claim a discount under section 80GG.

The least of these will be considered discounts under this category:

Five thousand rupees a month;

25% of total gross income *;

10% of gross income less than actual rent (ATI)

ATI = Total Income Less Long-Term Capital Gains, Short-Term Capital Gains under Section 111A, and Income under Section 111A or 111D and 60 UK to 80 UK Exemption (Exemption under Section 80G)

3. Children's allowance discount for a maximum. 2 children (Rs. 100 per child per month)

4. Hostel Expenses Allowance

Deduction for most. Between 2 children (Rs. 300 per child per month)

5. Discount Leave Travel Allowance (LTA)

The discount is only available for travel expenses (the employee is going anywhere in India with his family) and not for local vehicles, sightseeing, hotel accommodation, meals, etc.

The discount is only available for actual travel expenses i.e., employee-operated air, rail, or bus rentals. The discount is available only due to the submission of the expenditure bill.

An employer in PF and NPS Employees’ contribution to NPS and EPF is tax-free up to 12% of basic salary.

Standard deduction U/s 16 (ia) of Rs 50,000 is available for all salaried persons

Employment / professional tax is exempt U/s 16

It is important to note that if the professional tax is paid by the employer on behalf of the employee,

9. Deduction under the most popular of Section 80 and it allows discounts up to Rs 1.5 lakh. Like as invest in PF, ELSS, FD, NSC, NPS, life insurance. In addition to these, one can also claim payment of principal for a home loan, tuition fee, and stamp duty under this section.

10. Exemption under section 80D

People under the age of 60 years can claim Rs 25,000 for themselves and their family and Rs 25,000 for parents (if they are below 60 years).

Parents above 60 years of age where the exemption amount increases by another 25000 (for parents), making a total of Rs. 75000 (25,000 + 50,000)

And where both the individual and the parents are more than 60 years old, Rs 50,000 (for self & family) and Rs 50,000 (for parents) can be claimed.

However, it does not extend the overall exemption limit under section 80D

11. Exemption for interest on education can be claimed on the true basis of the interest paid for the loan taken for higher education in Section0E for self, spouse, or children.

12. Discount for grants 50-100% discount is given subject to 80G eligible grant conditions.

13. Section 24 - Interest on Home Occupancy Deductions It provides for a rebate of interest on home loans up to Rs. 2 lakhs for self-occupied houses and for houses to be exempted.

14. Section 80 EEA - This section provides a discount of Rs 1.5 lakh for first-time homeowners, which means you can increase the upper limit for technically self-acquired houses to Rs 3.5 lakh (excluding interest on the home loan which will end) on top of the discount available under Section 24. ).

15. Savings Bank Account Savings interest of 80 TTTA Tax on Interest Earned - Savings Account of Bank Savings/ Post Office /Cooperative Society

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

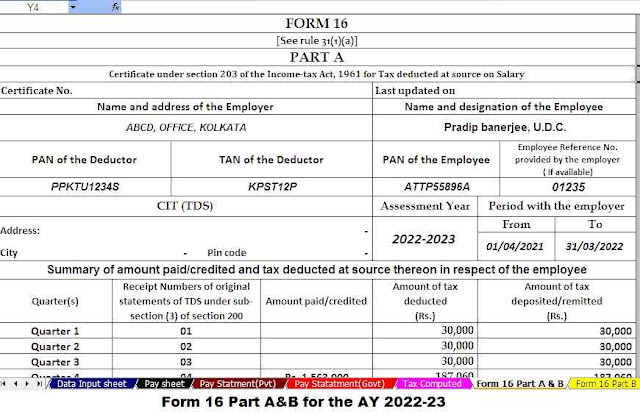

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

6) Automated Income Tax House Rent Exemption Calculation U/s 10(13A)

7. The calculation has made as per the New Budget 2021 with new amended G.P.F./C.P.C. & V.P.C. Maximum Limit Five Lacks.